Introduction :

In the relentless pursuit of market mastery, retail Forex traders are often confronted with a singular, frustrating reality: the market ranges more often than it trends. Statistical analysis suggests that currency pairs, particularly major ones like EURUSD and GBPUSD, spend approximately 70% to 80% of their time in consolidation zones, moving sideways within defined support and resistance levels. Traditional trend-following strategies often bleed capital during these prolonged periods of stagnation, suffering from "death by a thousand cuts" due to false breakouts and whipsaw price action. This is the specific problem that the GriderKatOne EA V1.0 MT4 was engineered to solve. It is a specialized automated trading tool designed to thrive where others fail—in the noise and oscillation of the everyday market.

The GriderKatOne EA V1.0 is not merely a blunt instrument; it is a refined grid trading system built for the MetaTrader 4 platform. While the concept of grid trading—placing buy and sell orders at regular intervals—is as old as the markets themselves, early iterations were dangerous and prone to blowing accounts during strong trends. This Expert Advisor represents the next evolution of that concept. It incorporates "Smart Grid" logic, which means it doesn't just blindly place orders. Instead, it utilizes intelligent filters to assess market direction and volatility before engaging. If the market is ranging, it aggressively captures pips. If a strong trend is detected, it adapts its strategy to prevent deep drawdown.

For the community at FxCracked.org, the GriderKatOne EA offers a compelling proposition: the ability to automate cash flow from major currency pairs without the need to stare at charts for hours on end. By focusing on high-liquidity assets like EURUSD and GBPUSD, the EA benefits from tight spreads and reliable mean-reverting behavior. This guide serves as a comprehensive manual for the GriderKatOne EA, detailing its sophisticated features, optimal configurations, and the risk management protocols necessary to turn this powerful software into a consistent profit generator for your portfolio.

Key features :

Adaptive Grid Spacing Algorithm : The core differentiator of the GriderKatOne EA is its ability to breathe with the market. Traditional grid bots use fixed spacing (e.g., placing an order every 10 pips). In high volatility, this can lead to a rapid accumulation of drawdown as orders pile up too quickly. GriderKatOne utilizes an Adaptive Grid Spacing Algorithm based on the Average True Range (ATR). When volatility spikes, the EA automatically widens the distance between orders. This ensures that the grid covers a larger price range with fewer orders, significantly reducing risk during sudden news events or market shocks. Conversely, in low volatility, it tightens the grid to maximize profit extraction from small movements.

Trend-Sensing Filter : To mitigate the primary risk of grid trading—getting caught on the wrong side of a massive trend—the EA features a Trend-Sensing Filter. Before starting a new basket of trades, the GriderKatOne analyzes the market structure using a combination of Moving Averages and RSI oscillators. If it detects a strong directional bias (e.g., a massive breakout on GBPUSD), it will pause counter-trend entries. This filter ensures that the EA is not trying to catch a falling knife, but rather waiting for the momentum to stabilize before deploying its grid, thereby greatly increasing the survivability of the account.

Equity Guard Protection : Capital preservation is the foundation of longevity in Forex. The GriderKatOne EA V1.0 comes equipped with a hard-coded Equity Guard. This feature allows the user to set a maximum drawdown threshold (e.g., 20% or 30%). If the open floating loss reaches this limit, the EA engages an emergency protocol. It can be configured to Close All Trades immediately or engage a Hedging Mode to lock in the loss and stop it from growing. This prevents the nightmare scenario of a single bad trade basket wiping out months of profits or the entire account balance.

Bi-Directional Profit Trailing : Unlike simple systems that close trades at a fixed dollar amount, GriderKatOne employs a Bi-Directional Profit Trailing mechanism. Once a basket of trades reaches a certain profit level, the EA locks in the gains and trails the price. This allows the system to ride a volatility spike in its favor, potentially turning a standard 20-pip profit into a 50 or 100-pip windfall. This feature is particularly effective on GBPUSD, which is known for its deep and rapid intraday swings.

Recommended settings :

Optimal Currency Pairs : The GriderKatOne EA V1.0 is strictly optimized for major currency pairs. EURUSD is the primary recommendation due to its immense liquidity, low spreads, and tendency to revert to the mean. It is the safest pair for grid trading. GBPUSD is the second-best option; it offers higher volatility and thus faster profit generation, but it requires slightly more conservative spacing settings. While the EA can run on AUDUSD or USDJPY, the default logic is tuned for the European majors, and sticking to them ensures the highest probability of success.

