Content The search for a reliable automated trading solution often leads traders toward high performance gold robots. One of the most significant releases in recent months is the Alpha Flow EA V1.0 MT4. Designed specifically to navigate the volatile swings of XAUUSD and major currency pairs, this expert advisor promises a blend of precision entry and robust risk management. In this detailed review, we will explore why this robot has become a staple for many algorithmic traders in 2025.

What makes Alpha Flow EA V1.0 stand out is its specialized focus on Gold. While many robots try to trade every asset on the market, Alpha Flow is optimized for the unique liquidity and price action patterns of the XAUUSD pair. It utilizes a sophisticated multi layered approach that combines sentiment analysis with technical price action. This allows the software to identify high probability reversal zones where the market is likely to bounce, providing a safer entry compared to traditional trend following bots.

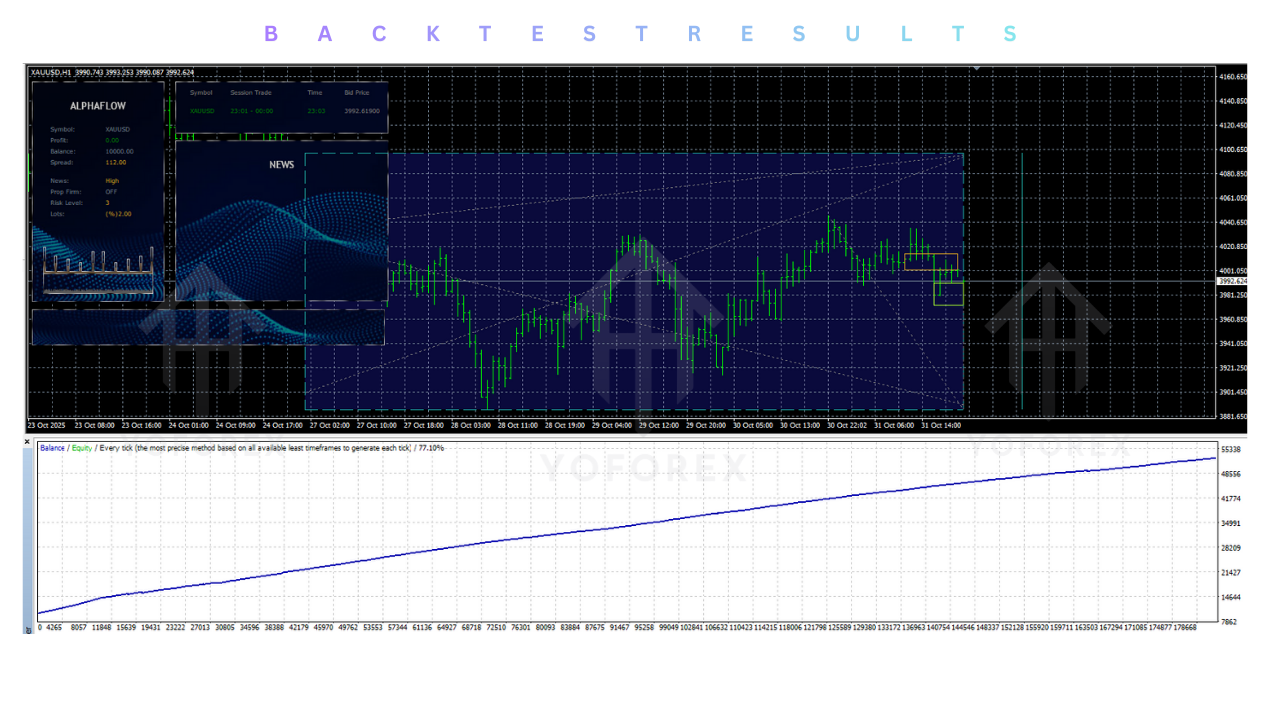

The core logic of Alpha Flow EA V1.0 MT4 centers on a smart grid system. Unlike basic martingale systems that can quickly lead to account depletion, this smart grid only activates when specific market conditions are met. It uses a mean reversion strategy to capitalize on price overextensions. When the price of Gold moves too far from its calculated average, the EA begins building a position with the expectation of a correction. This method is particularly effective in the hourly timeframe, where Gold frequently shows clear retracement patterns after a major push.

One of the most praised features of this version is its high frequency trading execution logic. By processing market data at incredible speeds, Alpha Flow reduces the risk of slippage, which is a common enemy for gold traders. This ensures that trades are opened and closed as close to the desired price as possible. Additionally, the software includes a built in news filter. This filter is designed to halt trading during high impact economic events, protecting your capital from the unpredictable volatility that usually accompanies news like the Non Farm Payroll or interest rate decisions.

For traders looking to pass prop firm challenges, Alpha Flow EA V1.0 MT4 offers a dedicated low risk mode. Many prop firms have strict daily drawdown and maximum loss rules. The EA allows users to set hard equity stops and maximum lot sizes to stay within these parameters. By adjusting the magic number and specific risk settings, traders can use the robot on multiple accounts without triggering copy trading violations, making it a versatile tool for professional fund management.

Performance data from various sources indicates that the robot aims for consistent monthly growth rather than overnight riches. Most users observe a monthly return ranging from five to ten percent, depending on the risk settings applied. The drawdown remains manageable for those who follow the recommended deposit of at least two hundred dollars for every 0.01 lot size. Using an ECN or Raw Spread account is highly recommended to ensure the tight spreads needed for the EA's scalping elements to remain profitable.

Setting up the Alpha Flow EA V1.0 is relatively simple. Once the files are placed in the experts folder of your MT4 terminal, you simply attach it to an H1 chart of your chosen asset. It is crucial to ensure that DLL imports are allowed in the terminal settings for the EA to communicate with its licensing and data servers. While it is a plug and play system, successful traders often spend time on a demo account first to understand how the robot reacts to different market environments before going live.

In conclusion, Alpha Flow EA V1.0 MT4 represents a strong option for those wanting to automate their gold trading. It strikes a balance between aggressive profit taking and defensive risk control. While no robot can guarantee a hundred percent success rate, the inclusion of AI filters and smart grid logic makes this a much safer alternative to standard trading bots. Whether you are a beginner or an experienced trader, integrating this EA into your portfolio could be the step you need toward more consistent results.

Comments

Leave a Comment