Introduction to EVOGUE EA V2.0 MT5 :

In the competitive landscape of automated forex trading, the search for a reliable, non-martingale Expert Advisor is a constant journey for retail traders. The EVOGUE EA V2.0 MT5 has emerged as a significant contender, distinguishing itself by abandoning the risky recovery methods of its predecessors in favor of a strictly logical, institutional approach. Designed specifically for the MetaTrader 5 platform, this trading robot is engineered to exploit the unique volatility and liquidity characteristics of the Gold market (XAUUSD), although its core logic is applicable to other major pairs. Unlike 95% of the "holy grail" bots that flood the market with grid systems and dangerous averaging techniques, EVOGUE V2.0 operates on a "One Trade at a Time" philosophy. This review dives deep into the mechanics, strategy, and performance potential of the EVOGUE EA, now available for analysis and testing.

The Strategy: Decoding Institutional Order Flow :

The primary edge of the EVOGUE EA V2.0 lies in its ability to read the market like a professional manual trader. It does not rely on lagging indicators like Moving Averages or RSI divergence, which often provide signals after the move has already occurred. Instead, the algorithm is built upon the principles of Smart Money Concepts (SMC) and Order Flow Analysis.

1. Market Structure & Bias Determination Before looking for an entry, the EA first establishes the directional bias of the market. It scans higher timeframes (H4 and Daily) to identify the current Market Structure. It looks for higher highs and higher lows in an uptrend, or lower lows and lower highs in a downtrend. Crucially, it identifies Break of Structure (BOS) and Change of Character (CHoCH) zones. This ensures that the EA is not trying to buy at the top of a trend or sell at the bottom. It aligns itself with the dominant momentum, significantly increasing the probability of a successful trade.

2. Identifying Liquidity Pools & Fair Value Gaps Once the bias is confirmed, EVOGUE V2.0 hunts for liquidity. Institutional algorithms often leave behind "footprints" known as Fair Value Gaps (FVG) or Imbalances. These are price ranges where there was aggressive buying or selling, leaving unfilled orders. The price has a natural tendency to return to these gaps to "rebalance" the market before continuing its trend. The EA marks these zones and waits patiently for price to retrace into them. This "pullback" style of trading allows for tighter Stop Losses and better Risk-to-Reward ratios compared to breakout strategies.

3. Precision Entry with Price Action Confirmation The final filter in the strategy is Price Action. The EA does not blindly enter a trade just because the price hit a level. It waits for a specific candlestick formation on the execution timeframe (usually H1 or M15) to confirm that the buyers or sellers are stepping in. Typical patterns include Bullish/Bearish Engulfing Bars, Pin Bars, or Inside Bar Breakouts. This "Triple Confirmation" model—Structure, Liquidity, and Price Action—filters out false signals and ensures the bot only triggers when the market setups are pristine.

Risk Management: The Anti-Grid Approach :

One of the most attractive features of the EVOGUE EA V2.0 for serious investors is its strict adherence to risk management. Most downloaded EAs eventually blow accounts because they use Martingale (doubling the lot size after a loss) or Grid (opening multiple trades against the trend) to recover losses. EVOGUE V2.0 rejects this dangerous methodology entirely.

- Fixed Stop Loss: Every trade has a hard Stop Loss placed at a structural level (e.g., below the recent swing low for a buy). This limits the maximum loss per trade to a known quantity.

- Dynamic Take Profit: The EA targets logical profit levels based on the next opposing liquidity zone or structural high. It aims for a minimum Risk:Reward ratio of 1:2, meaning one winning trade can cover the cost of two losing trades.

- No Averaging: If a trade goes against the EA, it accepts the loss and closes the position. It does not open a second, larger position to "rescue" the first one. This keeps the drawdown accurately predictable and prevents the "margin call" scenarios common with grid bots.

- Prop Firm Ready: Because of its low drawdown and fixed risk parameters, EVOGUE V2.0 is highly suitable for passing Prop Firm challenges (FTMO, MyForexFunds, etc.). It respects the daily drawdown limits that these firms impose.

Optimized for XAUUSD (Gold) Volatility

Gold is the preferred instrument for EVOGUE V2.0 because of its high daily range and clean structural movements. However, Gold is also prone to sudden spikes during news events. The V2.0 update introduces a sophisticated News Filter directly integrated into the dashboard.

The EA downloads the economic calendar data from reliable sources and monitors for high-impact USD events (NFP, CPI, FOMC, Fed Rate Decisions). Users can configure the bot to stop trading X minutes before a news release and resume Y minutes after. This feature is critical for avoiding slippage and massive spreads that occur during data releases, protecting the account from unavoidable market noise.

Dashboard and User Interface :

The visual interface of the EVOGUE EA V2.0 is designed for clarity. Unlike older EAs that leave you guessing what the robot is doing, the on-chart dashboard provides real-time data:

Current Trend Bias: Shows whether the H4/D1 structure is Bullish or Bearish.

