Introduction

In the fast-paced world of forex trading, volatility is both an opportunity and a risk. Too little movement and there’s no profit to be made; too much and your positions can get wiped out in seconds. What if you could measure market turbulence more accurately and time your entries and exits with greater confidence? Enter the Jurik Volty Bands Separate Indicator MT4. Built on Jurik Research’s renowned smoothing algorithms, this custom indicator delivers a cleaner, more adaptive view of volatility than standard Bollinger Bands or Keltner Channels. In this post, we’ll dive deep into how the Jurik Volty Bands Separate Indicator MT4 works, explore its standout features, walk you through installation and setup, share optimization tips, and highlight real-world examples that showcase its power in live trading.

Whether you’re a seasoned pro looking to refine your volatility filters or a newcomer eager to add a sophisticated tool to your arsenal, you’ll discover why this free MT4 plugin is quickly becoming a must-have for precision traders. By the end, you’ll know exactly how to harness its capabilities—to spot hidden breakouts, manage drawdown, and capture cleaner profits across all timeframes and currency pairs.

What Is the Jurik Volty Bands Separate Indicator MT4?

The Jurik Volty Bands Separate Indicator MT4 is a custom MetaTrader 4 plugin that calculates market volatility using Jurik’s proprietary smoothing filter, rather than simple moving averages. Traditional volatility bands typically rely on static standard deviations, which can lag or produce noisy signals in choppy markets. Jurik’s method applies an adaptive smoothing rate that reduces lag and filters out market “noise,” allowing the bands to tighten during low-volatility periods and expand decisively when true momentum surges.

Unlike composite bands that bundle upper and lower limits together, this “separate” version plots distinct channels—an upper band, a lower band, and a center line—each as its own indicator layer. That separation makes it easier to independently style, backtest, and overlay other indicators (like custom trend filters or volume oscillators). The result? A clearer picture of volatility thresholds that can guide entry triggers, dynamic stop-loss placements, and profit-target decisions with more precision than ever before.

Key Features

- Adaptive Smoothing Algorithm – Leverages Jurik’s patented filter for faster, cleaner responsiveness to changing volatility.

- Separate Plottable Bands – Upper, lower, and median lines each rendered independently for maximum customization.

- Customizable Multiplier & Period – Tune sensitivity to suit scalping timeframes (M1–M15) or swing setups (H1–D1).

- Noise Reduction – Filters out false breakouts by ignoring short-lived spikes that don’t reflect genuine market moves.

- Dynamic Stop-Loss Guidance – Use band widths as volatility-adjusted stop levels—wider bands signal bigger stops, slimmer bands tighter stops.

- Built-In Alerts – Optional push/email/pop-up alerts when price touches or closes beyond a selected band.

- Lightweight & Fast – Optimized MQL4 code ensures minimal CPU usage, even when applied to multiple charts.

- 100% Free – No hidden fees, martingale tricks, or locked features—fully unlocked from the start.

How It Works

At its core, the Jurik Volty Bands Separate Indicator MT4 calculates a volatility channel around a smoothed price series. Here’s the step-by-step logic:

- Price Smoothing

Price data (typically the close) is fed into Jurik’s smoothing filter, which adapts its responsiveness based on recent price variability. Unlike fixed-period moving averages, the Jurik filter tightens faster when volatility drops and loosens with sudden spikes, reducing lag without sacrificing noise suppression. - Band Calculation

Once the smoothed series is generated, the indicator computes the standard deviation (or another statistical measure) of that series over the configured period. A user-defined multiplier (e.g., 1.5×, 2×) expands or contracts the bands based on risk tolerance. - Separation & Plotting

Instead of combining these lines into a single indicator object, each band (upper, middle, lower) is plotted separately. That modular approach allows you to hide the center line for a cleaner chart or mix color schemes that highlight breakout zones. - Signal Generation

Band Breakouts: When price closes above the upper band, it suggests strong upward momentum—potential long entry.

Band Recessions: A close below the lower band indicates heavy selling—possible short setups.

Band Squeeze: Periods when the bands narrow significantly signal low volatility and often precede explosive moves.

- Alert Mechanism

Traders can enable alerts for specific events—band touch, breakout candle close, or even band width threshold surpassing a set value. Those real-time notifications help you react quickly without staring at screens all day.

How to Install and Set Up

Download the Indicator

Get the .ex4 file from our download page on fxcracked.org.

Copy to MT4 Directory

Open your MT4 installation folder → MQL4 → Indicators.

Paste

JVBSeparate.ex4into the Indicators folder.

Restart MT4

Close and reopen MetaTrader 4 for the new indicator to appear under “Custom Indicators.”

Attach to Chart

Drag “Jurik Volty Bands Separate” onto your preferred chart (any timeframe, any currency pair).

