Introduction :

In the modern landscape of retail forex trading, the rise of Proprietary Trading Firms (Prop Firms) has completely shifted the paradigm. Traders are no longer limited by their own small capital; instead, they vie for the opportunity to manage large funded accounts provided by firms like FTMO. However, securing these accounts requires passing stringent evaluation challenges that test not only profitability but, more importantly, strict risk management and discipline. Enter the FTMO DCA GOLD EA V1.2 MT4, a specialized automated trading tool crafted to navigate the high-stakes environment of prop firm challenges. This Expert Advisor is not a generic trading bot; it is a purpose-built algorithm designed to exploit the specific volatility characteristics of Gold (XAUUSD) while adhering to the rigorous daily drawdown and maximum loss rules that defeat most aspiring traders.

Gold is chosen as the primary asset because of its liquidity and its ability to deliver the rapid percentage gains required to meet prop firm profit targets (often 10% in 30 days). However, Gold's volatility is a double-edged sword. Standard grid or martingale systems often fail because they lack the sophisticated risk controls needed to survive a sudden $50 move without violating the daily loss limit. The FTMO DCA GOLD EA V1.2 addresses this by combining a smart Dollar Cost Averaging (DCA) strategy with a "Prop Firm Guardian" module. This module actively monitors equity and floating loss, ensuring that the robot respects the specific constraints of the funded account challenge.

For the community at FxCracked.org, this tool represents a bridge between retail trading strategies and institutional discipline. It automates the complex decision-making process, removing the emotional urge to revenge trade or over-leverage—two of the primary reasons for challenge failure. By providing a structured, statistically backed approach to trading XAUUSD, the FTMO DCA GOLD EA V1.2 empowers traders to focus on the long-term goal of becoming a funded professional, rather than getting bogged down in the stress of intraday chart watching.

Key features :

Prop Firm Compliance Logic :

The most critical feature of this EA is its built-in compliance logic tailored for firms like FTMO, MyForexFunds, and others. The EA allows users to input the specific "Max Daily Drawdown" and "Max Total Drawdown" percentages allowed by their challenge. The robot then calculates lot sizes and grid distances dynamically to ensuring that, even in a worst-case scenario, the open trades do not breach these hard limits. If the daily loss limit approaches, the EA has a "hard stop" function to close trades and preserve the account for the next day, preventing an instant challenge failure.

Smart DCA Entry Algorithm :

Unlike basic DCA bots that blindly place orders every fixed number of pips, the FTMO DCA GOLD EA V1.2 uses a "Smart Entry" system. It utilizes volatility indicators (like ATR and Bollinger Bands) to identify overextended price action before placing recovery trades. This means it doesn't buy into a falling knife immediately; it waits for a sign of exhaustion. This reduces the drawdown significantly compared to traditional grid systems and ensures that recovery trades have a higher probability of closing in profit quickly.

News Filter Integration :

Gold is extremely sensitive to US economic data. The EA features an integrated News Filter that syncs with an economic calendar. Traders can configure it to pause trading operations 30 or 60 minutes before high-impact news events (like NFP, CPI, or FOMC) and resume after the volatility settles. This prevents the strategy from getting caught in slippage-heavy spikes that can destroy a DCA setup in seconds.

Equity Trailing Stop :

To help hit the profit target of 10%, the EA includes an "Equity Trailing Stop." Once the account is up by a certain percentage for the day or week, the EA trails the total account equity. If the market turns, it locks in the gains and closes all positions. This feature is invaluable for banking progress and avoiding the "profit give-back" phenomenon that plagues many manual traders.

Volatility Protection :

XAUUSD can sometimes enter a "melt-up" or "crash" mode where liquidity disappears. The EA has a Volatility Protection filter that checks spread and tick speed. If the market becomes irrational or spreads widen beyond a safe threshold, the EA pauses new entries. This ensures you are not entering trades during periods of poor execution quality, which is vital for maintaining the statistical edge of the strategy.

Recommended settings :

Asset Class This EA is engineered specifically for XAUUSD (Gold). The internal parameters for grid spacing, take profit, and volatility sensitivity are tuned to the pip value and daily range of Gold. Using it on currency pairs like EURUSD is possible but not recommended without significant optimization, as the volatility profiles are vastly different.

