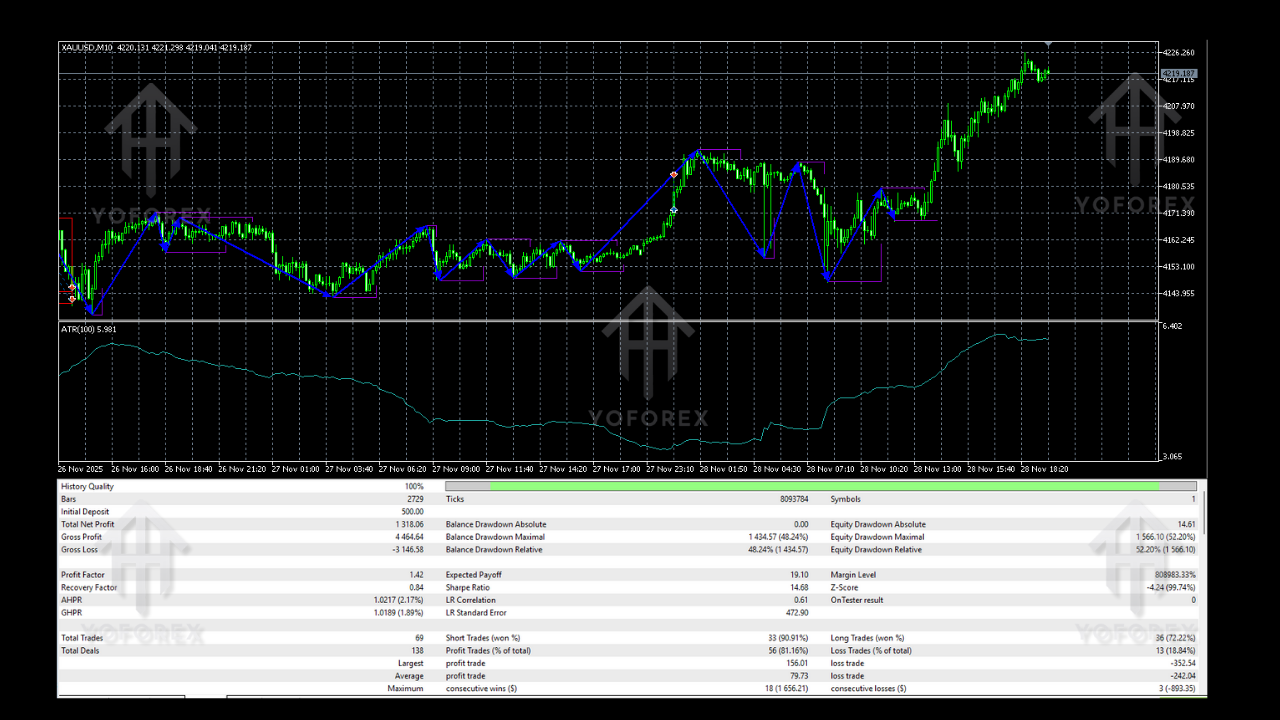

Gold BO ATR EA V2.0 MT5 Review: A Smart Volatility-Adaptive Gold Trading System

Introduction to Gold BO ATR EA V2.0 MT5

Gold trading has always been known for its exceptional volatility and rapid price behavior. XAUUSD moves differently from traditional currency pairs, making it both an opportunity and a challenge for traders. Many users struggle with inconsistent entries, emotional decision-making, and unpredictable market swings. To overcome these issues, algorithmic trading has become a preferred solution for disciplined gold trading. Gold BO ATR EA V2.0 MT5 stands out as a volatility-responsive Expert Advisor designed to trade gold using structured, rules-based logic.

This EA uses the Average True Range (ATR) to dynamically adjust its stop loss and take profit levels. Instead of relying on fixed pip distances, the EA responds to market volatility, making it more adaptable to gold’s fast and sudden movements. With a combination of breakout identification, pullback confirmation, and volatility-based risk management, Gold BO ATR EA V2.0 MT5 offers a balanced approach to automated gold trading.

Why Gold Trading Requires a Specialized EA

Gold does not follow the same pattern or speed as common forex pairs. Its movements are influenced by global uncertainty, liquidity shifts, market openings, and major economic releases. This often results in sudden spikes, sharp pullbacks, and unpredictable price expansions. Traders who approach gold with basic strategies often face unnecessary losses.

A gold-focused EA solves this problem by:

- Understanding gold-specific volatility

- Adjusting risk based on ATR

- Avoiding emotional trading pitfalls

- Maintaining consistent decision-making

Gold BO ATR EA V2.0 MT5 is built exactly for these challenges, making it suitable for traders looking for stability in a fast-moving market.

