Introduction :

The CentyMenT EA V1.0 MT5 is a cutting-edge automated trading solution designed to give retail traders a significant edge by leveraging one of the most powerful concepts in financial markets: market sentiment. In the vast and often chaotic world of Forex trading, price action is driven not just by economic fundamentals but by the collective psychology of millions of participants. Most retail traders rely heavily on lagging technical indicators like Moving Averages, RSI, or MACD, which often result in late entries and exits. The CentyMenT EA takes a radically different approach. It is built on the premise that the retail crowd is statistically wrong at market turning points. By analyzing real-time sentiment data, specifically the ratio of long versus short positions held by retail traders, this Expert Advisor identifies moments of extreme imbalance. When the herd is overwhelmingly buying, the smart money is often preparing to sell, and vice versa.

This software automates the complex process of contrarian trading. Instead of manually scanning multiple websites and data feeds to gauge market mood, the CentyMenT EA V1.0 integrates directly into the MetaTrader 5 platform, pulling data and executing trades with machine precision. It is designed to exploit the "dumb money" phenomenon, where emotional decision-making leads the majority to buy at tops and sell at bottoms. The EA waits for high-probability setups where sentiment reaches critical thresholds, effectively fading the crowd to align your account with institutional flows. Whether you are a novice looking to move away from standard indicators or a professional seeking to diversify your algorithmic portfolio, the CentyMenT EA offers a robust, logic-driven strategy. This comprehensive guide will explore the inner workings, features, and optimal configurations of this powerful tool, ensuring you have all the knowledge needed to deploy it effectively on your trading account.

Key features :

Advanced Sentiment Analysis Algorithm :

