In the evolving landscape of algorithmic trading, automation has shifted from simple indicator-based execution to intelligent systems capable of adapting to market conditions. Traders today are no longer looking for basic Expert Advisors that open random trades. Instead, they demand precision, adaptability, and disciplined risk control. This is where Euro AI EA V1.0 MT5 positions itself as a next-generation solution.

Euro AI EA V1.0 MT5 is designed to assist traders who want systematic trade execution backed by artificial intelligence logic, price behavior analysis, and structured recovery mechanisms. Built exclusively for the MetaTrader 5 platform, this Expert Advisor focuses on delivering consistency by reducing emotional decision-making and enforcing predefined rules across every trade cycle.

This in-depth guide explores how Euro AI EA V1.0 MT5 works, its internal strategy logic, recommended configurations, risk profile, backtesting expectations, and who it is best suited for. The goal is to give traders a clear, professional understanding before deploying it in live conditions.

Overview of Euro AI EA V1.0 MT5

Euro AI EA V1.0 MT5 is an AI-powered automated trading system developed for traders who prefer structured execution over discretionary trading. The EA analyzes price movement, volatility expansion, and trend confirmation signals before initiating trades. Unlike traditional bots that rely on a single indicator, Euro AI EA combines multiple data layers to filter low-probability entries.

The EA is primarily optimized for high-liquidity instruments, with particular strength in volatile environments where momentum and breakout behavior dominate price action. It is engineered to operate efficiently on lower timeframes while maintaining strict trade management logic to avoid overexposure.

One of the defining aspects of Euro AI EA V1.0 MT5 is its controlled recovery system. Instead of aggressive grid behavior, it follows a calculated position adjustment method designed to stabilize equity curves while limiting excessive drawdown.

How Euro AI EA V1.0 MT5 Works

Euro AI EA V1.0 MT5 follows a multi-phase execution process that ensures trades are opened only when specific technical and volatility conditions align.

Market Scanning Phase

The EA continuously scans the market to identify periods of expanding volatility. This step is crucial because low-volatility conditions often produce false signals and sideways price movement. By filtering out such environments, the EA increases its probability of entering meaningful price moves.

Trend Confirmation Logic

Once volatility criteria are met, the EA evaluates directional bias using internal trend-confirmation algorithms. This process helps determine whether bullish or bearish momentum is dominant, ensuring that trades align with prevailing market direction rather than counter-trend speculation.

Entry Execution

After confirmation, the EA executes a trade using predefined risk parameters. Entry timing is designed to avoid chasing price spikes and instead focuses on structured breakouts or continuation setups.

Recovery & Risk Adjustment

If a trade moves into temporary drawdown, Euro AI EA V1.0 MT5 may initiate a controlled recovery position based on user-defined limits. This mechanism is carefully structured to avoid uncontrolled lot escalation.

Exit & Trade Management

The EA manages open positions using a combination of take-profit targeting, breakeven logic, and optional trailing stop functionality. Positions are closed automatically once predefined conditions are satisfied.

Core Strategy Logic

Euro AI EA V1.0 MT5 does not rely on a single trading concept. Instead, it blends multiple approaches into a unified system:

- Volatility breakout recognition

- Trend continuation filtering

- Price structure validation

- Dynamic position sizing

- Capital protection logic

This layered strategy helps the EA remain adaptable across different market phases, including trending, corrective, and high-impact volatility periods.

Supported Trading Instruments

Euro AI EA V1.0 MT5 is most effective on high-liquidity instruments where spreads remain tight and execution speed is consistent. While it can technically operate on multiple symbols, it is commonly optimized for:

- Major forex pairs

- High-volatility instruments such as gold

Traders are advised to avoid thinly traded symbols, as irregular price behavior can interfere with AI-based decision logic.

Recommended Timeframes

The EA performs best on lower timeframes where price momentum and volatility shifts are clearly visible. Commonly used timeframes include:

- M5

- M15

Lower timeframes allow the EA to capitalize on short-term price expansions while maintaining strict risk control.

Recommended Settings

To achieve stable performance, traders should configure Euro AI EA V1.0 MT5 conservatively, especially during initial deployment.

Risk Per Trade

Low to moderate risk settings are strongly recommended. Avoid aggressive lot sizing until sufficient forward testing is completed.

Recovery Limit

Always define a maximum recovery level. This ensures that the EA does not continue opening positions indefinitely during unfavorable market conditions.

Trading Sessions

Limiting operation to high-liquidity trading sessions can significantly improve execution quality.

