Introduction

Gold is not a “quiet” market. XAUUSD can move fast, spike hard, and reverse without warning—especially around session opens, news releases, and liquidity sweeps. For many traders, that’s exactly the problem: by the time you confirm the breakout, the move is already halfway done. That’s where breakout automation becomes interesting.

Gold Ambush Breakout Aurum XAUUSD Algo EA V1.0 MT4 is built for traders who want a systematic, rules-based way to participate in gold breakouts on MetaTrader 4. The idea is simple: wait for compression or a defined range, then attack when price breaks out with intent—without emotional entries, hesitation, or “revenge trading” after a missed move.

In this guide, we’ll break down what this EA is, how it typically operates, who it’s for, how to set it up, and the best practices to use it more safely on volatile XAUUSD conditions.

What Is Gold Ambush Breakout Aurum EA?

Gold Ambush Breakout Aurum XAUUSD Algo EA V1.0 MT4 is an automated trading robot designed specifically for XAUUSD (Gold) on the MT4 platform. Its core concept revolves around breakout trading—capturing strong directional price movement when gold breaks above resistance or below support after consolidation.

Breakout systems generally aim to:

- Trade when volatility expands after a quiet period

- Catch trend continuation moves after range buildup

- Avoid choppy, directionless price action

Gold is a popular asset for breakout logic because it frequently builds tight zones and then expands rapidly—especially during high-liquidity sessions.

