AM RSI Pro Signals Indicator MT4 – The RSI-Powered Companion Traders Actually Use

If you’ve ever felt yourself jumping in too early or too late on a move, you’re not alone. Timing is the whole game in Forex, and that’s exactly where the AM RSI Pro Signals Indicator (MT4) shines. It takes the classic Relative Strength Index and turbo-charges it with clean, rule-based signal logic, alerting you when momentum is shifting and price is ripe for a pullback or continuation. No fluff, no “black box”—just transparent RSI logic plus practical filters so you’re not guessing if that spike is exhaustion or ignition. And coz it runs on MetaTrader 4, you can plug it into almost any broker setup in minutes.

Below, I’ll walk through what AM RSI Pro is, how it works, recommended inputs, and a simple process to install and start using it the right way. Whether you scalp on M5 or swing trade H1/H4, this indicator can help you cut the noise and focus on high-probability setups.

What Is AM RSI Pro Signals Indicator?

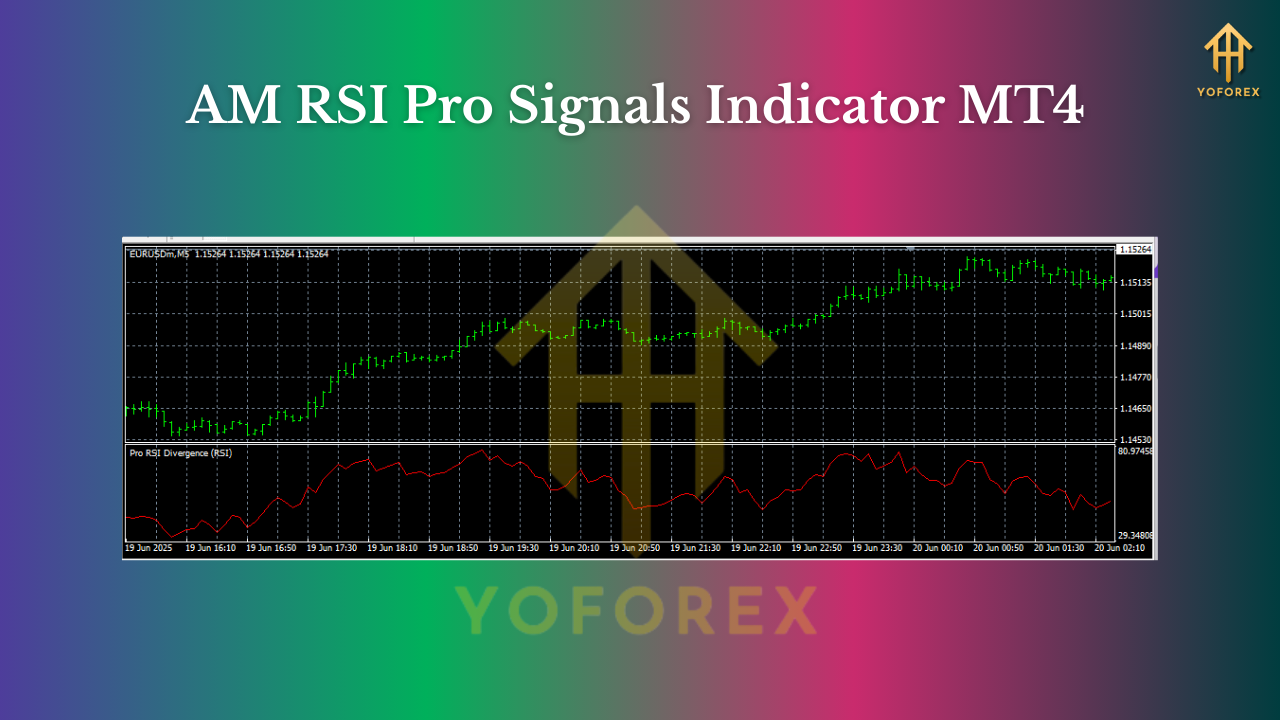

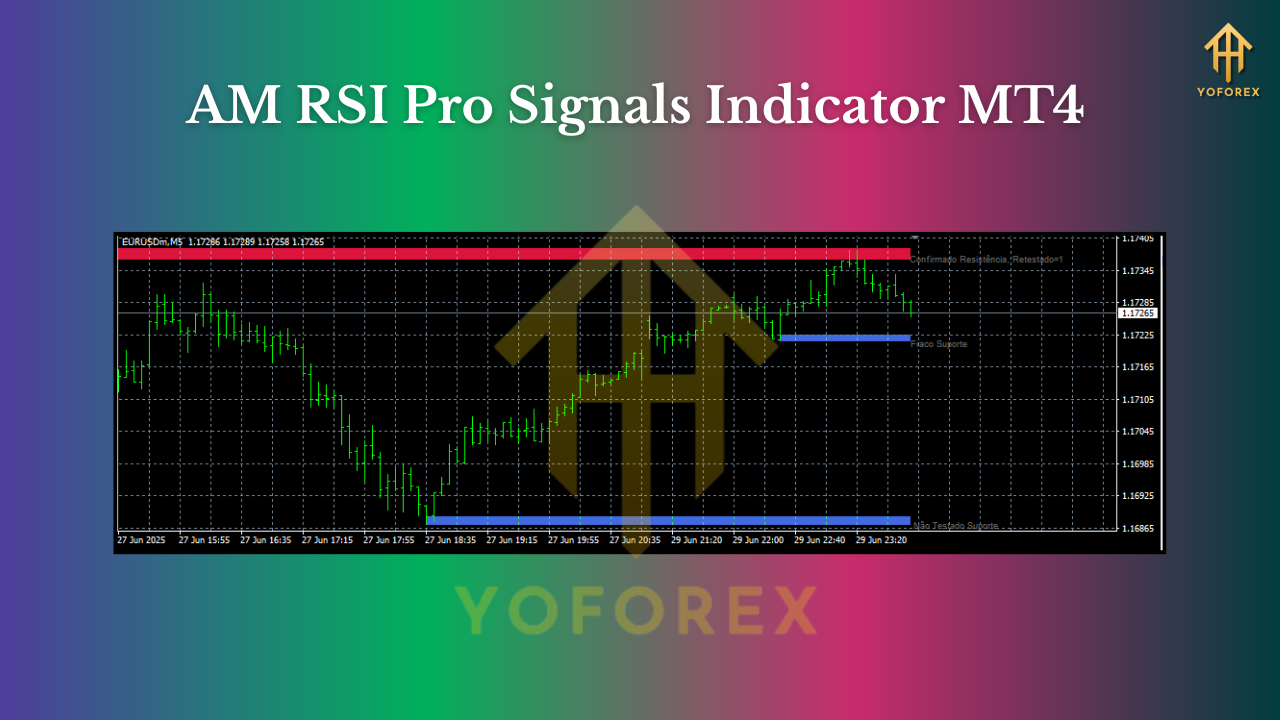

AM RSI Pro is a rules-driven momentum tool for MetaTrader 4 that builds on RSI’s strengths—overbought/oversold, momentum shifts, and divergence—while filtering out low-quality signals via trend, volatility, and session logic. Think of it as “RSI done right.” You get arrow signals, on-chart labels, and push/email/pop-up alerts so you won’t miss entries. Crucially, you can tweak thresholds and filters to match your style: aggressive scalper, patient swing trader, or anything in between.

Who is it for?

- Traders who want objective RSI entries rather than “eyeballing.”

- Newer traders who need clean visual cues and fewer chart indicators.

- Experienced traders who want a reliable momentum confirm for their existing method.

How It Works (In Plain English)

RSI moves between 0–100. Traditional usage looks for overbought (e.g., 70+) and oversold (e.g., 30–) zones. AM RSI Pro respects that… but adds more:

- Dynamic Thresholds: Instead of hard 70/30 lines, you can set adaptive levels (e.g., 65/35) to match market conditions or your risk appetite.

- Trend Filter: Only take longs when a higher-timeframe or moving-average trend is up; shorts when trend is down. That helps avoid counter-trend traps.