Spread & Slippage Filters

Enable spread protection to avoid entries during abnormal market conditions.

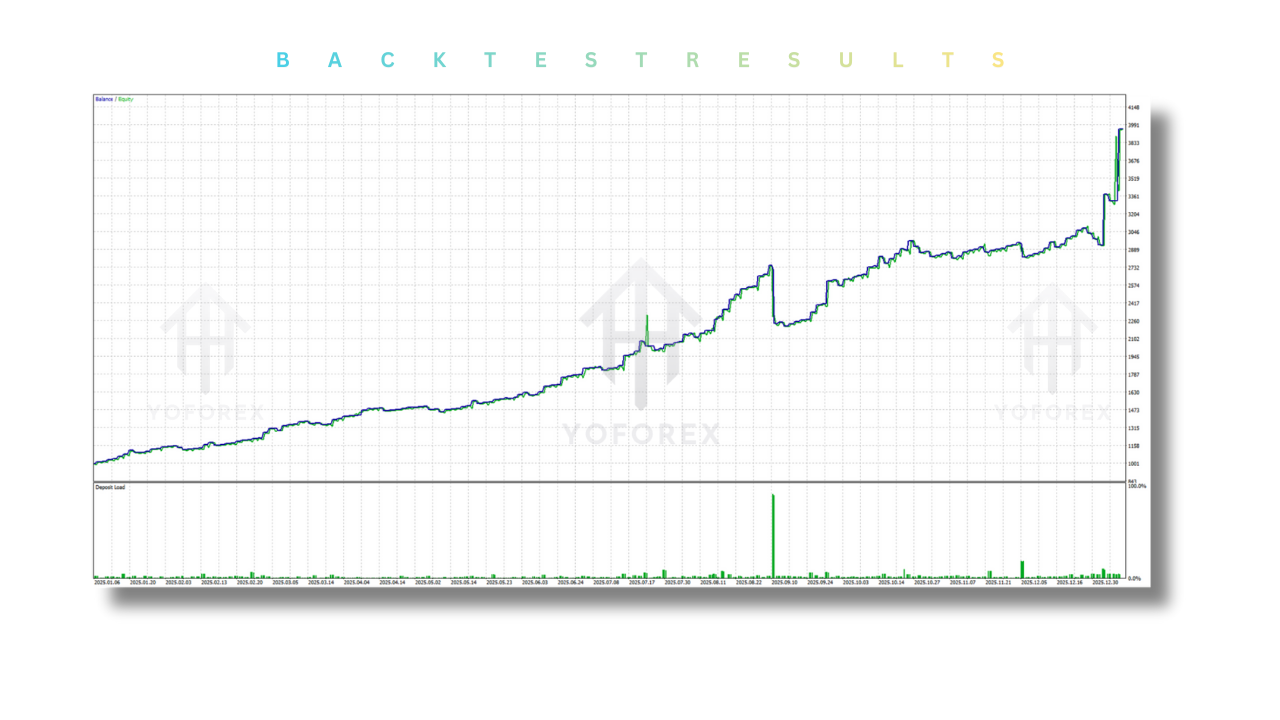

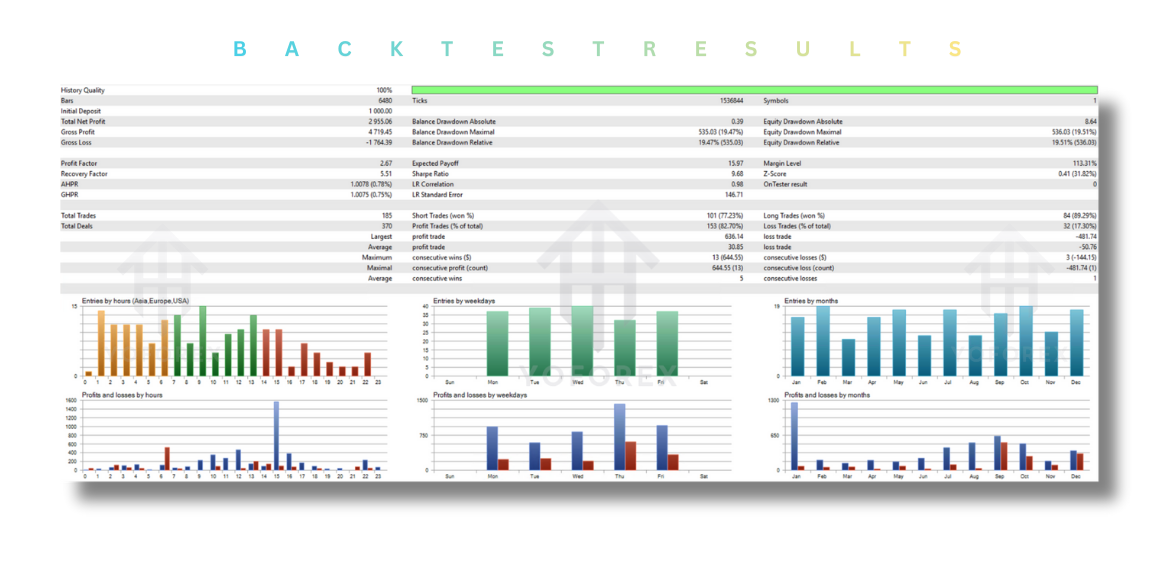

Backtesting Expectations

Backtesting Euro AI EA V1.0 MT5 can provide valuable insights into historical behavior, but results must be interpreted correctly. Because the EA reacts dynamically to volatility and price behavior, backtests should be conducted using high-quality tick data.

When reviewing backtests, traders should focus on:

- Maximum drawdown levels

- Recovery depth frequency

- Equity curve smoothness

- Trade duration consistency

Backtests are a reference tool, not a performance guarantee. Real-market conditions may differ significantly.

Forward Testing Importance

Before using Euro AI EA V1.0 MT5 on a live account, forward testing on a demo or cent account is essential. Forward testing reveals how the EA behaves under real spreads, slippage, and execution delays.

A minimum of two to four weeks of forward testing is recommended to evaluate consistency and risk exposure.

Installation Guide

Installing Euro AI EA V1.0 MT5 is straightforward:

- Download the EA file

- Open MetaTrader 5

- Navigate to File and open the data folder

- Place the EA file inside the Experts directory

- Restart the platform

- Attach the EA to the desired chart

- Enable algorithmic trading

- Configure settings according to your risk profile

Once attached, the EA will begin monitoring the market automatically.

Advantages of Euro AI EA V1.0 MT5

- AI-driven trade filtering

- Structured risk management

- Reduced emotional interference

- Adaptive strategy logic

- Suitable for volatile markets

- Fully automated execution

These advantages make Euro AI EA V1.0 MT5 appealing to traders seeking disciplined automation.

Disadvantages & Risk Factors

- Recovery logic requires proper configuration

- Not suitable for extremely low-spread brokers with execution delays

- Requires disciplined risk settings

- Not designed for manual intervention

Understanding these limitations is essential before live deployment.

Who Should Use Euro AI EA V1.0 MT5

This EA is ideal for:

- Traders seeking automated execution