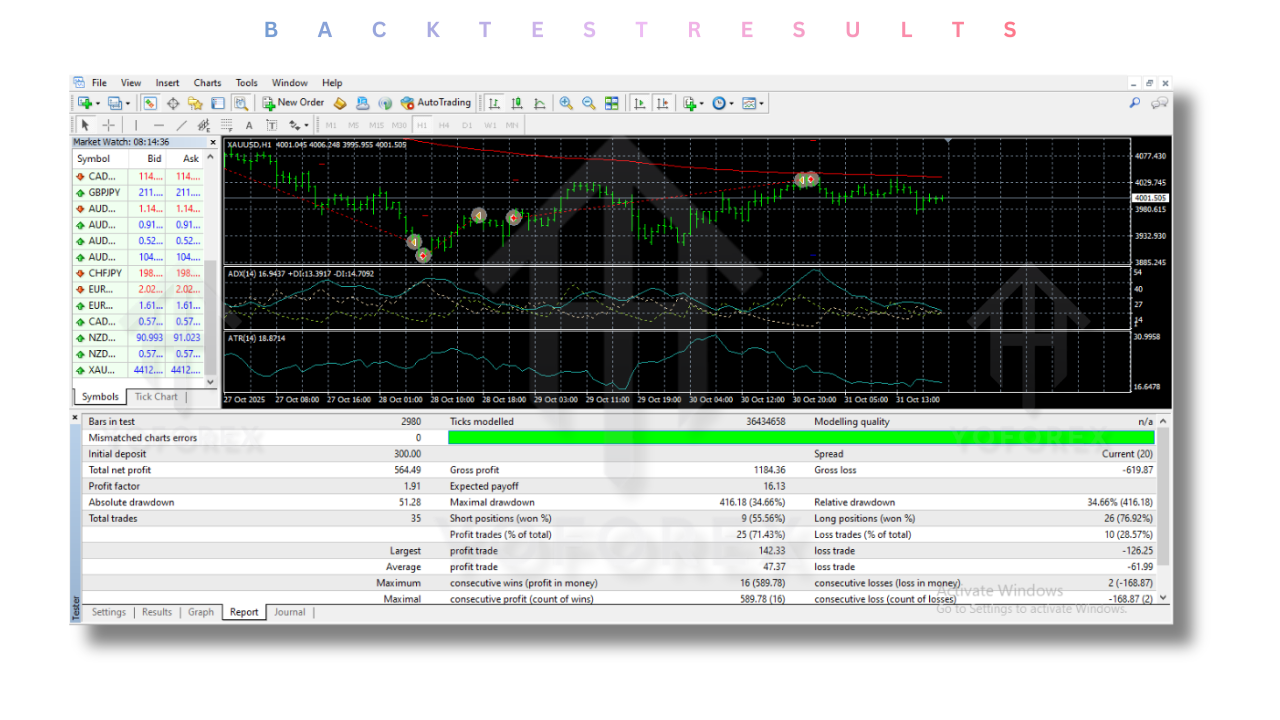

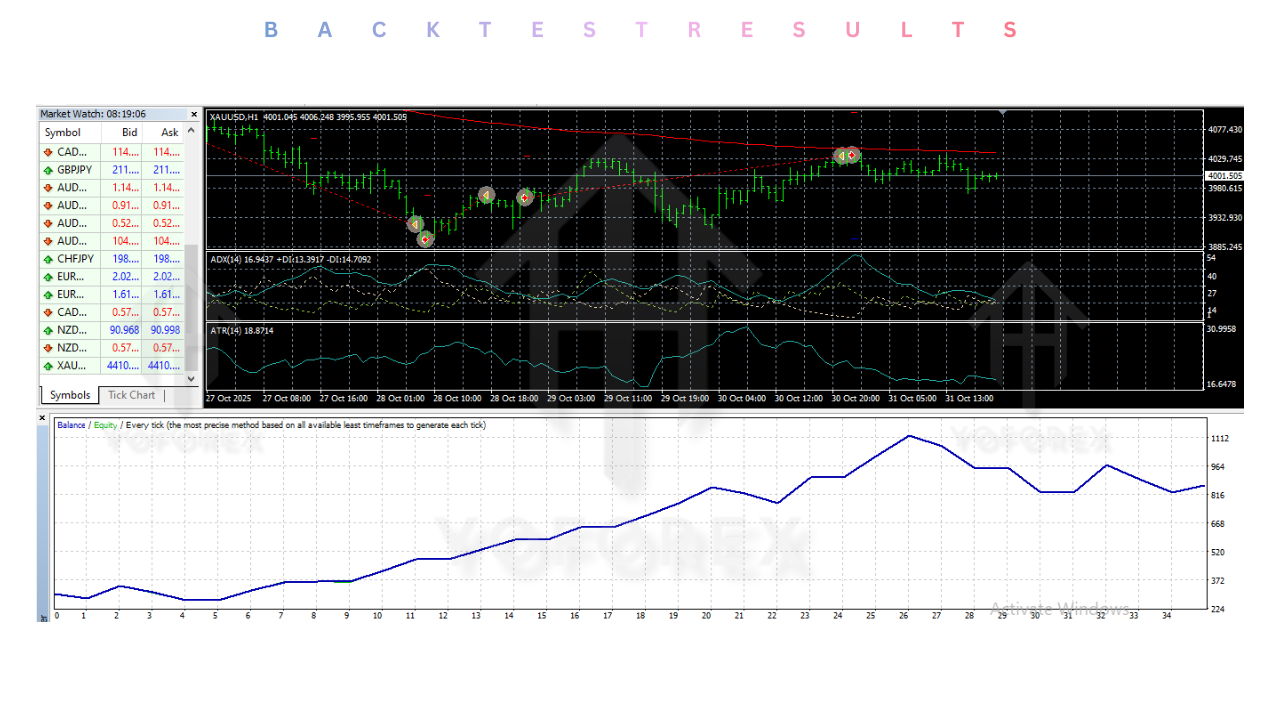

How the Breakout Logic Works (Conceptual)

While specific internal rules can vary by developer, most breakout EAs follow a structure like this:

1) Range Identification

The EA first detects a range or “box”—often based on:

- A lookback window (last X candles)

- Session highs/lows (Asian range, London range, etc.)

- Volatility compression conditions (narrow ATR, small candle bodies)

2) Breakout Trigger

Once the range is defined, the EA watches for price to break:

Above the range high (bullish breakout)

Below the range low (bearish breakout)

3) Confirmation Filters (Common in Strong Breakout Bots)

To reduce false breakouts, many bots include filters such as:

- Minimum candle size at breakout

- ATR/volatility threshold

- Spread filter to avoid bad fills

- Time filter (trade only certain sessions)

- Trend filter (e.g., moving average direction)

4) Trade Management

A breakout entry is only half the job. Proper automation usually includes:

- Stop-loss logic (fixed, ATR-based, or behind structure)

- Take-profit targets (fixed RR, partial close, trailing stop)

- Breakeven after X pips/points

- Trade timeout if breakout fails

If your version of Gold Ambush includes any of these controls, they’re not “nice-to-have”—they’re essential for gold.

Key Features (What You Should Expect in a Good XAUUSD Breakout EA)

Here are the features traders typically look for in a breakout-focused gold EA—and what you should prioritize when configuring:

XAUUSD-Optimized Execution

Gold pricing uses different point values and can behave differently than FX majors. A proper XAUUSD EA usually accounts for:

- Higher volatility spikes

- Wider spreads on some brokers

- Fast slippage during news

Spread & Slippage Protection

A breakout strategy is most sensitive during the exact moment price accelerates. If the spread widens, entries can become terrible. A spread filter helps avoid that.

Trading Session Filter

Many gold breakouts behave best during:

- London open / London-NY overlap

- Early New York session

A session filter can reduce random chop that happens in dead hours.

Risk Controls

Breakouts can fail. A strong EA typically includes:

- Fixed % risk or fixed lot option

- Max daily trades

- Max loss/day or equity protection

- One-trade-at-a-time option

Dynamic Exit Options

Breakouts may run hard or snap back quickly. Useful exit tools include:

- Trailing stop

- Breakeven

- Partial close

Even if you prefer a simple TP/SL, having flexibility helps.

