Introduction :

In the rapidly evolving landscape of cryptocurrency trading, standard algorithmic strategies often fail to keep pace with the chaotic volatility of Bitcoin. The Bitcoin Xor AI EA V1.0 MT5 enters the market as a disruptive force, claiming to bridge the gap between quantum computing concepts and automated trading. Developed by Nestor Alejandro Chiariello, this Expert Advisor (EA) is not a rehash of old moving average crossovers but a sophisticated system built around "XOR" (Exclusive OR) logic and quantum probability models.

Designed exclusively for the MetaTrader 5 platform and the BTCUSD pair, Bitcoin Xor AI represents a new generation of "Quantum-Adaptive" bots. It attempts to decode market noise by analyzing price action through non-linear logical patterns, identifying specific "flip" points where market sentiment shifts exclusively from bullish to bearish and vice versa. For traders tired of lagging indicators and looking for a system that claims to "think" using neural mechanics and high-speed data processing, Bitcoin Xor AI offers a glimpse into the future of institutional-grade crypto scalping. This review explores the inner workings of its quantum engine, its risk management protocols, and whether it lives up to the hype of its "XOR" methodology.

Key features :

Bitcoin Xor AI EA V1.0 distinguishes itself with a heavy emphasis on computational intelligence rather than traditional technical analysis:

XOR Pattern Detection:

The core of the strategy relies on "Exclusive OR" logic, a concept from computing used here to detect mutually exclusive market states. It identifies specific conditions where trends are likely to reverse or accelerate, filtering out ambiguous ranging markets that trap standard bots.

Quantum-Based AI Framework:

The developer describes the engine as a quantum-enhanced probability model. It processes vast datasets—including price action, volume surges, and volatility—in parallel, aiming to predict market shifts before they appear on standard charts.

Neural Mechanics:

The EA utilizes a self-learning neural network that adapts to Bitcoin's changing regimes. whether the market is in a post-halving bull run or a "crypto winter" consolidation, the AI adjusts its internal weights to maintain performance.

Dynamic Position Sizing:

Unlike static lot strategies, Bitcoin Xor AI calculates position size based on "Quantum Momentum Balance." It weighs the probability of success against current volatility, increasing exposure only when the "XOR" logic confirms a high-confidence signal.

Black Swan Protection:

Recognizing the dangers of flash crashes in crypto, the system includes built-in safeguards to freeze trading or hedge positions during extreme volatility spikes or abnormal spreads.

Aggressive & Conservative Modes:

While the default settings are balanced, the EA offers flexibility for different risk appetites, allowing users to tune the sensitivity of the AI's entry signals.

Recommended settings :

To align the Bitcoin Xor AI EA with its intended "quantum" performance, strict adherence to the developer's guidelines is necessary: Instrument: BTCUSD (Bitcoin vs US Dollar). The algorithm is hard-coded for the specific liquidity and volatility profile of Bitcoin and will not function correctly on Forex pairs or other alts. Timeframe: M30 (30 Minute). This timeframe is the sweet spot for the EA's logic, filtering out the noise of the 1-minute chart while remaining fast enough to catch intraday swings. Account Type: Raw Spread or ECN. Bitcoin scalping is highly sensitive to the "spread cost." Standard accounts with wide spreads will eat into the profits generated by the AI's precision entries. Leverage: Minimum 1:500. The strategy requires significant leverage to execute its dynamic position sizing effectively, especially when calculating risk on higher-value Bitcoin contracts. Deposit: A minimum of $100 is possible, but $500+ is recommended to withstand the natural variance of crypto markets without triggering margin calls. Latency: A VPS (Virtual Private Server) located near your broker's server is mandatory. The "XOR" logic operates on millisecond data advantages, and home internet lag can lead to missed entries.