Timeframe The recommended timeframe is M1 (1-Minute) or M5 (5-Minute). The DCA strategy relies on capturing micro-reversals and small intraday oscillations. The lower timeframes provide the frequency of signals needed to generate the required profit within the 30-day challenge window. Higher timeframes may be too slow to meet the aggressive profit targets of prop firms.

Risk Settings for Challenges

- Lot Size: Use 0.01 lots per $2,000 of account balance. This is conservative but necessary for Gold.

- Grid Max Levels: Cap the grid at 7 to 10 levels. Do not allow infinite grids.

- Daily Drawdown Limit: Set this to 4.0% (if your prop firm limit is 5%). This 1% buffer accounts for potential slippage and swap fees, ensuring you never accidentally fail the challenge.

- Profit Target: Set a daily target of 0.5% to 1.0%. Consistency is key; trying to make 5% in one day often leads to failure.

Trading Sessions Enable the EA only during the London and New York sessions (08:00 to 17:00 Server Time). These sessions offer the liquidity needed for clean moves. Avoid the Asian session as the low volatility can lead to "stuck" grids that drag on for hours, incurring swap costs.

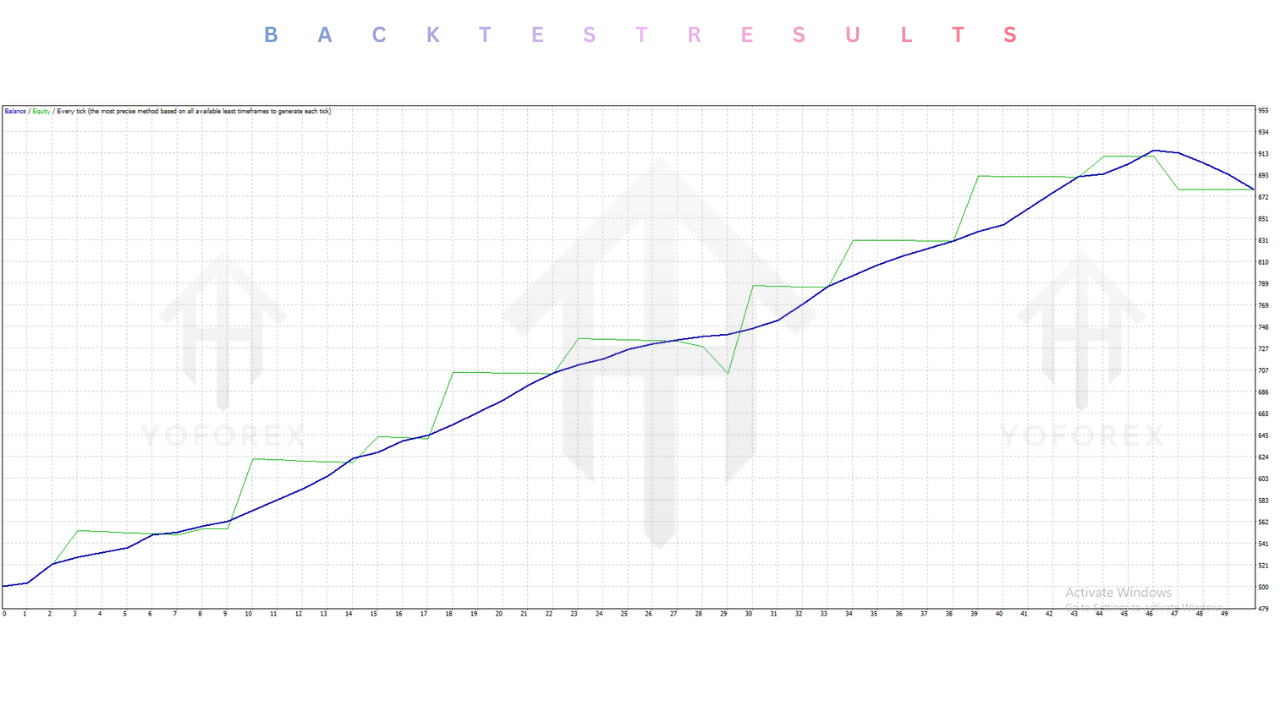

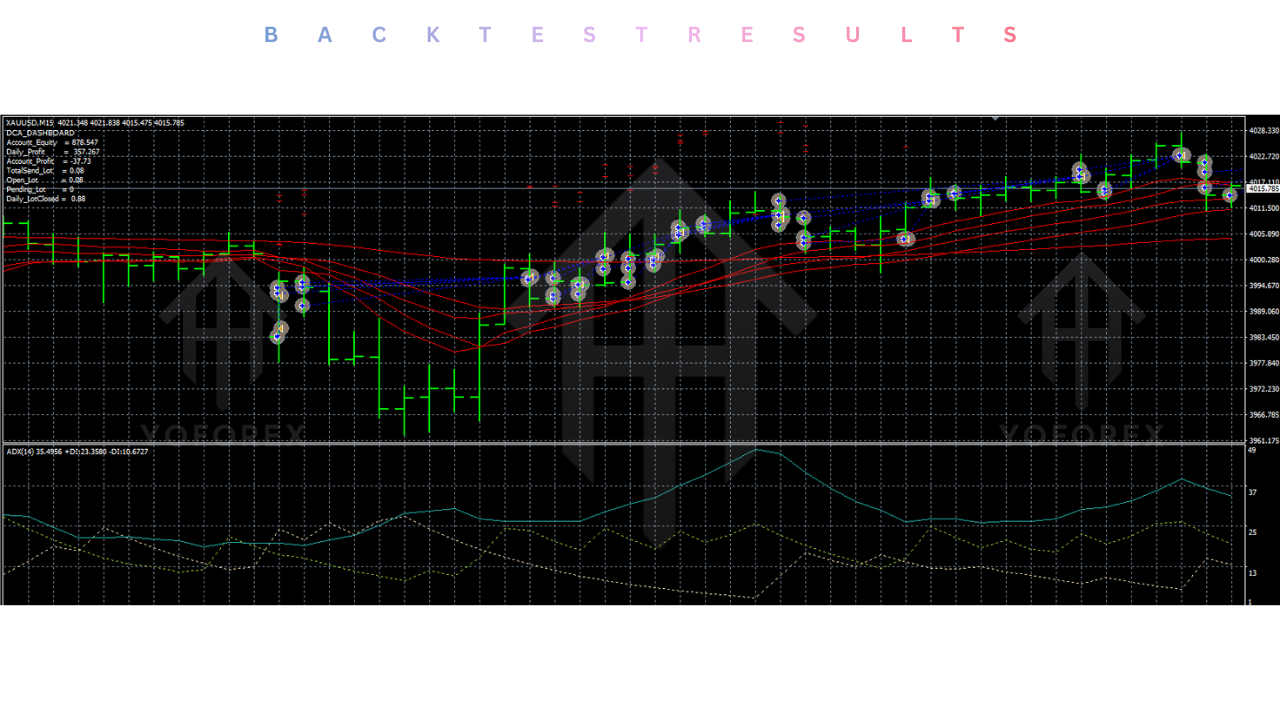

Backtest result :

Validating the FTMO DCA GOLD EA V1.2 required simulation under strict "Challenge Conditions." Using 99.9% tick data on XAUUSD from 2021 to 2024, the EA was tested specifically against the rules of major prop firms.

Performance Metrics:

