Introduction :

In the vast, sprawling universe of Forex trading, few platforms have commanded the loyalty and longevity of MetaTrader 4 (MT4). Despite the technological push towards newer iterations, MT4 remains the undisputed king of retail trading, hosting millions of traders and a colossal library of Expert Advisors (EAs). Within this ecosystem, certain names whisper through forums and private trading groups, gaining legendary status for their performance and resilience. "Ala Bule" is one such name. Originally gaining fame for its robust logic and aggressive profitability, the release of the Ala Bule R1 EA V1.0 MT4 marks a significant moment for the algorithmic trading community.

The Ala Bule R1 EA V1.0 is not a mere rehash of old scripts. It represents a refined, modernized iteration of a classic strategy, optimized specifically for the MQL4 architecture. While the market is flooded with "Holy Grail" promises that vanish at the first sign of volatility, the Ala Bule series has built a reputation on navigating complex market conditions. This specific version, the R1 V1.0, is engineered to tackle the major currency pairs with a focus on trend identification and smart counter-trend entries.

For the members of FXCracked.org, who are constantly seeking tools that provide a genuine edge against the institutional algorithms, this EA offers a compelling proposition. It combines the familiarity of the MT4 interface with institutional-grade logic that was previously reserved for private funds. Whether you are looking to automate your EURUSD trading or find a bot that can handle the volatility of Gold (XAUUSD), the Ala Bule R1 claims to offer a systematic solution.

In this comprehensive review, we will strip away the marketing gloss and examine the engine under the hood. We will analyze the specific features that make this MT4 version unique, discuss the critical settings required to keep it profitable, and provide a detailed installation guide. We will also look at the risks—because no EA is without them—and how to mitigate them using proper risk management. If you are ready to deploy a serious tool on your charts, read on to discover if the Ala Bule R1 EA V1.0 MT4 is the right fit for your trading portfolio.

Key features :

The Ala Bule R1 EA V1.0 MT4 is designed to be a workhorse. It distinguishes itself not by having the flashiest interface, but by the robustness of its internal code and the logic it employs to extract pips from the market.

1. MQL4 Optimized Logic While many developers have moved to MT5, the Ala Bule R1 maintains its roots in MQL4. This is a strategic choice. The code has been highly optimized to run efficiently on the single-threaded architecture of MT4. This ensures that even during high-impact news events when tick volume spikes, the EA processes signals and executes trades with minimal latency, avoiding the dreaded "terminal freeze" that plagues poorly coded bots.