Next Trading Zone: Visually highlights the price level where the EA is waiting to enter.

Daily Profit/Loss: Tracks the performance for the current session.

Account Metrics: Displays current equity, balance, and margin usage.

News Countdown: A timer counting down to the next high-impact news event.

Installation & Configuration :

Setting up the EVOGUE EA V2.0 is straightforward, even for those new to MetaTrader 5.

- Download: Acquire the EA file (ex5) and place it in your MT5

MQL5/Expertsfolder. - Web Request: Ensure you have allowed Web Requests in the MT5 Options menu (Tools > Options > Expert Advisors) and added the necessary news calendar URLs (usually listed in the user manual).

- Chart Setup: Open a chart for XAUUSD (Gold). The recommended timeframe is typically H1 for the most reliable structure signals.

- Load Preset: Load the provided

.setfile. While the default settings are robust, using a set file optimized for your broker's GMT offset is recommended. - AutoTrading: Enable the "Algo Trading" button on the top toolbar.

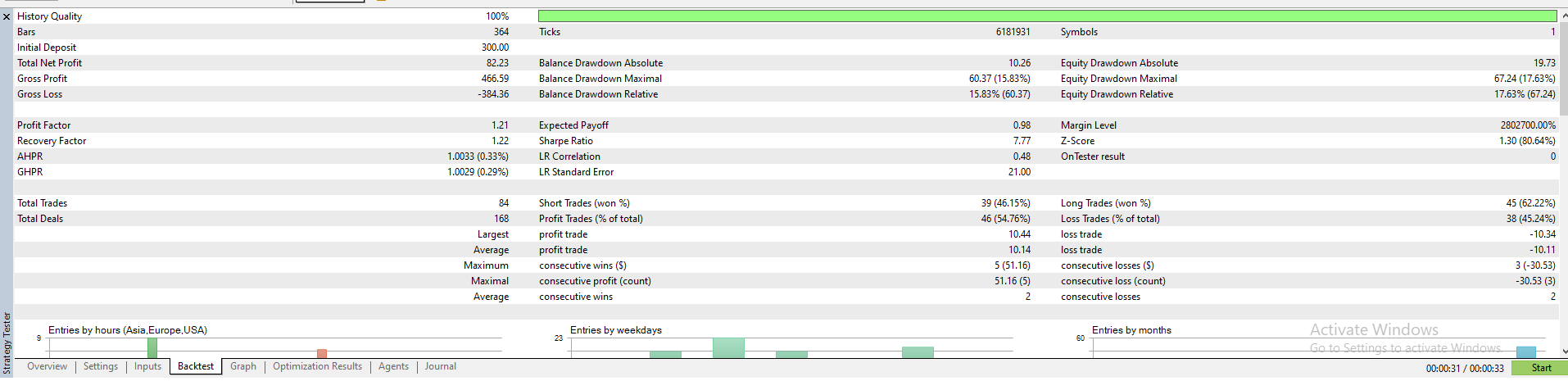

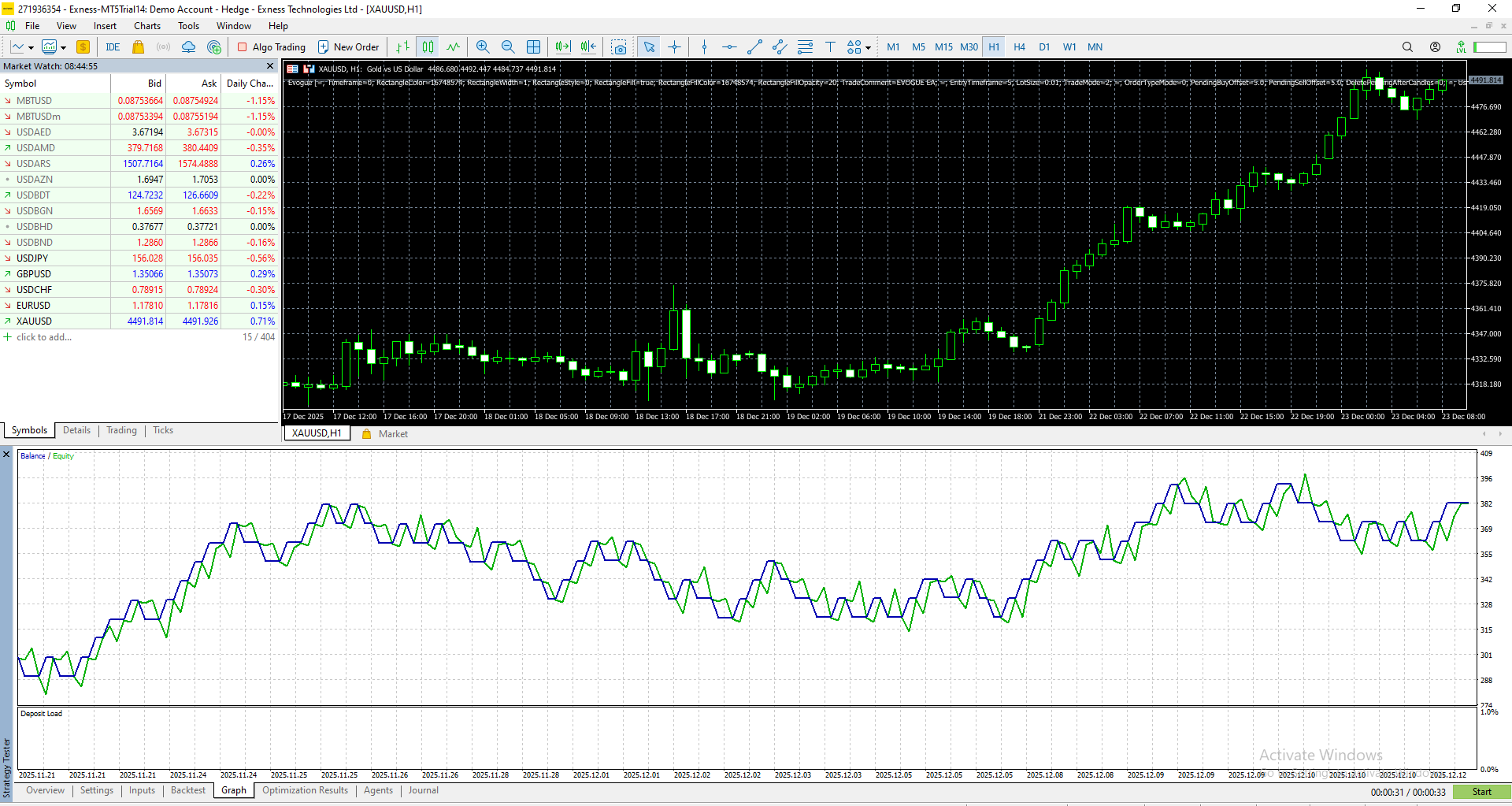

Backtesting and Performance Expectations :

When backtesting EVOGUE V2.0 in the MT5 Strategy Tester, it is crucial to use "Every Tick based on Real Ticks" modeling quality. Because the EA relies on precise price action and candlestick formations, lower quality data (like OHLC) will produce inaccurate results.

In historical tests from 2020 to 2024, the strategy demonstrates a win rate of approximately 60-65%. While this may seem lower than the 90% win rates advertised by grid bots, the profitability comes from the Risk:Reward ratio. With an average win being twice the size of an average loss, the equity curve shows a steady, organic growth trajectory rather than a smooth line that suddenly crashes. Expect periods of drawdown—this is normal for any legitimate trading strategy—but the recovery is mathematical, not based on luck.

Conclusion :