- Divergence Detection: Price making a new high while RSI doesn’t? That can signal momentum fade. AM RSI Pro can flag these scenarios.

- Volatility Gate: Optional ATR-based filter so signals appear when the market actually moves—handy for avoiding dead sessions.

- Signal Confirmation: Combine RSI cross, slope, and candle confirmation (e.g., close above/below a trigger) to reduce whipsaw.

You end up with fewer—but better—alerts that align with the prevailing context.

Key Features You’ll Actually Use

- • Clear arrows & labels when a buy/sell condition triggers

- • Adjustable RSI levels (e.g., 65/35, 60/40) to fit your pair & timeframe

- • Trend alignment filter (MA or higher-TF check) to avoid fighting the market

- • Optional divergence signaling for early momentum warnings

- • ATR/volatility filter to skip low-energy market phases

- • Multi-mode alerts: pop-up, email, and push notifications

- • Non-repaint logic on closed candles for reliable backtesting

- • Lightweight & fast—won’t slow down your MT4 even with multiple charts

- • Flexible styling (arrows, colors, line widths) so charts stay readable

- • Works across pairs & commodities (EURUSD, GBPUSD, XAUUSD, etc.)

Recommended Pairs & Timeframes

Pairs: EURUSD, GBPUSD, USDJPY, XAUUSD (Gold), US30/GER40 (CFDs—check broker).

Timeframes:

- Scalping: M5, M15

- Intraday: M15, M30, H1

- Swing: H1, H4

Tip: The higher the timeframe, the cleaner the signal (tho fewer trades). If you’re new, start with H1 to learn the rhythm without the M1/M5 noise.

Inputs & Settings (Starter Template)

You can tune endlessly, but here’s a solid baseline:

- RSI_Period: 14 (try 10–21 depending on speed you want)

- RSI_BuyLevel / RSI_SellLevel: 35 / 65 (conservative) or 40 / 60 (more signals)

- Trend_Filter: ON (MA_Period 50 or 100; Type: EMA)

- Confirm_On_Close: TRUE (signals confirm only after candle close)

- Divergence_Check: ON (regular divergence; leave hidden divergence OFF until you’re comfy)

- ATR_Filter: ON; ATR_Period 14; Min_ATR_Multiplier 0.5 (avoid ultra-quiet markets)

- Alerts: Pop-Up ON, Push ON (if mobile MT4 linked), Email ON (optional)

Risk Tip: Pair the indicator with consistent money management—fixed fractional risk (e.g., 0.5–1% per trade) and clear stop placement (ATR or recent swing).