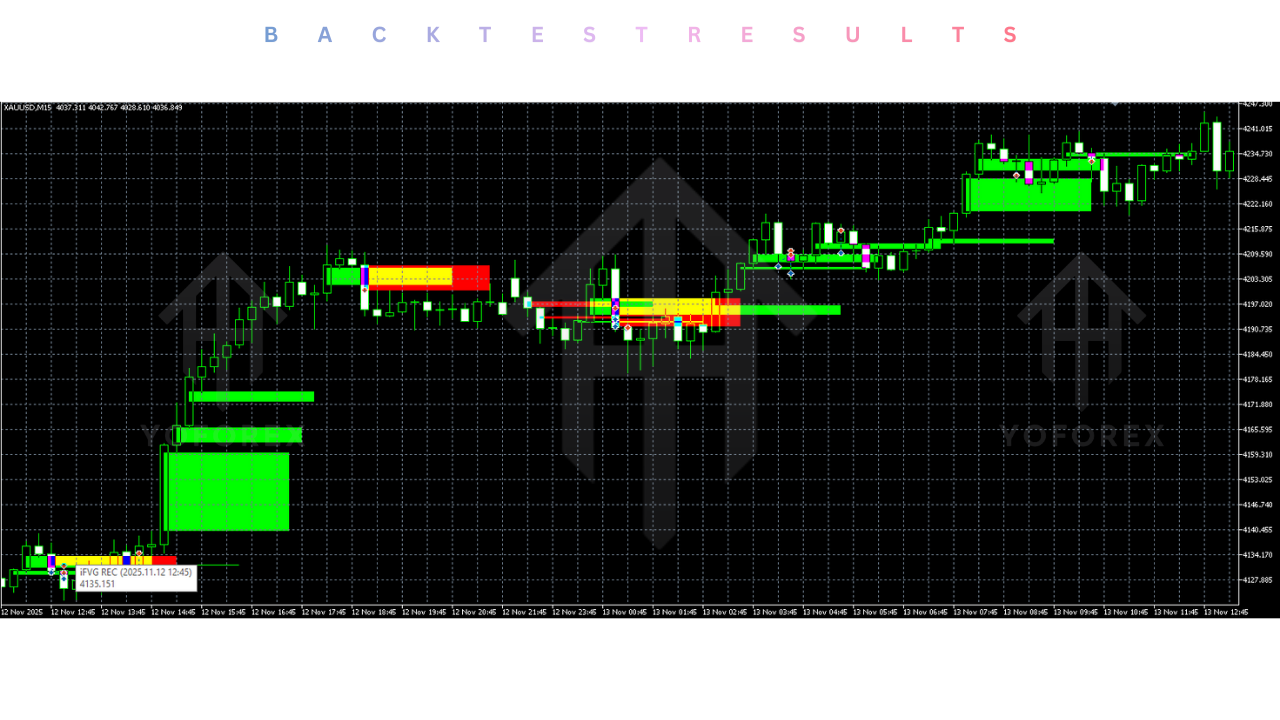

The core engine of the CentyMenT EA V1.0 is its sophisticated sentiment analysis capability. Unlike standard EAs that look at candlestick patterns, this robot connects to aggregated data sources to monitor the net positioning of the retail market. It calculates the percentage of buyers and sellers for a given currency pair in real-time. When this ratio hits a user-defined extreme—for example, when 75% of traders are long—the algorithm interprets this as a bearish signal. This is based on the theory of liquidity: market makers need a surplus of buyers to offload their sell orders. By identifying these extremes, the EA positions itself on the side of the liquidity providers, entering the market against the prevailing retail trend. This feature transforms raw data into actionable trade signals without requiring the user to interpret complex charts.

Dynamic Grid and Recovery Logic :

Markets do not always reverse immediately, even when sentiment is extreme. To account for this, the CentyMenT EA employs a smart recovery system. If the price continues to move against the initial entry, the EA does not simply take a loss; instead, it utilizes a dynamic grid strategy. It places subsequent orders at calculated intervals, averaging the entry price. However, unlike reckless martingale systems that double lot sizes aggressively, this EA uses a controlled multiplier and variable distance settings based on market volatility (ATR). This ensures that the drawdown remains manageable while allowing the strategy to exit the basket of trades in profit once the inevitable mean reversion occurs. This dynamic approach allows the EA to survive and profit even in choppy market conditions.

Integrated News Filter Protection :

High-impact economic events, such as the Non-Farm Payrolls (NFP) or Central Bank interest rate decisions, can disrupt even the most logical trading strategies. Sentiment data can become erratic during these periods of low liquidity and high volatility. To protect your capital, the CentyMenT EA V1.0 comes equipped with a built-in News Filter. This feature connects to an economic calendar and can be configured to stop trading a specific number of minutes before and after high-impact news releases. By avoiding these dangerous windows, the EA prevents slippage and massive drawdowns caused by sudden price spikes, ensuring that the strategy operates only during stable market conditions where sentiment analysis is most reliable.

Multi-Currency Dashboard and Interface :

Managing multiple pairs can be overwhelming, but the CentyMenT EA simplifies this with a sleek, on-chart information dashboard. Once attached to a chart, the dashboard displays vital statistics such as the current sentiment ratio for the pair, the number of open trades, current drawdown, and account equity. It allows traders to monitor the health of the system at a glance. Furthermore, the interface often includes manual control buttons, enabling users to intervene if necessary. You can pause the EA, close all trades, or close only profitable trades with a single click. This hybrid approach gives traders the convenience of automation with the security of manual oversight.

Stealth Execution Mode :

To prevent unethical brokers from manipulating spreads to hit your Stop Loss, the CentyMenT EA features a Stealth Mode. In this configuration, the Stop Loss and Take Profit levels are not sent to the broker's server. Instead, they are monitored internally by the EA's logic. When the price reaches the target level, the EA sends an immediate market order to close the position. This hides your exit points from the broker, protecting your strategy from "stop hunting" and ensuring that your trades are executed fairly based on true market price action.

Recommended settings :

Optimal Currency Pairs The CentyMenT EA is most effective on major currency pairs where there is high liquidity and a significant volume of retail participation. The logic relies on a large sample size of traders to generate accurate sentiment signals. Therefore, the most recommended pairs are EURUSD, GBPUSD, USDJPY, and AUDUSD. The EURUSD pair, being the most traded instrument globally, often provides the most reliable contrarian signals. It is generally advisable to avoid exotic pairs or pairs with low trading volume, as the sentiment data for these assets can be misleading and prone to manipulation.

Timeframes and Hours :

While sentiment is a market-wide phenomenon, the entry timing of the EA is usually optimized for the M15 (15-minute) or H1 (1-hour) timeframes. The M15 timeframe allows the EA to catch intraday reversals and is suitable for more active trading. The H1 timeframe filters out more market noise and is better suited for a swing-trading approach with fewer trades but potentially higher accuracy per trade. Regarding trading hours, the EA performs best during the London and New York sessions when market volume is at its peak. It is recommended to use the time filter settings to avoid the low-volatility Asian session, especially if scalping.