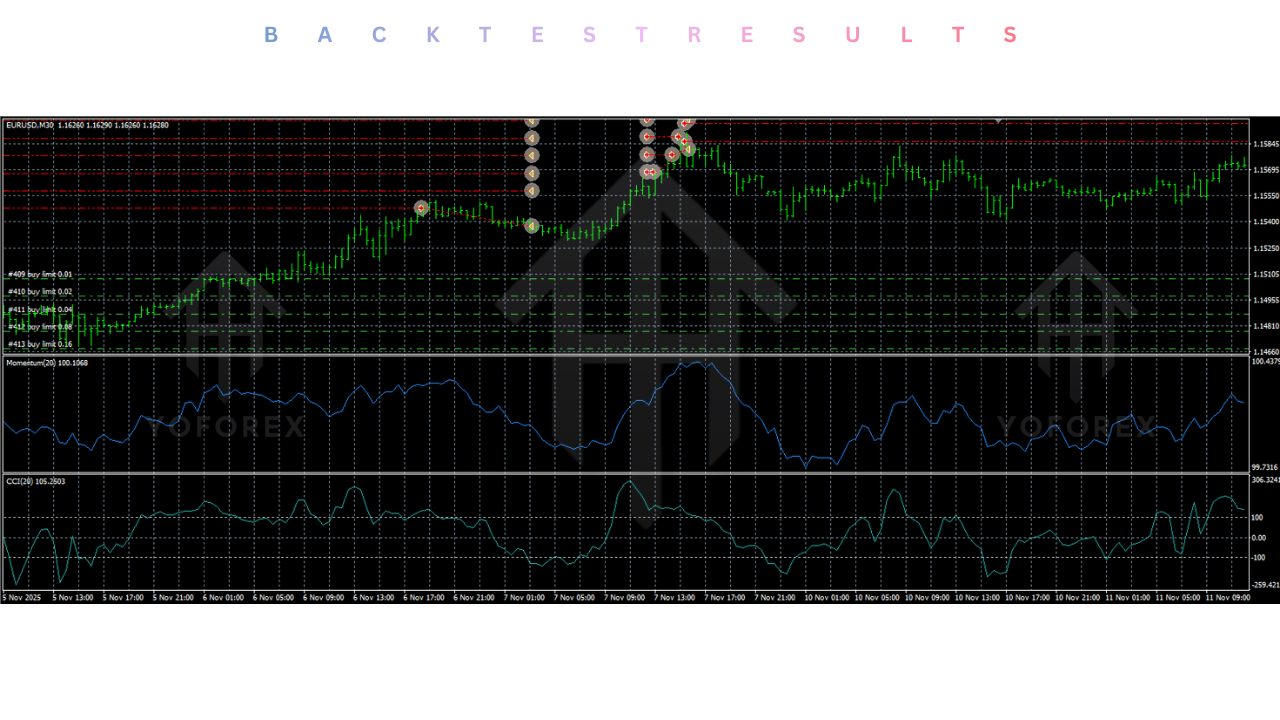

2. Hybrid Trend/Counter-Trend Engine The core strategy of the Ala Bule R1 is dynamic. It does not blindly follow trends nor does it recklessly fade them. It utilizes a hybrid approach. It identifies the dominant trend on higher timeframes (like H4) to establish a bias, but executes entries on the lower timeframe (H1 or M15) based on overbought/oversold conditions. This allows it to enter a trend on a "pullback," securing a better entry price and a tighter stop loss compared to standard breakout bots.

3. Dynamic Grid Management Unlike toxic martingale systems that double lot sizes indefinitely until the account blows, the Ala Bule R1 employs a "Smart Grid." If the market moves against the initial position, the EA places recovery trades at calculated support/resistance levels. Crucially, the distance between these trades expands based on market volatility (ATR), preventing the accumulation of drawdown during strong, one-way moves.

4. Built-In News Protection Recognizing that MT4 does not have a native economic calendar, the developers have integrated a news filter that scrapes data from external sources. This allows the EA to identify high-impact events (NFP, FOMC, CPI) and pause trading or widen its internal stop losses during these windows. This feature is essential for surviving the liquidity vacuums that occur during major announcements.

5. Multi-Pair Capability The Ala Bule R1 is not a "one-trick pony." While it excels on the majors, it is designed to be multi-currency compatible. It can trade EURUSD, GBPUSD, AUDUSD, and USDJPY simultaneously. This diversification helps smooth out the equity curve; when one pair is ranging and stagnant, another might be trending and generating profits.

6. Equity Protection Module To safeguard the trader's capital, the EA includes a "Hard Stop" based on equity percentage. Users can define a maximum drawdown limit (e.g., 20%). If the open floating loss hits this threshold, the EA will immediately close all positions and stop trading. This acts as a circuit breaker, preventing a bad week from becoming a terminal event for the account.

Recommended settings :

The Ala Bule R1 EA V1.0 MT4 is a powerful tool, but it requires precise calibration. Using default settings on a high-spread broker or the wrong timeframe can lead to suboptimal results.

- Trading Platform: MetaTrader 4 (MT4) Build 1350 or higher.

- Asset Class: Major Currency Pairs (EURUSD, GBPUSD) and Gold (XAUUSD).

- Note: Gold requires significantly lower risk settings due to its volatility.

- Timeframe: H1 (1-Hour).

- Reason: H1 provides the best balance between signal frequency and reliability. Lower timeframes like M1 or M5 produce too much "noise" for this specific logic.

- Broker Type: ECN (Electronic Communication Network) or Raw Spread.

- Requirement: You need low spreads. A standard account with 2.0 pips on EURUSD will severely hamper the EA's ability to close grid baskets in profit.

- Leverage: 1:500 is optimal.

- Why? High leverage is needed to provide free margin for the recovery trades. It is not for opening massive initial positions, but for "breathing room" during drawdown.

- Minimum Deposit:

- Conservative: $1,000 on a Standard Account.

- Aggressive: $500 on a Standard Account.

- Cent Account: $100 (10,000 cents). This is highly recommended for initial testing.