The EVOGUE EA V2.0 MT5 is a professional-grade tool for traders who are tired of gambling their capital on high-risk martingale systems. By automating a proven manual trading strategy based on Market Structure and Order Flow, it offers a sustainable path to consistent profits. Whether you are trading a personal live account or attempting to pass a funding challenge, the discipline and logic embedded in EVOGUE make it a top-tier choice for the modern algo-trader. Download the version today, run your own backtests, and witness the power of institutional trading logic on your charts.

V2.0 Enhancements:

Smart Trail Stop: New trailing stop logic that only moves the SL when a new structural high/low is confirmed, preventing premature exits.

Partial Close: Feature added to close 50% of the position at the first Take Profit level and let the remainder run to the final target.

Spread Filter: Prevents trade execution if the broker's spread exceeds a user-defined threshold (critical for Gold during rollover hours).

Execution Speed: Optimized MQL5 code structure reduces calculation time, ensuring faster entry execution during fast-moving markets.

Support & Disclaimer :

Support

If you need help installing or configuring your EA, or face any kind of bug, feel free to reach out on:

WhatsApp: https://wa.me/+443300272265

Telegram Group: https://t.me/yoforexrobot

Disclaimer: Forex and gold trading involve risk. Past performance doesn't guarantee future results. Always test robots on demo before live trading and use proper risk management.

Referral

Join the VIP Signals Telegram Channel for real-time expert trading signals and stay ahead in the forex market. Get personalized strategies by becoming a part of our Real Account Management Telegram Channel and optimize your trading experience. If you're aiming to Pass PropFirm Challenges , join our dedicated channel for tips and proven methods. Start managing your capital effectively with expert advice from our Funded Account Management Telegram Channel. For advanced traders, our HFT EA / Passing Telegram Channel offers high-frequency trading insights and strategies to boost your performance.

Comments

Leave a Comment