- Users who prefer systematic strategies

- Traders comfortable with AI-assisted decision-making

- Individuals who value risk structure over high-frequency trading

It may not be suitable for traders expecting instant profits or those unwilling to manage risk carefully.

Why Choose Euro AI EA V1.0 MT5

Euro AI EA V1.0 MT5 stands out due to its structured approach to automation. Rather than relying on random entries, it uses intelligent filtering and disciplined execution. This makes it suitable for traders focused on long-term consistency rather than short-term speculation.

Risk Disclaimer

Forex and CFD trading involves substantial risk. Past performance does not guarantee future results. Always trade responsibly and use risk capital only.

Conclusion

Euro AI EA V1.0 MT5 represents a modern approach to automated trading by combining artificial intelligence logic with structured risk management. It is not a shortcut to guaranteed profits, but rather a tool designed to assist disciplined traders in executing strategies consistently.

When used responsibly, tested thoroughly, and configured conservatively, Euro AI EA V1.0 MT5 can become a valuable component of a trader’s automated trading framework.

Support & Disclaimer

Support

If you need help installing or configuring your EA, or face any kind of bug, feel free to reach out on:

WhatsApp: Click here

Telegram Group: Join our community

Disclaimer: Forex and gold trading involve risk. Past performance doesn't guarantee future results. Always test robots on demo before live trading and use proper risk management.

Refferal

Join the VIP Signals Telegram Channel for real-time expert trading signals and stay ahead in the forex market. Get personalized strategies by becoming a part of our Real Account Management Telegram Channel and optimize your trading experience. If you're aiming to Pass PropFirm Challenges, join our dedicated channel for tips and proven methods. Start managing your capital effectively with expert advice from our Funded Account Management Telegram Channel. For advanced traders, our HFT EA / Passing Telegram Channel offers high-frequency trading insights and strategies to boost your performance.

Happy Trading

Comments

Leave a Comment