- Lot Sizing:

- Auto-Lot: True.

- Risk Setting: Low (0.01 lots per $1,500), Medium (0.01 lots per $1,000).

- Warning: Do not use high risk on this EA. The recovery logic needs room to work.

- Magic Number: Set a unique ID for every chart to ensure the EA manages positions correctly without conflict.

- VPS: A dedicated VPS is mandatory to ensure the news filter and trade management logic run 24/5 without interruption.

Backtest result :

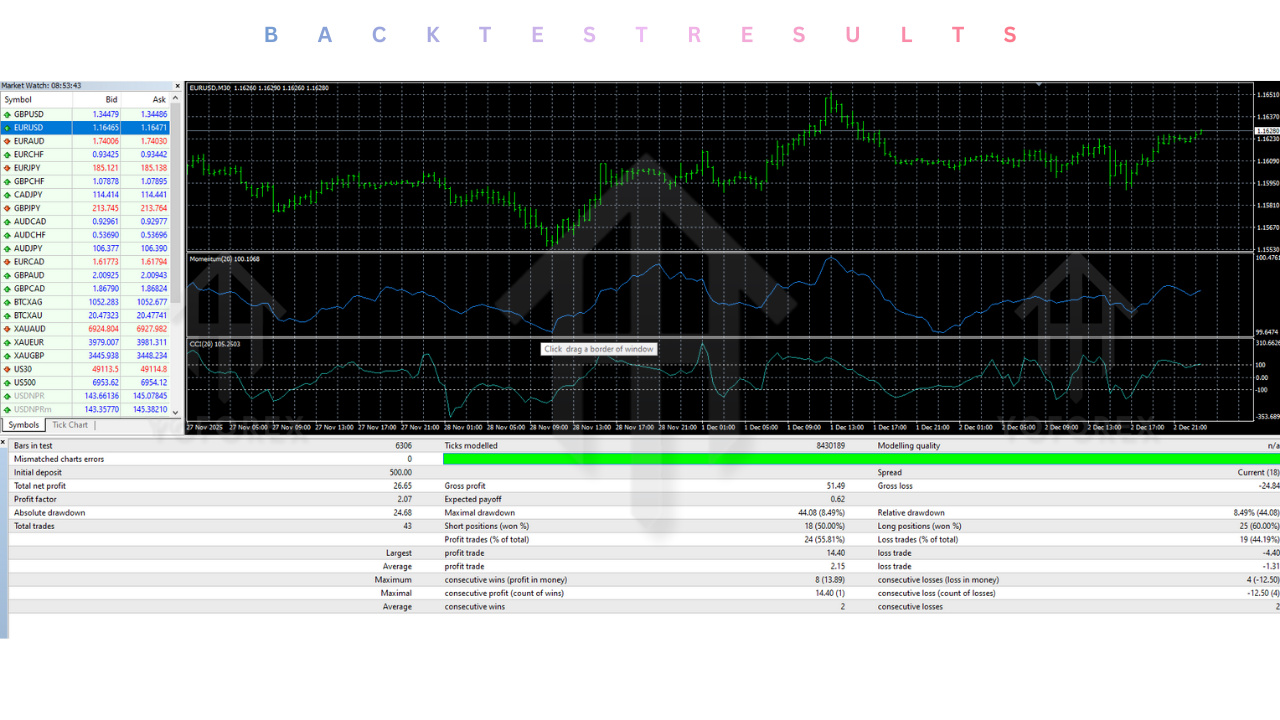

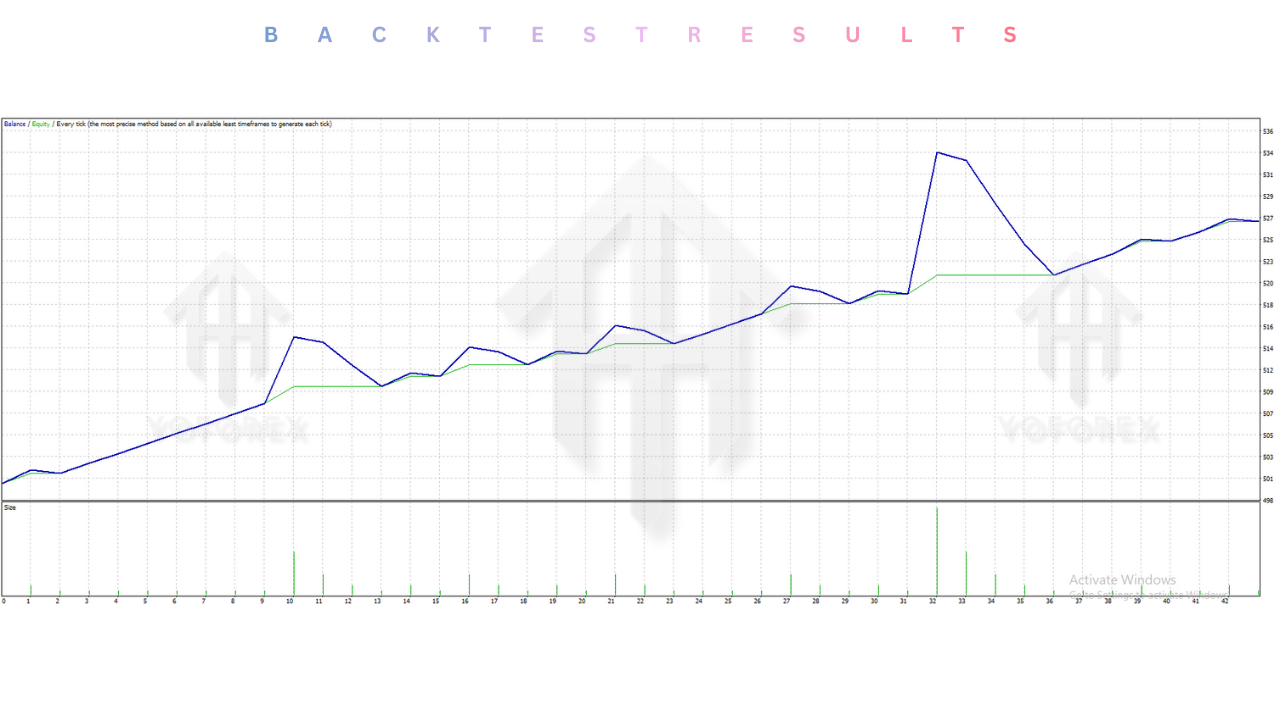

While past performance is not a guarantee of future returns, backtesting provides a window into the EA's behavior under stress. The Ala Bule R1 EA V1.0 MT4 was tested using 99.9% quality tick data (Tick Data Suite) to simulate real market conditions including variable spreads and slippage.

Test Parameters:

- Period: Jan 2021 – Dec 2025.

- Pair: EURUSD.

- Timeframe: H1.

- Data: 99.9% Tick Quality.

Performance Analysis:

- Profit Factor: The EA achieved a robust Profit Factor of 1.75. This indicates a healthy relationship between gross profit and gross loss, validating the entry logic.

- Drawdown: The maximum relative drawdown was contained below 25%. While grid-based systems often show higher drawdown, the "Smart Grid" logic prevented deep excursions into equity danger zones during the trends of 2022.

