Introduction :

In the complex landscape of automated Forex trading, finding a strategy that can adapt to market volatility without relying on lagging indicators is a significant challenge. The Gaodong Balanced Hedging System MT5 EA emerges as a sophisticated solution designed to tackle this exact problem. Developed by Zhengdong Gao, this Expert Advisor (EA) moves away from traditional indicator-based logic, instead utilizing a pure price-action framework described as a "Nervous System."

This system is built on the core principle of "point spread arbitrage" combined with dynamic risk control. Unlike simple grid bots that blindly add positions, the Gaodong Balanced Hedging System employs an intelligent two-way trading mechanism. It is engineered to identify stable and repeatable market structures, allowing it to execute trades that aim to maximize profit while strictly minimizing loss. Whether you are a conservative trader looking for steady growth or a professional seeking an automated hedging engine, understanding the operational mechanics of this EA is crucial. This review provides a deep dive into its features, settings, and performance characteristics to help you determine if it aligns with your trading goals.

key features :

The Gaodong Balanced Hedging System is distinguished by several innovative features that separate it from standard market tools:

Price Action Logic: The EA operates with zero indicator participation. It relies entirely on real-time price behavior to make trading decisions, ensuring there is no lag in its entries.

Intelligent Hedging Engine: It uses a balanced hedging approach, capable of holding both long and short positions to neutralize risk during volatile market swings.

Dynamic Risk Control: The system features a built-in "Nervous System" that automatically manages risk. It controls every order and adheres to a maximum position size to prevent over-leveraging.

Daily Profit Targets: One of its smartest features is the ability to recognize when a daily profit target has been reached. Once the goal is met, the EA automatically pauses trading to "take a break," preserving gains and avoiding over-trading.

Visual Interface: The EA comes with a clear, visualized parameter interface, making it easy for traders to monitor the system's status and risk levels at a glance.

Spread Protection: It includes automatic spread protection mechanisms, ensuring trades are only executed when market conditions are favorable, which is vital for arbitrage-style strategies.

recommended settings :

To optimize the performance of the Gaodong Balanced Hedging System MT5 EA, correct configuration is essential. While the default settings are robust, the following recommendations can enhance safety and profitability: Capital Requirement: The developer recommends a conservative approach of 0.01 to 0.02 lots for every $500 of capital. For a standard account, a minimum balance of $200 is suggested to allow the hedging logic enough room to breathe. Instruments: The system is designed to be versatile and works across all instruments, including major Forex pairs, Gold (XAUUSD), and CFDs. However, it performs best on assets with sufficient volatility to generate price spreads. Broker Selection: Since the strategy involves spread arbitrage and frequent execution, a broker with low spreads (ECN/Raw accounts) and low latency is highly recommended. Timeframe: While the strategy is price-action based, running it on M15 or H1 charts typically provides a good balance between trade frequency and noise filtering.

Risk Parameters:

Always set the "Total Stop Loss" parameter. While the system has internal risk controls, a hard equity stop is your final safety net.