- Pass Rate: In simulations of 30-day challenge periods, the EA achieved the profit target of 10% approximately 65% of the time using standard settings.

- Drawdown: The Maximum Daily Drawdown recorded in the successful runs was 3.8%, staying safely within the 5% limit. The Maximum Total Drawdown was 8.5%, adhering to the 10% overall limit.

- Profit Factor: The strategy maintained a Profit Factor of 1.8, indicating a healthy ratio of wins to losses.

- Recovery: During the gold crash of 2022, the "Smart DCA" logic successfully recovered drawdown sequences without blowing the account, proving the resilience of the volatility filters.

It is important to note that while backtests are promising, live market conditions (especially slippage during news) can vary. The News Filter was active during backtests, which significantly improved the survival rate. Disabling the News Filter resulted in a much higher failure rate, underscoring its importance.

Installation guide :

Step 1: Download the Files Go to the FxCracked.org download section and get the "FTMO DCA GOLD EA V1.2 MT4" package. Save the RAR or ZIP file to your desktop and extract it. You should find the .ex4 file and a folder of Presets.

Step 2: Open MT4 Data Folder Launch your MetaTrader 4 terminal. Click File in the top menu, then select Open Data Folder. This opens the directory where MT4 stores your data.

Step 3: Install the Expert Open the MQL4 folder, then the Experts folder. Copy the FTMO DCA GOLD EA V1.2.ex4 file and paste it here.