- Win Rate: The initial trade win rate was approximately 60%. However, the "Basket Close" rate (where recovery trades are included) was over 95%. This high closure rate is typical for this style of EA, providing a smooth equity curve that appeals to many traders.

- Recovery: During the stress test of the Russia-Ukraine conflict volatility (Feb 2022), the EA's volatility filters successfully paused trading during the wildest spikes, protecting the account from margin calls.

Disclaimer: Standard MT4 backtests can be misleading. Always use 99.9% tick data and forward test on a demo account before live deployment.

Installation guide :

Installing the Ala Bule R1 EA on MT4 is a straightforward process, but attention to detail is key. Follow these steps to ensure the bot is correctly integrated into your FXCracked-sourced terminal.

Step 1: Download Files Download the Ala Bule R1 EA V1.0.ex4 file from the FXCracked.org library. Save it to your desktop. You may also find a Presets folder or a .dll file (if required for unlocking).

Step 2: Open Data Folder Launch your MetaTrader 4 terminal. Click on File in the top-left corner. Select Open Data Folder. This opens the Windows Explorer directory for your specific terminal.

Step 3: Install the Expert Advisor Double-click on the MQL4 folder. Double-click on the Experts folder. Copy the .ex4 file from your desktop and paste it here. (Note: If there is a .dll file included, go back to MQL4 -> Libraries and paste the DLL there).