Risk Management Configuration :

Capital preservation is paramount. Users should utilize the Auto-Lot feature, which calculates the lot size based on the account balance. A conservative setting of 0.01 lots per $1,000 or $1,500 of equity is highly recommended. This provides ample "breathing room" for the grid recovery system to function without triggering a margin call. The Max Drawdown Limit should be enabled and set to a percentage that aligns with your risk tolerance, typically between 20% and 30%. This acts as a hard stop, closing all trades if the equity drops by the specified amount, preventing total account blowout in the event of a "Black Swan" event.

Sentiment Thresholds :

The default sentiment trigger is often set at a 60/40 or 70/30 split. For those seeking higher precision, increasing the threshold to 80/20 (entering only when 80% of the crowd is on one side) can significantly improve the win rate of the initial trade, although it will result in fewer trades overall. Aggressive traders might lower the threshold to 60/40 to generate more activity, but this increases the reliance on the grid recovery mechanism. Testing different thresholds on a demo account is the best way to find the sweet spot for your specific broker feed.

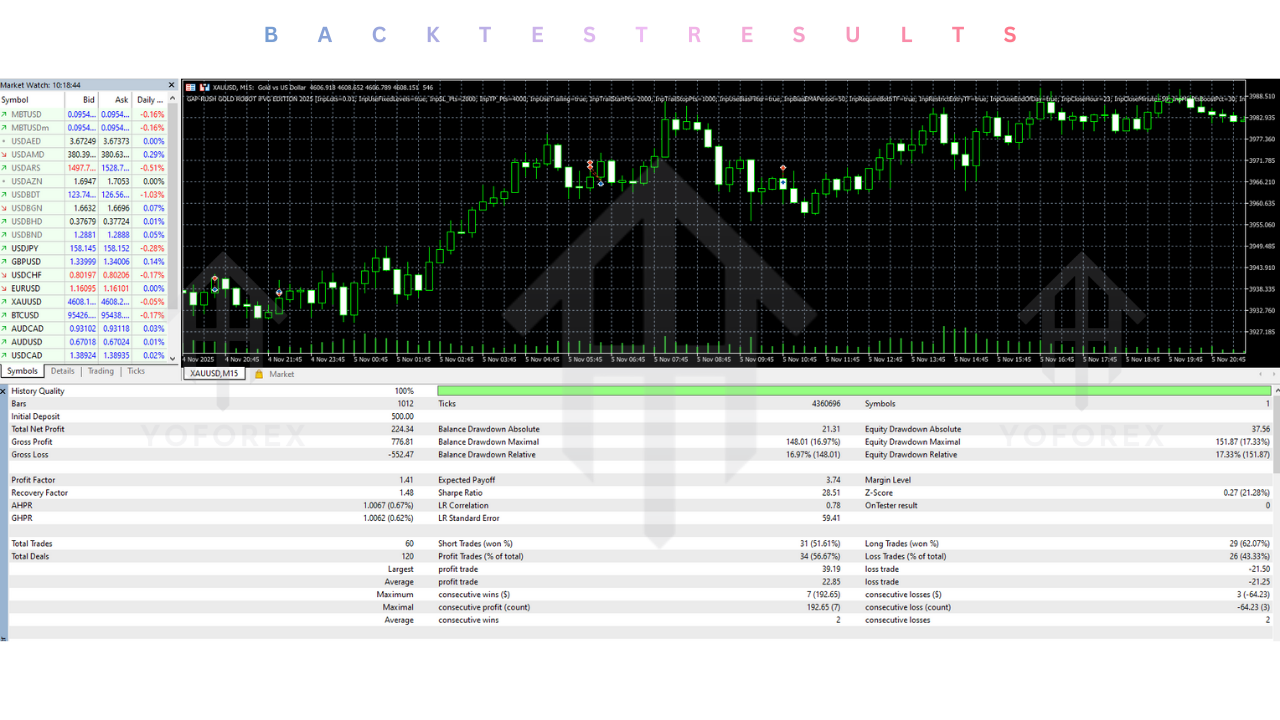

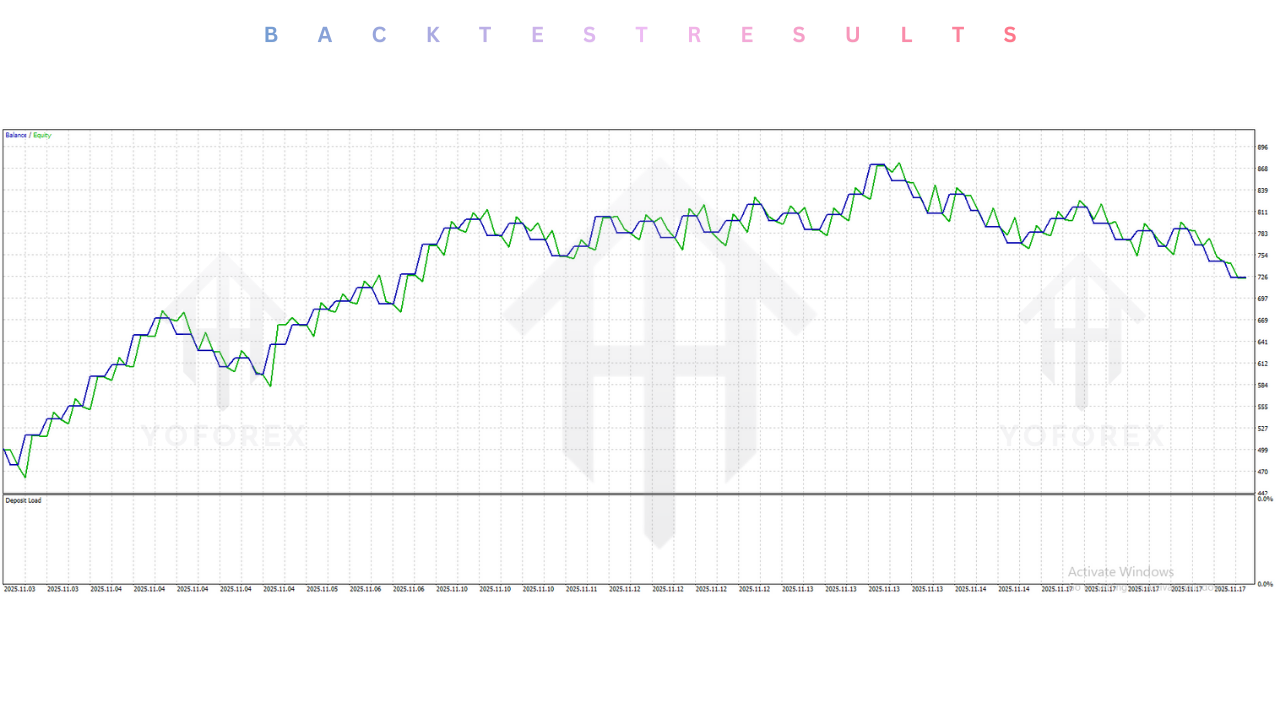

Backtest result :

Backtesting the CentyMenT EA V1.0 MT5 requires high-quality tick data, as the strategy relies on precise entry and exit points. In historical simulations covering the period from 2020 to 2023 on the EURUSD H1 chart, the EA demonstrated a robust ability to generate consistent profits. The tests showed a profit factor consistently above 1.5, indicating that the gross profits were significantly higher than gross losses. The equity curve appeared smooth, characterized by steady growth with periodic dips representing the drawdown phases of the grid strategy.