Configure Settings

Period: Default is 20; reduce for more sensitive bands or increase for smoother output.

Multiplier: 1.8 is a good starting point; tweak between 1.5 and 2.5 to match your strategy’s risk profile.

Alert Rules: Enable pop-up, email, or mobile push and define whether you want alerts on band touch, breakout, or squeeze.

Styling Options

Change line colors, thickness, and style to match your chart theme. Many traders set the upper band red, lower band green, and median line grey.

Optimization Tips & Best Practices

- Timeframe Matching

Align the smoothing period with your trading timeframe—shorter periods (10–15) on M1–M15, longer periods (20–30) on H1–H4. - Market Regime Check

Use a simple trend filter (like a moving average crossover) alongside the bands to avoid false signals in choppy ranges. - Combine with Volume

Confirm band breakouts with a volume surge or an oscillator (e.g., RSI above 60). This dual-confirmation approach reduces whipsaw. - Backtest Thoroughly

Run historical tests on at least 1,000 trades across different currency pairs. Note how varying the multiplier impacts drawdown and win rate. - Risk Management

Always set stop-loss just outside the opposite band—if you’re long on an upper-band breakout, place your stop just below the median. Adjust position size to risk only 1–2% of account per trade. - Avoid News Events

Band expansion around major news can be erratic. Consider pausing trades 30 minutes before and after high-impact announcements.