Recommended Timeframes & Market Conditions

Even though the EA runs on MT4 charts, breakout systems commonly perform best when the timeframe isn’t too noisy.

Commonly effective timeframes for breakout logic:

- M15 for active breakout hunting

- M30/H1 for cleaner signals (less noise)

Best conditions for breakout trading:

- Clear consolidation range

- Volatility expansion environment (ATR rising)

- Strong session liquidity

- Avoiding major whipsaw news minutes (unless it’s designed for news spikes)

If you trade gold, you already know: XAUUSD can fake out both directions. The EA must either filter aggressively or manage exits tightly.

Setup Guide (MT4 Installation)

If you’re new to MT4 EAs, here’s the clean setup path:

- Open MT4 → File → Open Data Folder

- Go to MQL4 → Experts

- Paste the EA file (

.ex4or.mq4) into Experts - Restart MT4

- Drag the EA onto the XAUUSD chart

Enable:

- AutoTrading ON

- Allow Live Trading

- DLL imports (only if the EA needs it and you trust the source)

Important:

Always test on demo first. Even a small setting mistake (lots, stop values, digits) can cause oversized trades on gold.

Suggested Settings & Best Practices (Safer Configuration)

Because you didn’t share the EA’s full parameter list, here are universal breakout EA best practices you can apply inside the inputs:

1) Start With Conservative Risk

- Fixed lot for testing (example: 0.01–0.05 depending on balance)

- Or risk-based lots at 0.5%–1% per trade maximum until proven stable

2) Enable Spread Protection

- Set a strict max spread limit appropriate for your broker

- Gold spreads vary widely by broker—measure your typical spread first

3) Limit Trades Per Day

Breakouts are quality > quantity. A good rule:

1–3 trades/day maximum

This prevents “machine-gun trading” in choppy ranges.

4) Use Time Filters

If the EA supports it, focus on:

London session and NY session

Avoid low-liquidity hours where gold can chop.

5) Use an Equity Stop / Daily Loss Cutoff

If available, set something like:

Stop trading for the day if account down 2%–4%

This simple rule saves accounts.

Pros and Cons

Pros

- Automation removes hesitation during fast gold breakouts

- Rules-based trading helps avoid emotional entries

- Breakout style fits XAUUSD when volatility expands

- Potential to capture strong directional moves in short time

Cons / Risks

- False breakouts are common in gold

- Spread widening can ruin entries if no protection is used

- Performance can vary heavily by broker execution quality

- Needs correct settings and disciplined risk limits (no exceptions)

Who Should Use This EA?

This EA is a better fit for:

- Traders who like range-breakout or session breakout strategies

- Traders who want structured automation on XAUUSD

- People willing to test, optimize, and control risk properly

- Traders using brokers with stable spreads + low slippage on gold

Not ideal for:

- Traders expecting guaranteed profits

- Traders who refuse to use SL / risk caps (gold can wipe bad setups fast)

- Anyone running it on random settings without testing

FAQs

1) Can I run it on any broker?

You can, but breakout EAs are extremely sensitive to:

- Spread behavior

- Slippage

- Execution speed

A poor broker environment can turn a “good strategy” into a losing one.

2) Does it work during news?

Some breakout systems thrive during news, others get destroyed. If your EA doesn’t have a news filter, it’s usually safer to avoid major red-folder events or reduce risk during those windows.

3) What’s the best account type?

Typically:

- Low-spread / Raw spread accounts are preferred

- Ensure XAUUSD contract specs are consistent (digits, lot size, etc.)

4) Can I run it on VPS?

Yes—and for gold breakouts it’s often recommended. Faster execution can reduce slippage during the breakout moment.

Conclusion

Gold Ambush Breakout Aurum XAUUSD Algo EA V1.0 MT4 is positioned around a strategy that many gold traders already respect: catching volatility expansion after consolidation. When breakout conditions are clean and your execution environment is stable, this style can deliver sharp, fast opportunities.

Support & Disclaimer

Support

If you need help installing or configuring your EA, or face any kind of bug, feel free to reach out on:

WhatsApp: https://wa.me/+443300272265

Telegram Group: https://t.me/yoforexrobot

Disclaimer: Forex and gold trading involve risk. Past performance doesn't guarantee future results. Always test robots on demo before live trading and use proper risk management.

Referral

Join the VIP Signals Telegram Channel for real-time expert trading signals and stay ahead in the forex market. Get personalized strategies by becoming a part of our Real Account Management Telegram Channel and optimize your trading experience. If you're aiming to Pass PropFirm Challenges , join our dedicated channel for tips and proven methods. Start managing your capital effectively with expert advice from our Funded Account Management Telegram Channel. For advanced traders, our HFT EA / Passing Telegram Channel offers high-frequency trading insights and strategies to boost your performance.

Comments

Leave a Comment