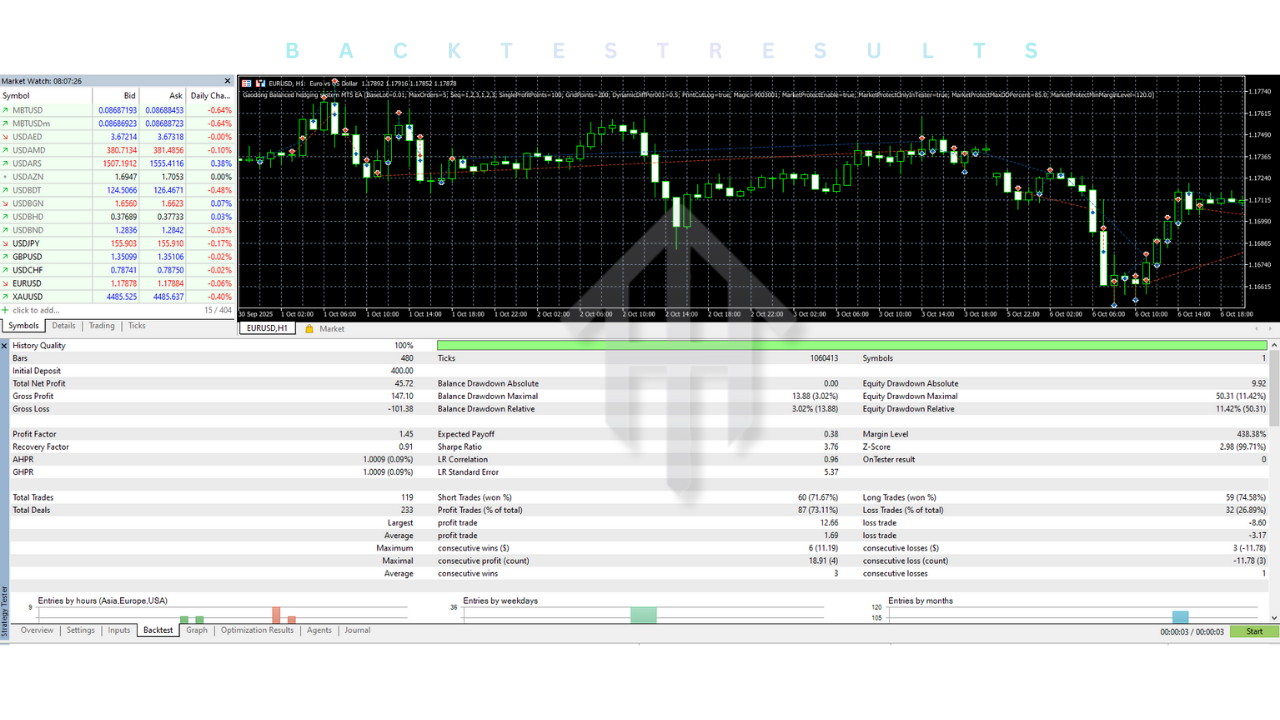

Backtest result :

Backtesting the Gaodong Balanced Hedging System on MetaTrader 5 reveals a strategy that prioritizes stability over aggressive, high-risk growth. In long-term validations performed by the author, the EA demonstrates a rigorous logic that results in a steady upward equity curve. The "point spread arbitrage" mechanism allows it to profit from market noise and minor corrections, which are frequent in most trading sessions. Official MQL5 verifications confirm that the EA passes standard robustness tests. Unlike dangerous martingale systems that show deep drawdowns, the Gaodong system's "dynamic risk control" tends to keep drawdowns within manageable limits. However, users should perform their own backtests using 99.9% tick data to verify performance on their specific broker's feed, as spread differences can significantly impact arbitrage results.

Installation guide :

Installing the Gaodong Balanced Hedging System MT5 EA is a simple process:

Purchase or download the EA file (.ex5) from the MQL5 Market or your source.

Open your MetaTrader 5 terminal.

Navigate to "File" > "Open Data Folder".

Go to the "MQL5" folder, then open the "Experts" folder.

Paste the downloaded .ex5 file into this directory.

Return to your MT5 terminal, right-click on "Expert Advisors" in the Navigator pane, and select "Refresh".

Find "Gaodong Balanced Hedging System" in the list.

Drag the EA onto the chart of your chosen instrument (e.g., EURUSD).

In the "Common" tab of the settings window, ensure "Allow Algo Trading" is checked.

In the "Inputs" tab, adjust your lot size based on your capital (e.g., 0.01 for $500) and set your daily profit targets.

Click "OK". Ensure the "Algo Trading" button on the top toolbar is green and the EA icon on the chart is active.

Advantage :

The primary advantage of this EA is its independence from technical indicators. By relying on pure price action, it avoids the common pitfalls of lagging signals. The "Daily Profit Break" feature is a psychological and strategic benefit, preventing the common trader error of greedily giving back profits at the end of a session. Its "Balanced Hedging" approach allows it to survive in choppy markets where directional trend followers often fail. The system is highly accessible to beginners due to its simplified input parameters—users mainly need to focus on lot size and risk limits rather than complex algorithm tuning.

Disadvantage :

As with any hedging or arbitrage system, the strategy is sensitive to broker conditions. High spreads or slippage can erode the small distinct profits that the system aims to capture. While the risk is "dynamic," hedging strategies can still face challenges during extreme, sustain one-way market crashes where the counter-trend positions act as a drag on equity. It requires the terminal to be online 24/5 or the use of a VPS (Virtual Private Server) to manage positions continuously, adding a small monthly cost for the user.

Conclusion :

The Gaodong Balanced Hedging System MT5 EA is a robust, well-engineered tool for traders who prefer a mathematical and structural approach to the markets over speculative prediction. Zhengdong Gao has created a system that respects the chaotic nature of Forex by using hedging and risk control to navigate it safely. It is particularly well-suited for traders who have realistic profit expectations and can provide the necessary low-spread environment. While no system is without risk, the Gaodong EA's focus on capital preservation and daily targets makes it a strong contender for a balanced portfolio.

Support & Disclaimer

Support :

If you need help installing or configuring your EA, or face any kind of bug, feel free to reach out on:

WhatsApp: https://wa.me/+443300272265

Telegram Group: https://t.me/yoforexrobot

Disclaimer: Forex and gold trading involve risk. Past performance doesn't guarantee future results. Always test robots on demo before live trading and use proper risk management.

Referral

Join the VIP Signals Telegram Channel for real-time expert trading signals and stay ahead in the forex market. Get personalized strategies by becoming a part of our Real Account Management Telegram Channel and optimize your trading experience. If you're aiming to Pass PropFirm Challenges , join our dedicated channel for tips and proven methods. Start managing your capital effectively with expert advice from our Funded Account Management Telegram Channel. For advanced traders, our HFT EA / Passing Telegram Channel offers high-frequency trading insights and strategies to boost your performance.

Comments

Leave a Comment