Core Strategy Behind Gold BO ATR EA V2.0 MT5

1. Breakout Structure Detection

The EA monitors key market levels and identifies breakout opportunities. Breakouts often signal the beginning of meaningful movements, especially in XAUUSD. Instead of entering blindly, the EA waits for clear structural confirmation before acting.

2. Pullback Confirmation

After a breakout, the EA waits for a controlled pullback. This prevents the system from executing trades during false breakouts or liquidity sweeps. Pullback-based entries are known for offering stronger probability setups.

3. ATR-Based Risk Adjustment

The Average True Range is the heart of this EA. It determines:

- Stop loss distance

- Take profit targets

- Volatility zones

- Trade comfort levels

This ensures that the EA adapts to both calm and hyper-volatile market conditions.

4. Momentum and Trend Alignment

The EA includes internal logic that checks if momentum is aligned with the breakout direction. This helps avoid entries against major flows, reducing unnecessary losses.

5. Controlled Trade Management

The EA integrates:

- Break-even settings

- Optional trailing stop

- Volatility exit filters

- Rules to avoid multiple trades during uncertain phases

The structured approach makes it suitable for long-term use.

Key Features of Gold BO ATR EA V2.0 MT5

Adaptive ATR Logic

ATR-based decision-making allows the EA to adjust automatically depending on market conditions. High volatility = wider stops. Low volatility = tighter stops.

No Martingale or Grid

Many EAs rely on risky doubling techniques. Gold BO ATR EA V2.0 MT5 avoids such methods completely.

Smart Breakout Entry System

Combining breakout analysis with pullback confirmation creates a stronger foundation for consistent trading.

Designed Exclusively for Gold

The EA focuses only on XAUUSD, rather than attempting to trade multiple pairs with generic rules.

Beginner-Friendly Setup

Minimal configuration is needed. Traders simply attach the EA to the chart and load settings.

Trade Filtering in Unstable Conditions

The EA avoids trading during extremely unstable market situations, preserving account health.

Performance Characteristics and Market Behavior

While results can vary depending on broker conditions and market phases, the EA generally performs well in:

Trending Markets

Strong breakouts combined with momentum often generate long movements where the EA capitalizes effectively.

High-Volatility Sessions

ATR helps expand protective levels, allowing the EA to stay within the movement instead of being stopped out prematurely.

Structured Market Phases

The EA thrives when gold respects breakout and pullback patterns.

Reduced Overtrading

The system avoids taking unnecessary positions by filtering low-quality setups.

Ideal Conditions to Use Gold BO ATR EA V2.0 MT5

To achieve optimal performance, traders should consider:

- ECN or Raw Spread accounts

- VPS hosting for uninterrupted execution

- Low-latency environments

- Timeframes such as M15 and M5

The EA does not require constant supervision once configured correctly.

Recommended Settings Overview

- Pair: XAUUSD

- Platform: MT5

- Timeframe: M15 or M5

- Minimum deposit: 200 to 300 USD

- Risk per trade: 1% to 2%

- Best environment: ECN account with stable spreads

These settings offer a balanced approach between performance and safety.

Advantages of Gold BO ATR EA V2.0 MT5

- Volatility-aware risk management

- Breakout and pullback combination improves accuracy

- Safer trading due to the absence of martingale

- Reduces emotional trading mistakes

- Fully rules-based, structured logic

- Effective during market expansion phases

- Perfect for traders who prefer steady, disciplined growth

Disadvantages to Consider

- Not suitable for traders expecting high-frequency trades

- Performance depends on broker execution quality

- Gold can sometimes behave erratically even with strong logic

- Requires a stable internet or VPS

- Users must avoid unrealistic expectations

Who Should Use This EA

Gold BO ATR EA V2.0 MT5 is ideal for:

- Traders who prefer structured systems

- Individuals who struggle with emotions

- Beginners seeking simplicity

- Experienced traders who want diversification

- Anyone looking for a volatility-adjusting gold EA

It is not ideal for those seeking aggressive strategies or extremely high-risk methods.

Final Opinion on Gold BO ATR EA V2.0 MT5

Gold BO ATR EA V2.0 MT5 brings an organized, volatility-aware approach to gold trading. Its ATR-driven structure and breakout methodology make it a powerful tool for traders who want consistency. While no EA can promise perfect results, this system offers a disciplined method to navigate XAUUSD’s unpredictable nature.

With proper risk management, a stable trading environment, and realistic expectations, this EA can enhance a trader’s automated trading journey. Those seeking a dependable gold trading solution will find Gold BO ATR EA V2.0 MT5 to be a compelling option worth considering.

For assistance or discussions, traders can connect through the following:

WhatsApp: https://wa.me/+443300272265

Telegram Group: https://t.me/yoforexrobot

Comments

аренда мебели для мероприятий москва Качественная мебель для событий в Москве. Разнообразие моделей и лояльные тарифы.

Leave a Comment