Introduction

Every trader, whether beginner or experienced, eventually hits the same wall – market noise. Price keeps jumping up and down, candles form random shapes, and half the indicators on your chart start giving mixed signals. But beneath all that noise, there is one simple reality: at any moment, either buyers or sellers are in control.

If you can see that balance clearly, your trades change completely.

The Buyers vs Sellers Indicator V1.0 MT4 is built exactly for that purpose. Instead of relying only on lagging moving averages or generic oscillators, it focuses on real market pressure and volume dominance. It gives a visual representation of which side – buyers or sellers – is pushing harder right now, so you don’t have to guess momentum direction.

This is especially useful if you are tired of entering a “perfect looking” trade that reverses just a few candles later. The indicator helps expose when a move is truly backed by strong participation and when it’s just a weak push that might fade away. Whether you scalp, intraday trade or swing trade, this tool can become a core part of your decision-making.

In this guide, we’ll break down what the indicator does, its features, how to install it on MT4, and how to actually use it in real market conditions.

What Is the Buyers vs Sellers Indicator V1.0 MT4?

The Buyers vs Sellers Indicator V1.0 MT4 is a custom trading tool designed to reveal the real-time battle between buying and selling pressure in the market. Instead of focusing purely on price direction, it highlights who is behind the move – the buyers or the sellers – and how strong they are compared to each other.

Instead of asking “Is the market trending?”, this indicator answers a deeper question:

“Who is actually controlling the market right now – buyers or sellers?”

Typically, the indicator displays:

- Dynamic visual output showing buy pressure vs sell pressure

- A clear bias meter that tilts in favor of buyers or sellers

- Strength representation through bars, histograms, or colored zones

- Real-time updates as price and volume change

Because it uses tick data and volume behavior, the indicator reacts quickly and adapts to new market conditions in seconds. It works on all major and minor forex pairs, gold, indices, and even some crypto pairs on MT4. You can use it on lower timeframes for scalping or on higher timeframes like H1 and H4 for swing trading.

The real beauty of this tool is that it helps you see early shifts in power. Many traders lose money by entering right when buyers are getting tired or when sellers are losing steam. This indicator makes those shifts more visible, so you can avoid jumping in at the worst possible moment.

Key Features of Buyers vs Sellers Indicator V1.0 MT4

Real-Time Buy vs Sell Power

The indicator continuously analyzes incoming market data to measure how aggressive buyers are vs how aggressive sellers are. This gives you a live “power meter” instead of just a simple up or down signal.

Volume-Weighted Logic

It doesn’t just look at price direction, it takes into account volume-based pressure. If buyers are pushing the price up but with weak volume, the indicator will show that the move isn’t truly supported. Same goes for sellers.

Clear Trend Bias Detection

With its color-coded visual output, you can quickly see whether the market is in clear buyer control, seller control, or a more neutral, choppy phase. This helps you avoid forcing trades when the market is undecided.

Early Reversal Clues

When buying pressure begins to fade during an uptrend, or selling pressure starts to weaken during a downtrend, the indicator often reacts before price fully reverses. This early warning can be super useful for exits or for catching the new direction.

No Repainting

Signals and pressure readings do not repaint after the candle closes. This means what you see in backtesting is what you would have seen live, making the tool more reliable for strategy building.

Easy-to-Read Interface

You don’t need to be a quant or a coder to understand the output. The visual layout is designed for clarity – even beginners can grasp the basic meaning of the signals after a bit of practice.

Works on All Forex Pairs and Timeframes

You can apply the indicator to majors, minors, gold, and CFD pairs. It behaves well from M1 to H4 and even D1, depending on your trading style.

Great Companion for SMC and Price Action

If you trade using Smart Money Concepts (SMC), ICT style, order blocks, or liquidity grabs, this indicator can act as a confirmation tool for the direction of real market pressure behind those setups.

How the Indicator Works – The Core Logic

Behind the scenes, the indicator mixes three main elements:

- Aggressive buying vs aggressive selling – It looks at how price behaves when buyers step in vs when sellers step in.