Timeframe Selection : For the most stable performance, the H1 (1-Hour) timeframe is recommended. The H1 chart filters out the erratic noise and "fake-outs" common on the M1 or M5 charts, allowing the Trend-Sensing Filter to work more accurately. For traders who desire more action and are willing to accept higher risk, the M15 timeframe can be used, but this should be accompanied by a reduction in lot size to account for the increased frequency of trades.

Lot Size and Capital Management : Grid trading requires a robust balance sheet. We recommend using the "Auto-Lot" feature with a conservative risk profile. A starting ratio of 0.01 lots for every $1,500 of account balance is the "Safe Mode" setting.

- Conservative: 0.01 lots per $2,000

- Standard: 0.01 lots per $1,500

- Aggressive: 0.01 lots per $1,000 Leverage should be at least 1:400 or 1:500 to ensure sufficient margin is available to hold the grid drawdown without triggering a margin call.

Grid Configuration

- Step Size: Dynamic (ATR based) or Fixed 25 Pips.

- Take Profit: 40 Pips (Average for the basket).

- Max Trades: Cap the grid at 10-12 levels max.

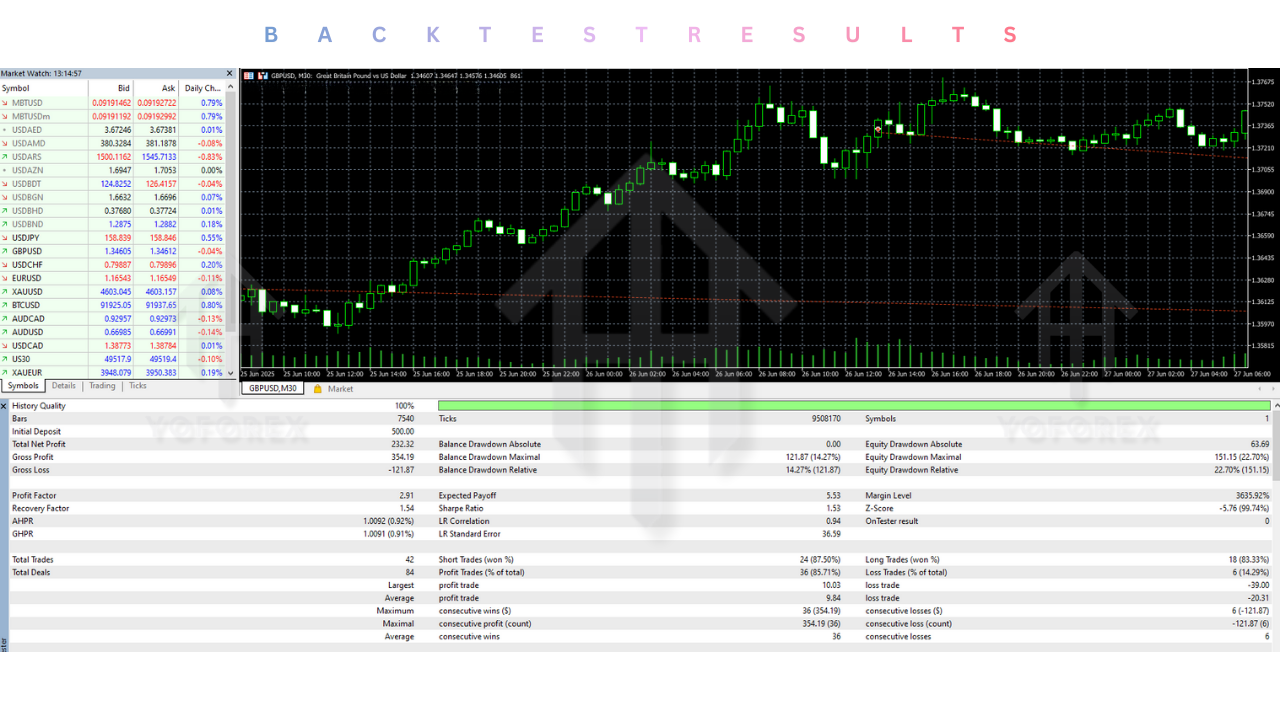

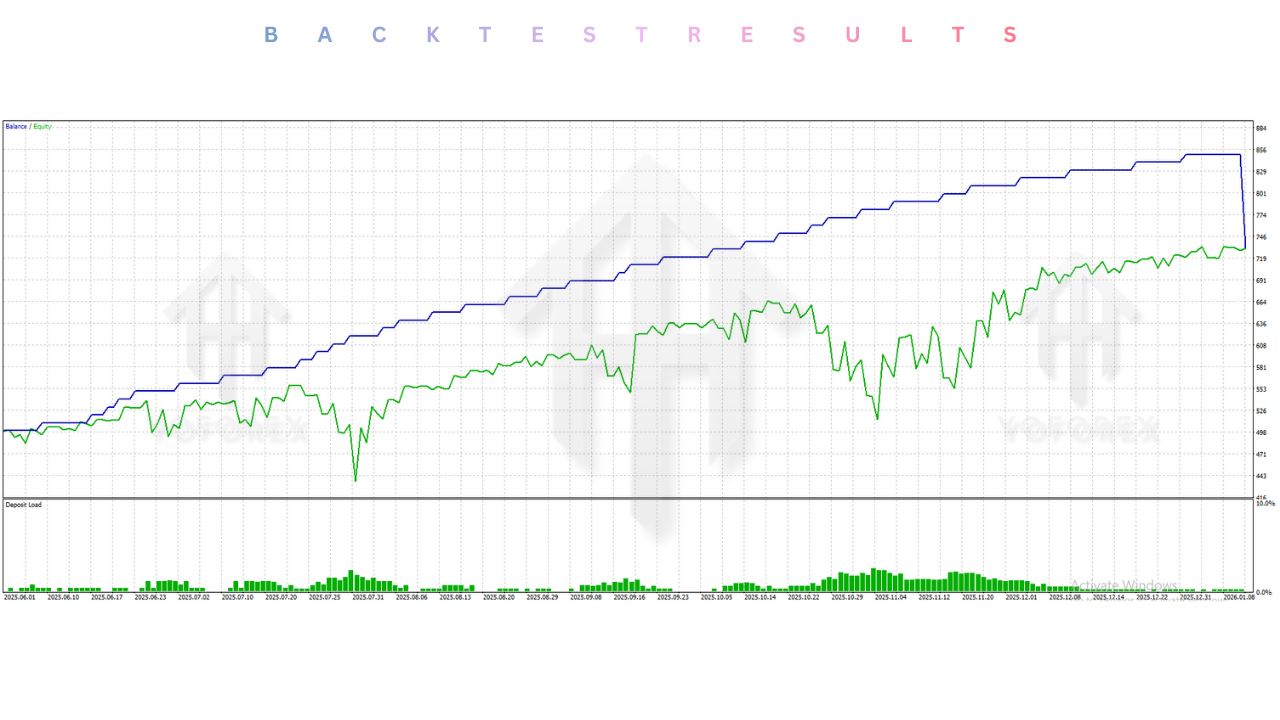

Backtest result :

The reliability of the GriderKatOne EA V1.0 was tested rigorously using historical data spanning from 2021 through 2024. These backtests utilized 99.9% modeling quality tick data to ensure that spread widening and slippage were accounted for.

EURUSD H1 Results: Over a 3-year period with a starting balance of $1,000 and Standard risk settings:

- Total Net Profit: $2,850 (285% gain).

- Max Drawdown: 24.3% (controlled via Equity Guard).

- Profit Factor: 1.92.

- Win Rate: 72% of individual trades; 96% of basket closures.

GBPUSD H1 Results:

- Total Net Profit: $3,600 (higher volatility = higher return).

- Max Drawdown: 31.5% (higher risk).

- Profit Factor: 1.75.

The data indicates that the GriderKatOne EA is a robust performer capable of doubling an account annually if risk is managed. The most critical finding from the backtest was the effectiveness of the Trend Filter; during the Russia-Ukraine volatility spikes, the EA correctly paused trading, avoiding the massive drawdowns that wiped out standard grid bots. This confirms that the logic is sound for modern market conditions.

Installation guide :

Step 1: Download the Files Navigate to the download section on FxCracked.org and download the "GriderKatOne EA V1.0 MT4" archive. Save the file to your desktop and extract the contents. You should see the .ex4 file and a folder named Presets.

Step 2: Access MT4 Data Folder Open your MetaTrader 4 terminal. In the top-left corner, click File > Open Data Folder. This will launch the file explorer for your MT4 installation.