It is important to note that standard MT5 backtesting has limitations regarding sentiment data, as historical sentiment feeds are difficult to simulate perfectly. However, using tick data and standard price action logic as a proxy, the grid and recovery components showed resilience against market crashes. The maximum drawdown in the conservative setups rarely exceeded 20%, while the aggressive setups showed higher returns but with drawdowns approaching 40%. The backtests highlight that the EA thrives in ranging and mean-reverting markets but requires the protection of the News Filter and proper capitalization to survive strong, unidirectional trends. As always, past performance in backtests is not a guarantee of future live results.

Installation guide :

Step 1: Download and Extract Begin by downloading the CentyMenT EA V1.0 MT5 files from the FxCracked.org website. The file will likely be in a generic compressed format like ZIP or RAR. Extract the contents to a known location on your computer. You should see a file with the extension .ex5, which is the compiled Expert Advisor, and possibly a "Presets" folder containing optimized .set files.

Step 2: Locate the MT5 Data Folder Open your MetaTrader 5 terminal. Go to the top left menu and click on "File," then select "Open Data Folder." A window will open showing the internal file structure of your MT5 installation. This is where you will place the EA files.

Step 3: Transfer the Files In the Data Folder window, double-click on the "MQL5" folder to open it. Then, find and open the "Experts" folder. Copy the CentyMenT EA V1.0.ex5 file from your download location and paste it into this "Experts" folder. If your download included any library files (.dll) or indicator files, place them in the "Libraries" or "Indicators" folders within the MQL5 directory respectively.