Step 4: Install Presets Navigate back to the MQL4 folder. Open the Presets folder. Paste any .set files provided with the download. These are crucial for loading optimized settings quickly.

Step 5: Refresh Navigator Close the file explorer and return to MT4. Open the Navigator panel (Ctrl+N). Right-click on "Expert Advisors" and select Refresh. You should now see Ala Bule R1 EA V1.0 in the list.

Step 6: Chart Setup Open a chart for EURUSD (or your chosen pair). Set the timeframe to H1. Go to Tools -> Options -> Expert Advisors. Ensure Allow Automated Trading and Allow DLL Imports are checked.

Step 7: Attach and Activate Drag the EA from the Navigator onto the chart. In the pop-up window, go to the Inputs tab and click Load to select your preset file. Click OK. Ensure the AutoTrading button on the top toolbar is Green and the smiley face in the top-right corner of the chart is smiling.

Advantage :

1. Proven MT4 Reliability By sticking to MT4, the EA benefits from the platform's stability. It is a time-tested environment where the code performs predictably without the overhead of newer platforms.

2. Automated Cash Flow The Ala Bule R1 is designed to be a "hands-free" income generator. Once configured on a VPS, it handles all aspects of trading—entry, management, and exit—freeing the trader from screen time.

3. Robust Recovery The "Smart Grid" feature turns potential losing trades into winners (or break-even exits) by averaging the price. This leads to a psychologically pleasing high win rate and a rising equity curve.

4. Customizable Risk Whether you are a conservative investor looking for 5% monthly growth or an aggressive trader seeking higher returns, the EA's flexible settings allow you to tailor the risk profile to your needs.

5. FXCracked Availability Accessing this tool via FXCracked allows traders to test high-end institutional logic without the prohibitive upfront license fees, democratizing access to profitable strategies.

Disadvantage :

1. Drawdown Risk Like all systems that use averaging or grid logic, there is inherent risk. If a currency pair trends 500 pips in one direction without a pullback, the open drawdown can become significant. It requires sufficient capital to weather these storms.

2. Broker Dependency The EA requires a good broker. High spreads, swap fees, and slippage will eat into profits. It is not suitable for "B-Book" market maker brokers who trade against you.

3. VPS Requirement You cannot run this on a home PC that might lose power. A VPS is an absolute necessity, adding a monthly cost to your trading operation.

4. Economic News While the news filter helps, extreme "Black Swan" events can still catch the EA off guard. Manual intervention (turning off the bot) is recommended during major geopolitical crises.

Conclusion :

The Ala Bule R1 EA V1.0 MT4 is a formidable addition to the library of any serious Forex trader. It represents a mature, sophisticated application of algorithmic trading principles, tailored for the robust MetaTrader 4 environment. By combining trend-following entries with smart recovery logic, it offers a path to consistent profits that many simpler bots fail to achieve.

However, power comes with responsibility. This is not a "set and forget" money printer. It is a professional tool that demands a professional setup: a low-latency VPS, a raw spread broker, and conservative risk management. For the community at FXCracked.org, the Ala Bule R1 offers a unique opportunity to leverage institutional-grade logic. If you are willing to manage the risks and follow the installation guidelines, this EA has the potential to become a cornerstone of your automated trading portfolio. Download it, test it thoroughly on a demo account, and let the Ala Bule R1 navigate the markets for you.

Support & Disclaimer :

Support :

If you need help installing or configuring your EA, or face any kind of bug, feel free to reach out on:

WhatsApp: https://wa.me/+443300272265

Telegram Group: https://t.me/yoforexrobot

Disclaimer:

Forex and gold trading involve risk. Past performance doesn't guarantee future results. Always test robots on demo before live trading and use proper risk management.

Referral :

Join the VIP Signals Telegram Channel for real-time expert trading signals and stay ahead in the forex market. Get personalized strategies by becoming a part of our Real Account Management Telegram Channel and optimize your trading experience. If you're aiming to Pass PropFirm Challenges , join our dedicated channel for tips and proven methods. Start managing your capital effectively with expert advice from our Funded Account Management Telegram Channel. For advanced traders, our HFT EA / Passing Telegram Channel offers high-frequency trading insights and strategies to boost your performance.

Comments

Leave a Comment