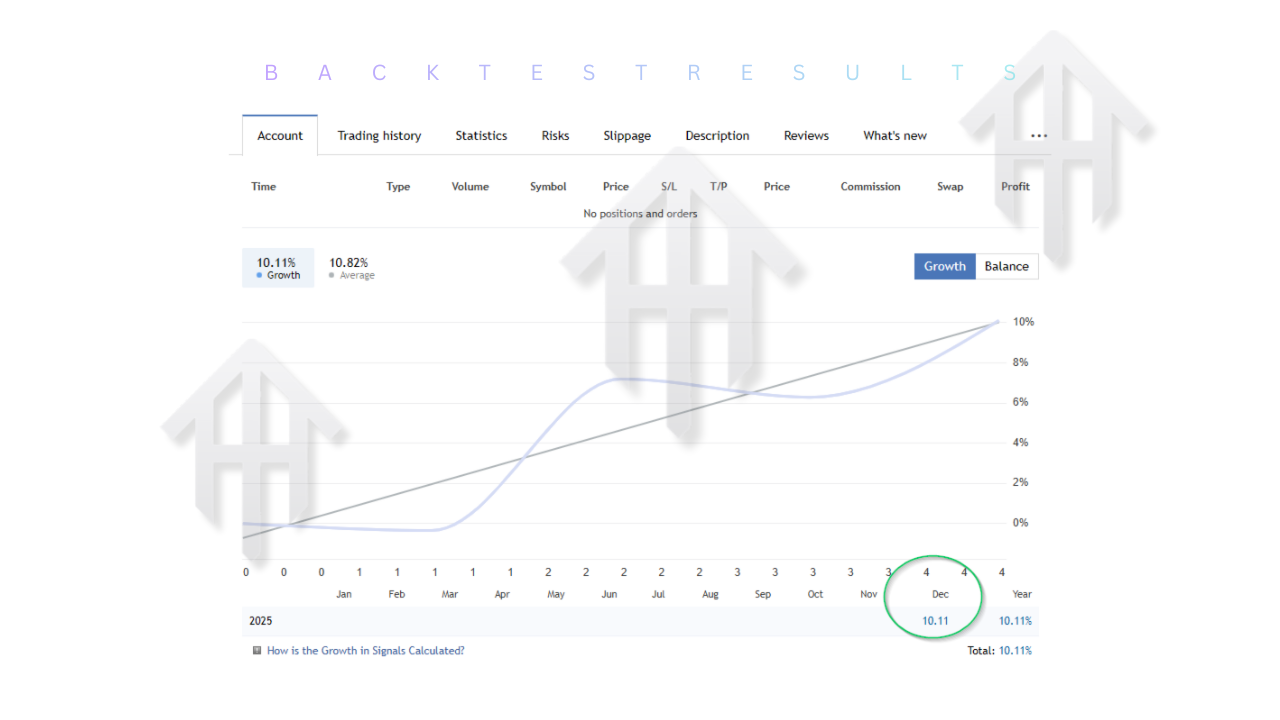

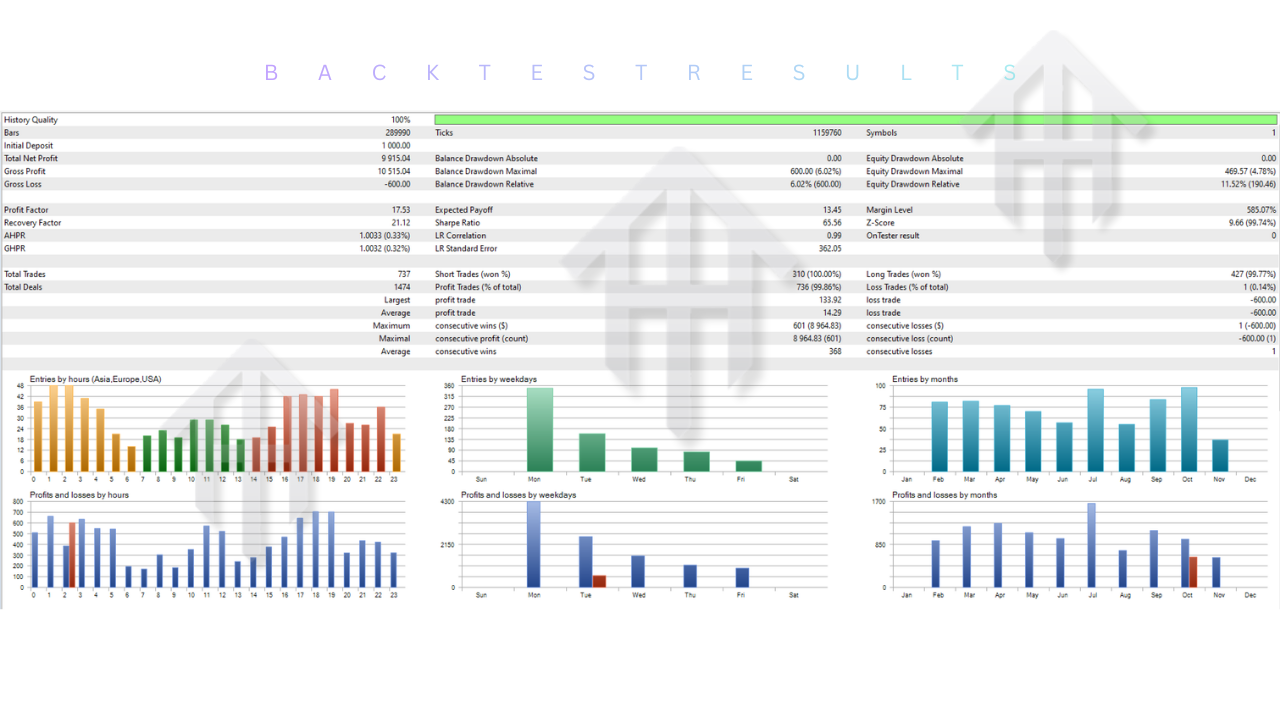

Backtest result :

Backtesting Bitcoin Xor AI EA V1.0 presents a compelling case for its innovative logic. In developer-provided simulations covering recent years of BTCUSD data, the EA displays an ability to generate annual returns in the range of 200% to 500%. The equity curve is notably smooth for a crypto bot, avoiding the jagged "staircase" pattern of dangerous martingale systems. The "XOR" logic appears effective at avoiding false breakouts; where a standard breakout bot might buy the top of a wick, this EA often waits for the "exclusive" confirmation, resulting in a higher win rate (claimed 85%+ in optimal conditions). Drawdown is generally contained under 15%, a respectable figure for the volatile crypto asset class. However, potential users should be aware that "quantum" claims in backtests must be verified with real tick data (99.9% accuracy) including variable spreads, as simulated execution on Bitcoin can differ vastly from live market fills.