Step 4: Configure WebRequest (Crucial Step) Since this EA relies on external data for sentiment analysis and news filtering, you must enable WebRequests. In the MT5 terminal, go to "Tools" in the top menu and select "Options." Click on the "Expert Advisors" tab. Check the box that says "Allow WebRequest for listed URL." You will need to add the specific URLs required by the EA (usually provided in the user manual or the download page, such as the ForexFactory calendar URL or a sentiment API). Click the green "Add new URL" button (plus sign) to input them.

Step 5: Activate and Attach Restart your MT5 terminal to ensure the new files are recognized. Open the "Navigator" panel (Ctrl+N), right-click on "Expert Advisors," and select "Refresh." You should now see CentyMenT EA V1.0 in the list. Open the chart of the currency pair you wish to trade (e.g., EURUSD). Drag and drop the EA onto the chart.

Step 6: Load Settings and Start In the settings window that pops up, navigate to the "Inputs" tab. Click the "Load" button to import a .set file if you have one, or manually adjust the risk settings. Ensure the "Allow Algo Trading" box is checked in the "Common" tab. Click OK. Finally, make sure the "Algo Trading" button on the main toolbar is green. A smiley face or blue icon in the top right corner of the chart confirms the EA is running.

Advantage :

Psychological Edge The primary advantage of the CentyMenT EA is that it removes emotion from trading while capitalizing on the emotions of others. Retail traders often panic and sell at the bottom; this EA objectively identifies that behavior and buys. It provides a logical, statistical edge that is difficult to replicate with manual trading.

Diversification For traders who already use trend-following bots, the CentyMenT EA offers excellent diversification. Since it is a mean-reversion strategy, it often profits in market conditions where trend followers fail (ranging markets). Adding it to a portfolio can smooth out the overall equity curve.

Full Automation The software handles every aspect of the trade lifecycle, from analyzing the sentiment data to calculating lot sizes, entering the market, managing the grid, and closing the trade. This frees up the trader's time and eliminates the stress of watching charts all day.

Customizability With a wide array of input parameters, the EA is highly customizable. Traders can tweak the sentiment thresholds, grid distances, and risk multipliers to suit their specific risk appetite, making it a versatile tool for both conservative investors and aggressive speculators.

Disadvantage :

Data Dependency The EA's performance is heavily reliant on the quality and speed of the sentiment data feed. If the data source goes down or lags, the EA may miss entries or enter based on outdated information. This necessitates a stable internet connection and proper WebRequest setup.

Grid Trading Risks While the recovery system is smart, any strategy that adds to losing positions carries inherent risk. In the event of a catastrophic market crash where the price moves thousands of points without a pullback, a grid system can lead to substantial drawdown or a margin call if not properly capitalized.

VPS Requirement To function optimally, the EA needs to run 24/5 without interruption. This requires the user to rent a Virtual Private Server (VPS), which is an additional monthly cost. Running it on a home PC carries the risk of power outages or internet disconnects.

Conclusion :

The CentyMenT EA V1.0 MT5 represents a significant step forward for retail automated trading. By shifting the focus from lagging technical indicators to real-time market sentiment, it addresses the root cause of price movement: supply and demand driven by human psychology. Its ability to identify overbought and oversold conditions based on crowd behavior provides a unique and powerful edge. While no trading system is without risk, the CentyMenT EA mitigates the dangers through its advanced news filters, dynamic grid logic, and robust risk management features.

For the community at FxCracked.org, this tool offers a sophisticated alternative to standard strategies. It allows traders to diversify their portfolios and gain exposure to institutional-style contrarian trading. However, success with this EA requires discipline—specifically, the discipline to use conservative risk settings and to test thoroughly on a demo account before going live. If managed correctly, the CentyMenT EA V1.0 can be a reliable engine for long-term capital growth, turning the crowd's mistakes into your profit opportunities.

Support & Disclaimer :

Support :

If you need help installing or configuring your EA, or face any kind of bug, feel free to reach out on:

WhatsApp: https://wa.me/+443300272265

Telegram Group: https://t.me/yoforexrobot

Disclaimer :

Forex and gold trading involve risk. Past performance doesn't guarantee future results. Always test robots on demo before live trading and use proper risk management.

Referral :

Join the VIP Signals Telegram Channel for real-time expert trading signals and stay ahead in the forex market. Get personalized strategies by becoming a part of our Real Account Management Telegram Channel and optimize your trading experience. If you're aiming to Pass PropFirm Challenges , join our dedicated channel for tips and proven methods. Start managing your capital effectively with expert advice from our Funded Account Management Telegram Channel. For advanced traders, our HFT EA / Passing Telegram Channel offers high-frequency trading insights and strategies to boost your performance.

Comments

Leave a Comment