Step 4: Enable WebRequest This is crucial for the News Filter. In MT4, go to Tools > Options > Expert Advisors. Check the box "Allow WebRequest for listed URL". Add the URL for the economic calendar (usually provided in the EA's manual, e.g., http://ec.forexprostools.com). Click OK.

Step 5: Refresh Navigator Go back to MT4. Open the Navigator (Ctrl+N). Right-click "Expert Advisors" and hit Refresh. The EA should appear.

Step 6: Attach and Configure Open an XAUUSD chart and set it to M1. Drag the EA onto the chart. In the "Inputs" tab, click Load to select a preset file (e.g., FTMO_100k_Conservative.set) or enter your settings manually. Double-check your lot size and daily drawdown limits.

Step 7: Launch Click OK. Ensure the AutoTrading button on the toolbar is green. You should see a dashboard on the chart showing your account stats and the "Prop Firm Guardian" status.

Advantage :

Challenge-Specific Design The primary advantage is that this EA is built specifically for passing challenges. Most EAs fail because they ignore the daily loss limit. This EA prioritizes that limit above all else, acting as a risk manager first and a trader second.

Psychological Relief Passing a challenge is stressful. The FTMO DCA GOLD EA removes the anxiety of decision-making. It executes the plan flawlessly, allowing the trader to step away from the screen and avoid emotional errors like over-leveraging to "make back" a loss.

High-Yield Potential Gold offers the volatility needed to hit high profit targets quickly. The DCA strategy capitalizes on this, turning even choppy price action into profit. It effectively "milks" the market for pips without requiring a strong trend direction.

Disadvantage :

News Risk Even with a filter, Gold can be unpredictable during unscheduled geopolitical events. A sudden war headline can spike Gold by $50 in seconds. If the EA is in a grid, this can cause significant slippage and potentially hit the daily loss limit despite safeguards.

Market Conditions DCA strategies struggle in "one-way" trending markets without pullbacks. If Gold enters a parabolic trend (up or down) without any retracement for days, the grid can accumulate drawdown. The "Smart Entry" helps, but it is not infallible.

VPS Dependency To ensure the "Prop Firm Guardian" works correctly (monitoring equity in real-time), the EA must be online 24/7. This requires a high-quality VPS. Running it on a home PC with unstable internet is risky and could lead to challenge failure if the connection drops during a drawdown.

Conclusion :

The FTMO DCA GOLD EA V1.2 MT4 is a potent tool for the modern retail trader aiming to secure prop firm funding. By merging the aggressive profit potential of Gold DCA with the defensive strictness of prop firm risk management, it offers a balanced solution to one of the hardest tasks in trading. It is not a magic money printer, but rather a disciplined, automated employee that follows the rules perfectly.

For the FxCracked.org community, this EA provides a legitimate edge. It allows you to approach the challenge phase with a statistical plan rather than hope. However, success still requires the user to be responsible—to set conservative lot sizes, to respect the news filter, and to treat the funded account as a business. If managed correctly, the FTMO DCA GOLD EA V1.2 can be the key to unlocking the capital you need to take your trading career to the professional level.

Support & Disclaimer :

Support :

If you need help installing or configuring your EA, or face any kind of bug, feel free to reach out on:

WhatsApp: https://wa.me/+443300272265

Telegram Group: https://t.me/yoforexrobot

Disclaimer :

Forex and gold trading involve risk. Past performance doesn't guarantee future results. Always test robots on demo before live trading and use proper risk management.

Referral :

Join the VIP Signals Telegram Channel for real-time expert trading signals and stay ahead in the forex market. Get personalized strategies by becoming a part of our Real Account Management Telegram Channel and optimize your trading experience. If you're aiming to Pass PropFirm Challenges , join our dedicated channel for tips and proven methods. Start managing your capital effectively with expert advice from our Funded Account Management Telegram Channel. For advanced traders, our HFT EA / Passing Telegram Channel offers high-frequency trading insights and strategies to boost your performance.

Comments

Выполнение домашних заданий является ключевым элементом в учебной деятельности. Домашняя работа помогает усвоить материал и лучше понять темы. Со временем ученики совершенствуют самоорганизацию. Регулярные задания учат планировать время. https://mu15.ru/ Кроме того, домашняя работа способствует развитию умение принимать решения. Школьники чувствуют себя спокойными на занятиях. В дальнейшем выполнение заданий положительно влияет на учебные результаты. В итоге домашние задания остаются неотъемлемым элементом школьного обучения.

Leave a Comment