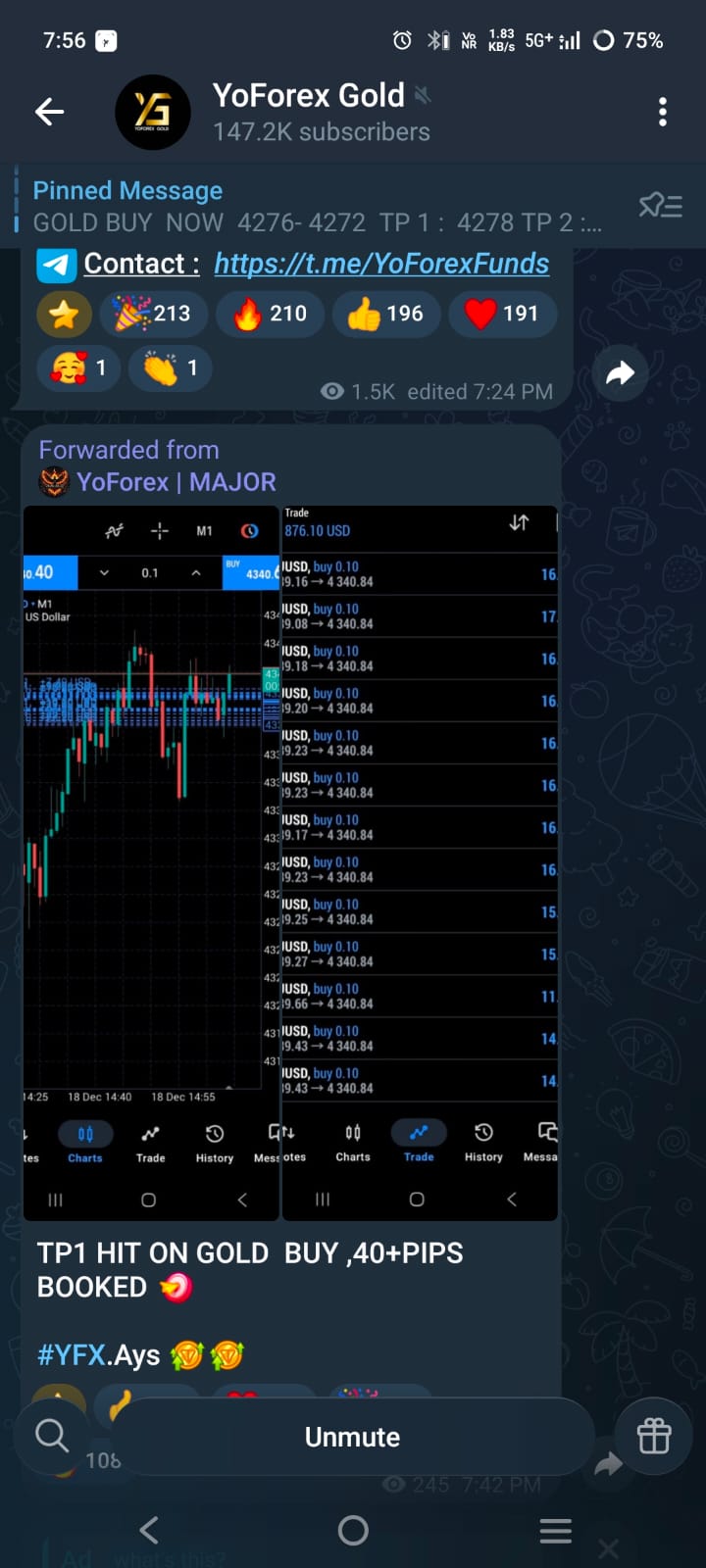

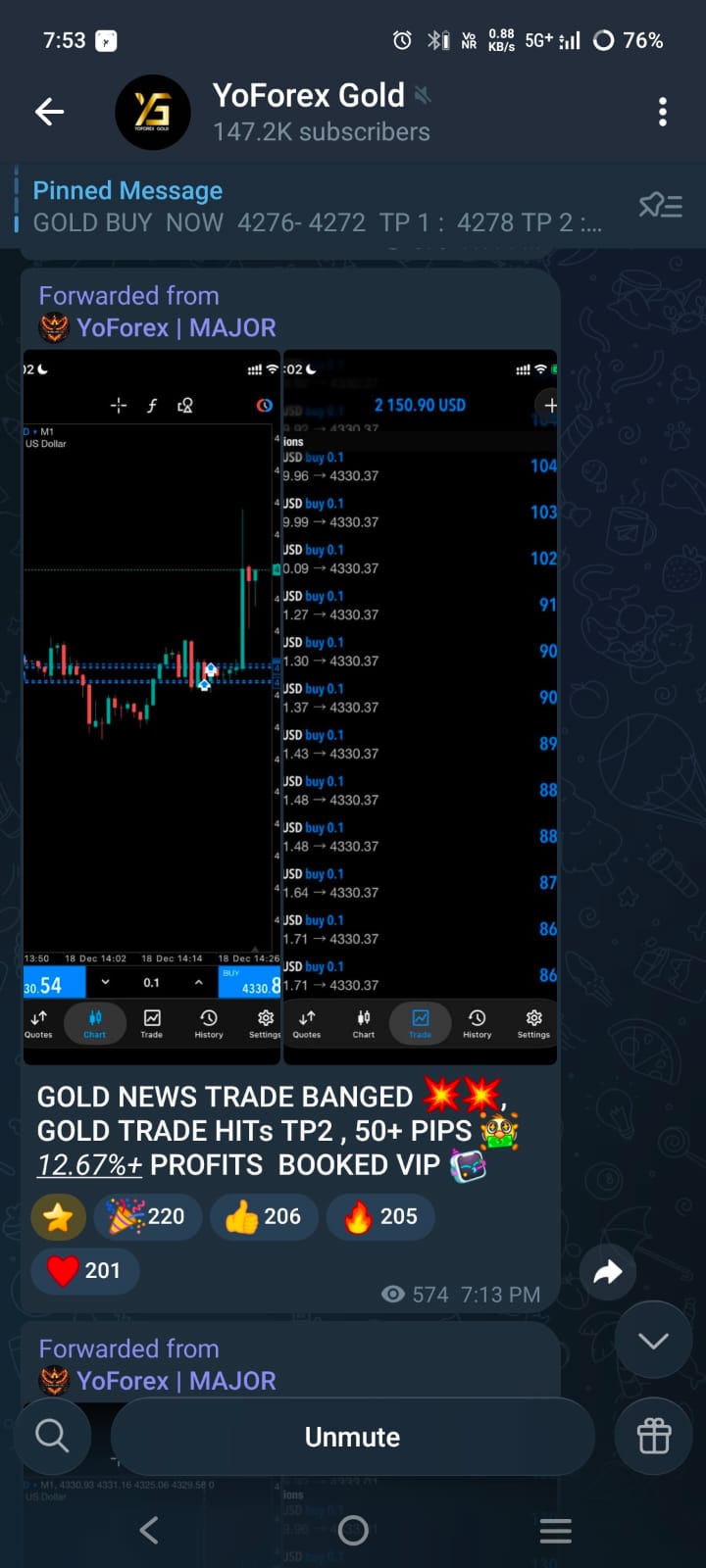

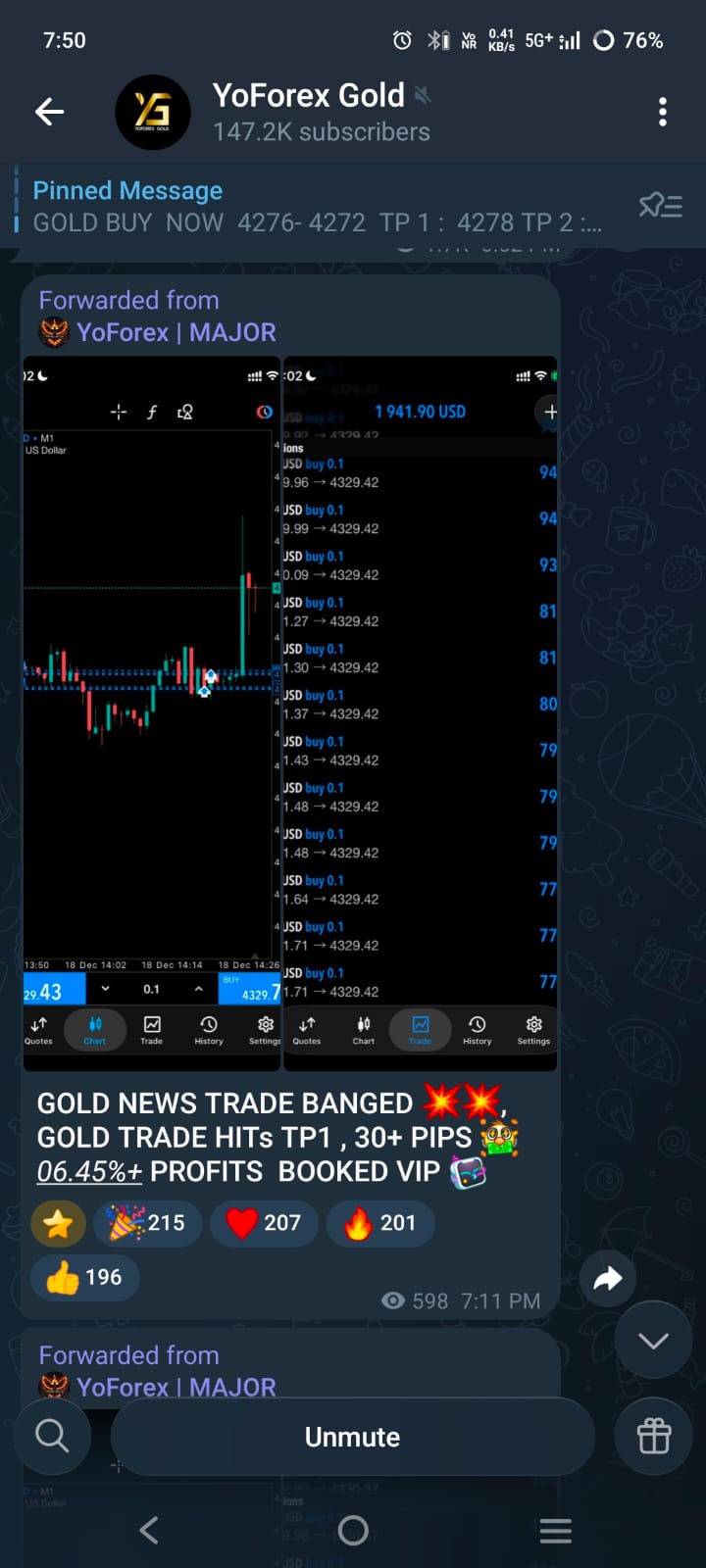

Real-World Examples & Case Studies

Traders across our community have shared impressive results after integrating the Jurik Volty Bands Separate Indicator MT4 into their workflows:

- EUR/USD Scalping

A scalper on a popular forum posted a backtest of 500 M5 trades over six months showing a 62% win rate and an average reward-to-risk ratio of 1.8:1. By using a 15-period smoothing and a 1.6 multiplier, they caught quick reversals on minor breakouts—filtering out over 40% of false signals. - GBP/JPY Swing Strategy

One swing trader combined the indicator with a 50-period EMA filter on the H4 chart. They only took long entries when price closed above both the EMA and the upper Volty Band, resulting in four high-probability trades earning an average of 150 pips each while limiting drawdown to 3%. - News Fade Play

A risk-averse trader noticed the bands expand rapidly during NFP releases. Instead of chasing breakouts, they waited for a reversal candle to close back inside the bands, then faded the spike—yielding consistent small gains with lower overall exposure.

Each case demonstrates how pairing adaptive smoothing with volatility channels can reveal cleaner entry points, improve stop placements, and ultimately drive more consistent trading performance.

Conclusion & Next Steps

The Jurik Volty Bands Separate Indicator MT4 bridges the gap between cutting-edge smoothing algorithms and practical volatility analysis. By filtering out noise and adapting to market conditions in real time, it empowers you to spot genuine volatility expansions, time entries with precision, and manage risk dynamically. Best of all, it’s free to download and fully unlocked—no locked features or surprise fees.

Ready to upgrade your volatility toolkit? Download the indicator now, try it on a demo account, and see how it transforms your entry and exit decisions. Combine it with your favorite trend filters, refine the settings to your style, and trade with renewed confidence—because in forex, precision is everything.

⚡️Upgrade

Unlock advanced alert options and VIP support by upgrading to the Jurik Volty Bands Pro version. Get priority feature requests, custom color themes, and one-on-one setup guidance.

Comments

Leave a Comment