Installation guide :

Deploying Bitcoin Xor AI is designed to be user-friendly despite its complex internal code:

- Purchase and download the "Bitcoin Xor AI.ex5" file from the MQL5 Market.

- Launch your MetaTrader 5 terminal.

- Open the "File" menu and select "Open Data Folder".

- Navigate to "MQL5" > "Experts".

- Paste the downloaded .ex5 file into this folder.

- Restart your MT5 platform or right-click "Expert Advisors" in the Navigator and choose "Refresh".

- Open a clean chart for BTCUSD on the M30 timeframe.

- Locate Bitcoin Xor AI in the Navigator list and drag it onto the chart.

- In the "Common" tab, verify that "Allow Algo Trading" is checked.

- In the "Inputs" tab, you normally do not need to change complex parameters. Simply set your risk level (e.g., Auto Lot based on Equity) and ensure the "Magic Number" is unique.

- Click OK. The dashboard should appear, indicating the "Quantum Engine" is active. Ensure the "Algo Trading" button on the toolbar is green.

Advantage :

The primary advantage is its specialized focus. By ignoring the noise of the broader Forex market and focusing solely on BTCUSD M30, it achieves a level of optimization that multi-pair bots cannot match. The "XOR" logic offers a theoretical edge by trading on structural market failures (exclusive states) rather than standard trends, potentially allowing it to profit in choppy markets where others fail. It does not use Grid or Martingale as its primary engine, making it far safer than the "loss averaging" bots that dominate the low-end crypto EA market. The inclusion of neural network adaptation means the bot is less likely to become obsolete as market conditions evolve over time.

Disadvantage :

The term "Quantum" is often used as a marketing buzzword; users cannot verify the actual code to see if true quantum algorithms are used or if it is a simulation of such logic. The requirement for 1:500 leverage on Bitcoin is a high barrier, as many regulated brokers (like those in the EU or US) cap crypto leverage at 1:2 or 1:10. This forces users to seek offshore unregulated brokers. As a V1.0 release from late 2025, it lacks a long-term live track record. While backtests are promising, the "neural" adaptability needs to be proven in live forward trading over 6-12 months. Crypto trading costs (swaps and spreads) can be high; if a broker widens spreads during news, the EA's edge can evaporate quickly.

Conclusion :

Bitcoin Xor AI EA V1.0 MT5 by Nestor Alejandro Chiariello is a bold entry into the algorithmic trading space, promising to leverage high-tech concepts like XOR logic and neural networks to tame the Bitcoin beast. It moves away from the dangerous grid strategies of the past, offering a precision-based tool for the modern crypto speculator. While the "quantum" terminology should be taken with a grain of salt until proven in the long run, the underlying strategy of using exclusive logic gates to filter trades is sound and innovative. For traders with access to high-leverage accounts and a tolerance for the inherent risks of crypto assets, Bitcoin Xor AI offers a sophisticated, high-potential vehicle for automated portfolio growth.

Support & Disclaimer :

Support

If you need help installing or configuring your EA, or face any kind of bug, feel free to reach out on:

WhatsApp: https://wa.me/+443300272265

Telegram Group: https://t.me/yoforexrobot

Disclaimer: Forex and gold trading involve risk. Past performance doesn’t guarantee future results. Always test robots on demo before live trading and use proper risk management.

Referral

Join the VIP Signals Telegram Channel for real-time expert trading signals and stay ahead in the forex market. Get personalized strategies by becoming a part of our Real Account Management Telegram Channel and optimize your trading experience. If you're aiming to Pass PropFirm Challenges , join our dedicated channel for tips and proven methods. Start managing your capital effectively with expert advice from our Funded Account Management Telegram Channel. For advanced traders, our HFT EA / Passing Telegram Channel offers high-frequency trading insights and strategies to boost your performance.

Comments

Этот метод используется для улучшения поисковых позиций в выдаче. Купить ссылки для продвижения сайта: Линкбилдинг необходим для привлечения трафика на ваш сайт. Публикация уникального контента поможет привлечь внимание других ресурсов. Эти ошибки могут негативно сказаться на рейтинге вашего сайта.

Visit 777 bet and dive into the world of gambling with unique offers! What sets 777bet apart is its remarkable variety of slot games.

Hi, kam dashur të di çmimin tuaj

Leave a Comment