- Volume pressure – It tracks whether those moves are supported by strong volume or just weak participation.

- Market imbalance – It highlights moments where one side significantly overpowers the other, which often leads to strong directional moves.

When all three factors line up – for example, strong buy aggression, high volume, and clear imbalance – the indicator will display strong buying dominance. When the opposite happens, selling dominance becomes obvious.

In practical terms, this helps you:

- Know if a breakout is real or fake

- See if a pullback is healthy or a sign of reversal

- Understand whether you are trading with the strong side or against it

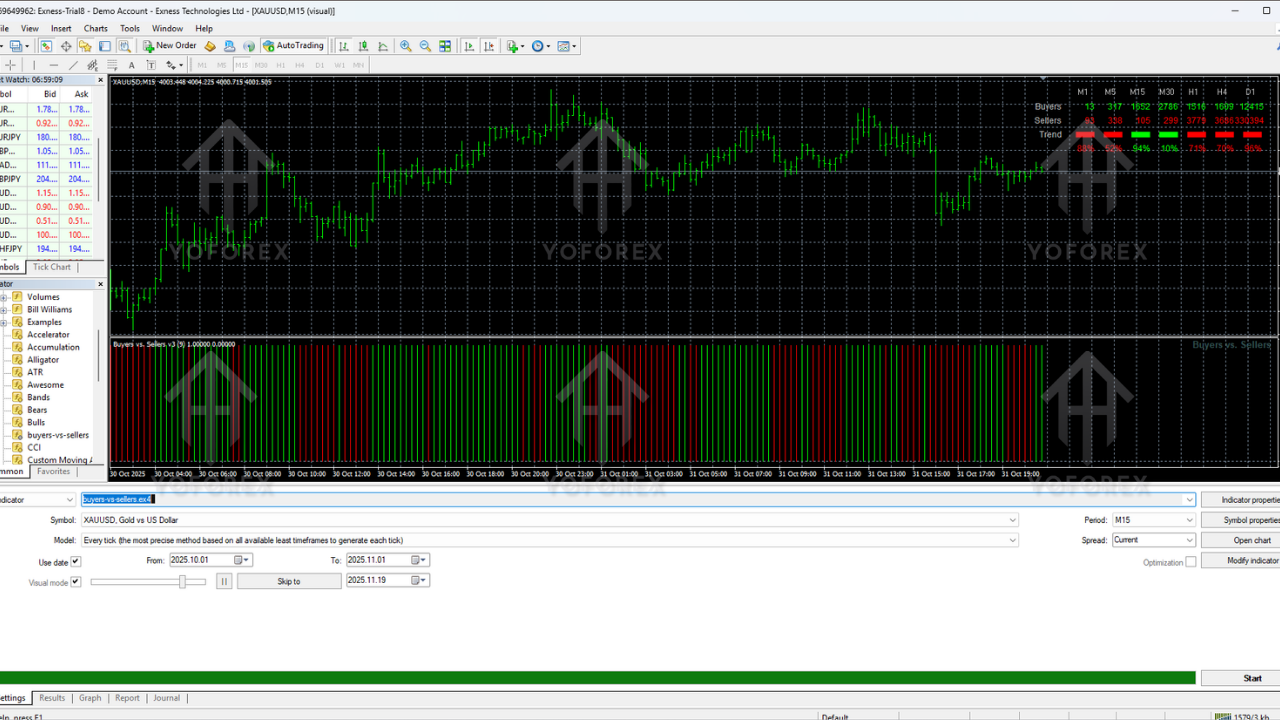

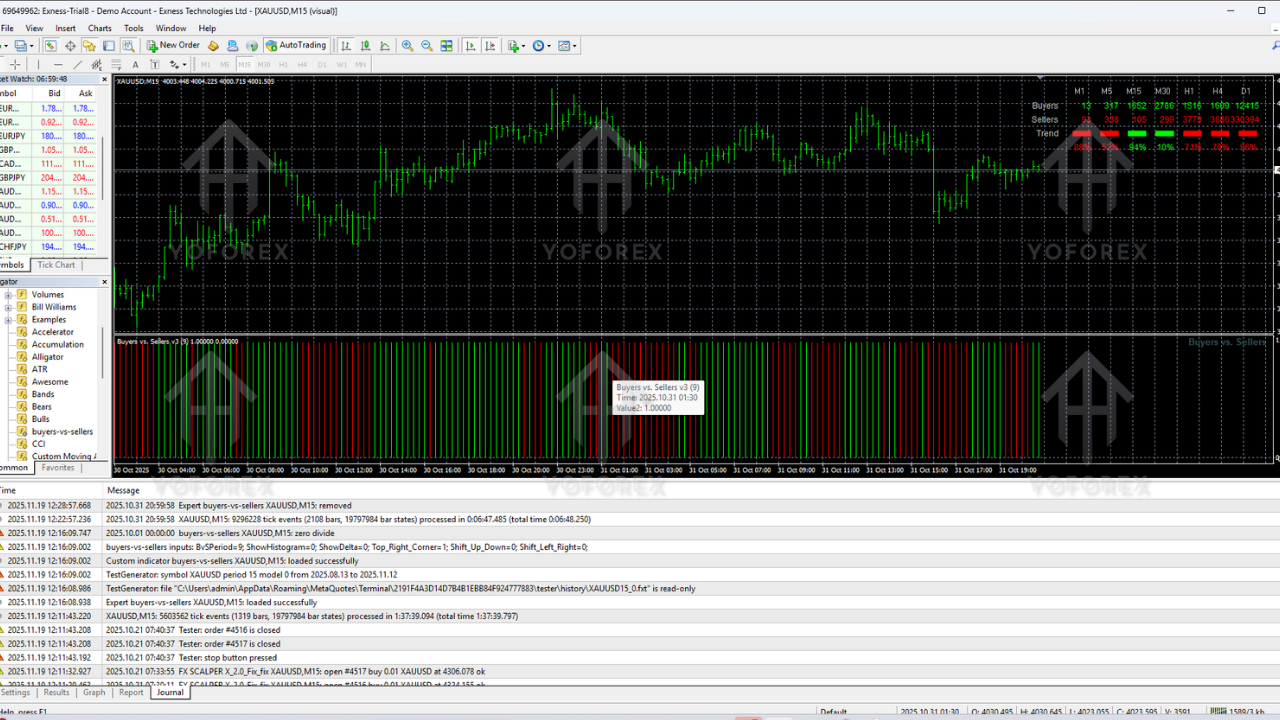

Backtest & Performance Overview

While this is not an Expert Advisor (EA) that opens trades automatically, you can still evaluate its behavior across historic data. In test sessions on pairs like EURUSD, GBPUSD, XAUUSD, and GBPJPY across M5, M15, and H1, the indicator showed consistent ability to highlight where one side truly dominated.

Some key observations from manual backtesting and visual analysis include:

- Strong in trending markets: During clear uptrends or downtrends, the indicator made it easy to stay on the right side of the momentum by showing sustained buyer or seller control.

- Good reversal sensitivity: Around major support and resistance zones, when market structure signaled a potential reversal, the indicator often showed a shift in pressure early.

- Useful on breakout candles: It helped confirm whether a breakout candle had true backing from buyers or sellers, which is crucial to avoid fakeouts.

- Stable signals: Because it doesn’t repaint, the historical readings matched what would have been visible in real time.

Scalpers found it very helpful during London and New York sessions, when volume is active and price responds clearly to order flow. Swing traders used it more as a confirmation layer on H1/H4 to choose direction, and then drilled down to lower timeframes for precise entries.

Of course, like any indicator, it’s not a magic bullet. But when combined with market structure, support and resistance, and basic risk management, it can significantly improve the quality of trade filtering and entry timing.