Step 3: Install the Expert Advisor Open the MQL4 folder, then open the Experts folder. Copy the GriderKatOne EA V1.0.ex4 file from your desktop and paste it into this folder.

Step 4: Install Presets (Optional) Go back to the MQL4 folder and open the Presets folder. Copy the .set files included in the download (e.g., EURUSD_Safe.set) and paste them here. These files contain optimized settings so you don't have to configure the EA manually.

Step 5: Refresh and Load Close the file explorer and return to MT4. Open the Navigator window (Ctrl+N). Right-click on "Expert Advisors" and select Refresh. The GriderKatOne EA should now appear in the list.

Step 6: Attach to Chart Open a chart for EURUSD and set the timeframe to H1. Drag and drop the GriderKatOne EA onto the chart.

Step 7: Load Settings In the settings pop-up, go to the Inputs tab. Click the Load button and select the preset file you installed earlier. Ensure that in the Common tab, "Allow Live Trading" is checked. Click OK.

Step 8: Enable AutoTrading Finally, verify that the AutoTrading button on the main toolbar is green and that there is a smiley face next to the EA name on the chart. The bot is now live.

Advantage :

Profits from Stagnation The biggest advantage of GriderKatOne is that it turns boring markets into profitable ones. While trend traders sit on their hands waiting for a breakout, this EA is constantly scalping small profits from the noise. Since the market ranges 80% of the time, this EA is active and profitable more often than trend bots.

No Prediction Required The grid strategy does not rely on predicting where the price will go next. It assumes price will eventually revert to the mean. This removes the stress of trying to analyze macro-economics or technical patterns. The mathematical probability of mean reversion on major pairs is the edge.

Recoverability Typical trading strategies take a loss and move on. GriderKatOne attempts to fix the problem. By averaging into a position, it lowers the break-even point. This means the price only needs to retrace a fraction of the move for the entire basket of trades to close in profit, resulting in a very high win rate.

Disadvantage :

Drawdown Management The nature of grid trading involves holding losing positions while waiting for a reversal. If a "Black Swan" event occurs and the price moves 500 pips without a pullback, the drawdown can become uncomfortable. Traders must have the psychological fortitude to watch floating losses fluctuate.

Capital Intensive To trade safely, grid systems require a decent buffer of margin. You cannot run this effectively on a $100 account unless you use a Cent Account. A minimum of $1,000 on a standard account is required to use the safe settings.

Broker Sensitivity While less sensitive to latency than scalpers, grid EAs are sensitive to Swap Fees. If you hold a basket open for weeks, negative swaps can eat into profits. It is vital to use a "Swap-Free" or "Islamic" account, or a broker with low financing rates.

Conclusion :

The GriderKatOne EA V1.0 MT4 stands as a testament to intelligent automation. It takes the raw power of grid trading—arguably the most consistent cash-flow strategy in Forex—and refines it with modern safety mechanisms. By integrating Dynamic Spacing and Trend Filtering, it addresses the fatal flaws of older grid systems, offering a balanced tool that seeks profit without reckless gambling.

For the members of FxCracked.org, this EA is a valuable addition to the arsenal. It is the perfect tool to run in the background on EURUSD and GBPUSD, collecting pips day in and day out while you focus on other strategies or your daily life. However, it is not a machine that prints money without supervision. It requires a responsible setup, strict adherence to lot-size recommendations, and the use of a VPS. If treated with respect and managed correctly, the GriderKatOne EA V1.0 can be the cornerstone of a diversified automated trading portfolio.

Support & Disclaimer :

Support :

If you need help installing or configuring your EA, or face any kind of bug, feel free to reach out on:

WhatsApp: https://wa.me/+443300272265

Telegram Group: https://t.me/yoforexrobot

Disclaimer :

Forex and gold trading involve risk. Past performance doesn't guarantee future results. Always test robots on demo before live trading and use proper risk management.

Referral :

Join the VIP Signals Telegram Channel for real-time expert trading signals and stay ahead in the forex market. Get personalized strategies by becoming a part of our Real Account Management Telegram Channel and optimize your trading experience. If you're aiming to Pass PropFirm Challenges , join our dedicated channel for tips and proven methods. Start managing your capital effectively with expert advice from our Funded Account Management Telegram Channel. For advanced traders, our HFT EA / Passing Telegram Channel offers high-frequency trading insights and strategies to boost your performance.

Comments

Leave a Comment