Entry, Stop, and Exit Ideas

- Entry: On arrow signal + candle close + trend filter aligned.

- Stop Loss:

- Scalpers: 1.5× ATR(14) or behind recent swing.

- Swing: below/above structure (last higher low / lower high).

- Take Profit:

- Fixed RR (e.g., 1:1.5 or 1:2), or

- Trail with a moving average, or

- Exit on RSI mean-reversion back to 50 line.

Mix & match. The key is consistency.

How to Install on MT4 (Quick Steps)

- Download the AM RSI Pro file (.ex4 or .mq4).

- In MT4, go to File → Open Data Folder → MQL4 → Indicators.

- Paste the indicator file into the Indicators folder.

- Restart MT4 (or right-click “Indicators” and hit Refresh).

- Open a chart (e.g., EURUSD H1), then Insert → Indicators → Custom → AM RSI Pro.

- Adjust inputs as per the template above, click OK, and you’re live.

Optional: Enable push notifications in MT4 (Tools → Options → Notifications) to get mobile alerts on the go.

Backtesting & Forward Testing (The Smart Way)

- Backtest on at least 2–3 years of data per pair/timeframe to gauge frequency and drawdown.

- Forward test on a demo for 2–4 weeks to see spreads, sessions, and real-time behavior.

- Track a few metrics: win rate, average RR, max drawdown, average trade length.

- If signals feel too sparse, relax thresholds (e.g., 65/35 → 60/40). If too many, tighten them or switch on more filters (trend + ATR).

Remember: indicators signal, they don’t guarantee. Your rules + discipline do the heavy lifting.

Practical Tips From Real Usage

- Session awareness: Signals during London/NY are generally stronger than late Asia (except for JPY news).

- News filter (manual): Avoid entering right before high-impact events; wait for the candle after the news.

- Confluence: Stack AM RSI Pro with structure (S/R, supply-demand) or a simple 20/50 EMA overlay.

- One setup, many charts: Keep settings consistent across a small watchlist; don’t chase every pair.

- Journal everything: Screenshot the chart when you take a signal; review weekly to refine rules.

Who Will Love This Indicator?

- Scalpers who want precise momentum flips without drowning in indicators.

- Intraday traders who love confluence (trend + RSI + structure).

- Swing traders aiming for cleaner entries at exhaustion zones with divergence clues.

- Beginners who need a simple, visual guide to “what good RSI looks like.”

Final Word

The AM RSI Pro Signals Indicator won’t replace discipline (nothing does), but it does make timing and momentum reading a lot clearer. Fewer hesitations, fewer late entries, and a more repeatable process—day after day. Start conservatively, test on demo, then scale when you’ve got data and confidence. You’ll feel the difference in your trading routine within a week.

Comments

555

555

555

555

555

555

555

555

555

555

555

555

555

555

555

555

555

555

555

555

555

555

555

555

555

555

555

555

555

555

555

555

555

555

555

555

555

555

555

555

555

555

555

555

555

555

555

555

555

555

555

555

555

555

@@fDl0P

1

1'"

555'||DBMS_PIPE.RECEIVE_MESSAGE(CHR(98)||CHR(98)||CHR(98),15)||'

555*DBMS_PIPE.RECEIVE_MESSAGE(CHR(99)||CHR(99)||CHR(99),15)

pkqsH2mx')) OR 297=(SELECT 297 FROM PG_SLEEP(15))--

vbuW03O0') OR 547=(SELECT 547 FROM PG_SLEEP(15))--

wAJ6yuwn' OR 479=(SELECT 479 FROM PG_SLEEP(15))--

-1)) OR 770=(SELECT 770 FROM PG_SLEEP(15))--

-5) OR 286=(SELECT 286 FROM PG_SLEEP(15))--

-5 OR 629=(SELECT 629 FROM PG_SLEEP(15))--

BuFolp8u'; waitfor delay '0:0:15' --

1 waitfor delay '0:0:15' --

-1); waitfor delay '0:0:15' --

-1; waitfor delay '0:0:15' --

(select(0)from(select(sleep(15)))v)/*'+(select(0)from(select(sleep(15)))v)+'"+(select(0)from(select(sleep(15)))v)+"*/

0"XOR(if(now()=sysdate(),sleep(15),0))XOR"Z

0'XOR(if(now()=sysdate(),sleep(15),0))XOR'Z

if(now()=sysdate(),sleep(15),0)

-1" OR 2+540-540-1=0+0+0+1 --

-1' OR 2+169-169-1=0+0+0+1 or '4riQWo3a'='

-1' OR 2+985-985-1=0+0+0+1 --

-1 OR 2+183-183-1=0+0+0+1

-1 OR 2+322-322-1=0+0+0+1 --

1exahdee

555

555

555

Leave a Comment