How to Install Buyers vs Sellers Indicator V1.0 on MT4

Step 1: Download the File

Download the indicator file (.ex4 or .mq4) from your website’s download area and save it on your computer.

Step 2: Open MT4 and Data Folder

Open your MetaTrader 4 platform. Click on File > Open Data Folder. This opens the core MT4 directory where all indicators are stored.

Step 3: Place the Indicator in the Indicators Folder

Inside the data folder, navigate to:

MQL4 > Indicators

Paste the Buyers vs Sellers Indicator file into this folder.

Step 4: Restart MT4

Close MT4 fully and reopen it so the platform can load the new indicator.

Step 5: Attach to a Chart

In the Navigator panel, go to the Indicators section. Look for Buyers vs Sellers Indicator V1.0, then drag and drop it to any chart you want to analyze.

Step 6: Adjust Settings (Optional)

Depending on the version, you may have inputs like:

- Volume sensitivity

- Reaction speed or smoothing

- Color options for buyers and sellers

- Minimum pressure threshold

You can leave default settings if you are new, or fine tune them later based on your style.

How to Use Buyers vs Sellers Indicator in Real Trading

1. Identify Dominant Side

First step is simple: check whether buyers or sellers are clearly stronger. If the indicator shows strong buyer dominance, you focus on buy setups. If sellers dominate, you focus on sell setups. If things look balanced or flat, you might skip trading until clearer bias forms.

2. Combine With Market Structure

Use basic structure tools like higher highs, higher lows, lower highs, lower lows, support, resistance, or order blocks. When structure and the indicator agree, your trade idea gains more confidence.

3. Confirm Breakouts

When price breaks a key level, check whether the indicator shows strong pressure from the breakout side. If volume and pressure confirm, the breakout is more likely to continue. If not, it might be a fakeout.

4. Spot Weakening Trends

If you are in a buy trade and the indicator starts showing decreasing buyer pressure while seller pressure slowly climbs, that may be a sign to tighten your stop or take profit. Same logic applies in reverse for sell trades.

5. Filter Choppy Markets

When buyers and sellers keep flipping quickly and pressure stays almost equal, the indicator is essentially telling you that the market is indecisive. In such conditions, staying out can sometimes be the best trade.

Recommended Settings and Best Practices

Every trader has a unique style, but here are some general tips:

- Use medium volume sensitivity when starting out to avoid too much noise.

- For scalping, a slightly faster reaction can help spot quick shifts.

- For swing trades, allow a bit more smoothing so you focus on bigger swings, not tiny fluctuations.

- Keep colors simple and clear so you can read dominance at a glance.

Also, avoid running ten other heavy indicators on top. The whole idea of this tool is to simplify your view, not make it messier.

Common Mistakes to Avoid

- Relying only on the pressure indicator without checking market structure.

- Entering trades when pressure is almost equal – that often means chop.

- Ignoring session timing, especially if you trade on very low timeframes.

- Opening large positions just because pressure looks strong without managing risk.

Use the indicator as a decision support tool, not as a replacement for a full trading plan.

Who Is This Indicator Best For?

The Buyers vs Sellers Indicator V1.0 MT4 is great for:

- Scalpers who need quick confirmation of real-time momentum

- Day traders who want to align with the dominant side during sessions

- SMC and ICT-style traders who already mark liquidity, order blocks, and structure

- New traders who struggle to see who is really in control of the market

If you often feel confused by mixed indicators or noisy signals, this tool can help cut through that and show a cleaner picture of buyer vs seller strength.

Final Thoughts

The Buyers vs Sellers Indicator V1.0 MT4 is not some magical holy grail, but it is a powerful and practical addition to any trading toolkit. By making market pressure and volume dominance visible, it gives you a clearer view of who is winning the battle at any moment.

Used together with proper market structure analysis, simple price action, and solid risk management, it can seriously improve your decision-making and reduce the number of trades you take against the real flow of the market. If you are looking for a more objective way to judge momentum instead of just eyeballing candles, this indicator is absolutely worth adding to your MT4 setup.

Comments

Leave a Comment