The landscape of retail forex trading is shifting rapidly. For years, traders on forums and download sites have cycled through the same variations of grid and martingale bots. These systems often promise high win rates but hide catastrophic risks. The release of Mad Turtle EA V6.5 for MetaTrader 5 represents a departure from this obsolete logic. Instead of relying on rigid mathematical progressions or simple indicator crossovers, this Expert Advisor utilizes the ONNX (Open Neural Network Exchange) standard to deploy trained machine learning models directly on your chart.

This article provides a comprehensive technical analysis of the Mad Turtle EA V6.5. We will explore how its neural network architecture differs from standard MQL5 coding, why the H4 timeframe is critical for its success, and how to configure the new Portfolio Mode to manage risk effectively without relying on dangerous recovery tactics.

The ONNX Architecture: Real AI in MQL5

Most trading robots marketed as "AI" are simply linear regression models or basic signal filters wrapped in marketing language. Mad Turtle V6.5 differs because it relies on external .onnx files. These files contain pre-trained neural networks that have learned to classify market conditions based on historical data.

When you attach the EA to a chart, it does not just calculate an RSI value. It feeds current market data into the neural network, which then outputs a probability score for Buy, Sell, or Wait. This non-linear approach allows the EA to adapt to complex patterns that traditional "If-Then" logic cannot capture. For the user, this means the installation process is slightly more complex. You must ensure that "Allow DLL imports" is enabled in your MetaTrader 5 settings, as the ONNX library requires these permissions to function correctly. Without this step, the neural network cannot initialize, and the EA will fail to place trades.

Strategy Analysis: The Turtle Philosophy

The core philosophy of this EA is trend following. It is named "Turtle" after the famous Turtle Traders experiment, which proved that a simple trend-following system could generate massive wealth if followed with discipline.

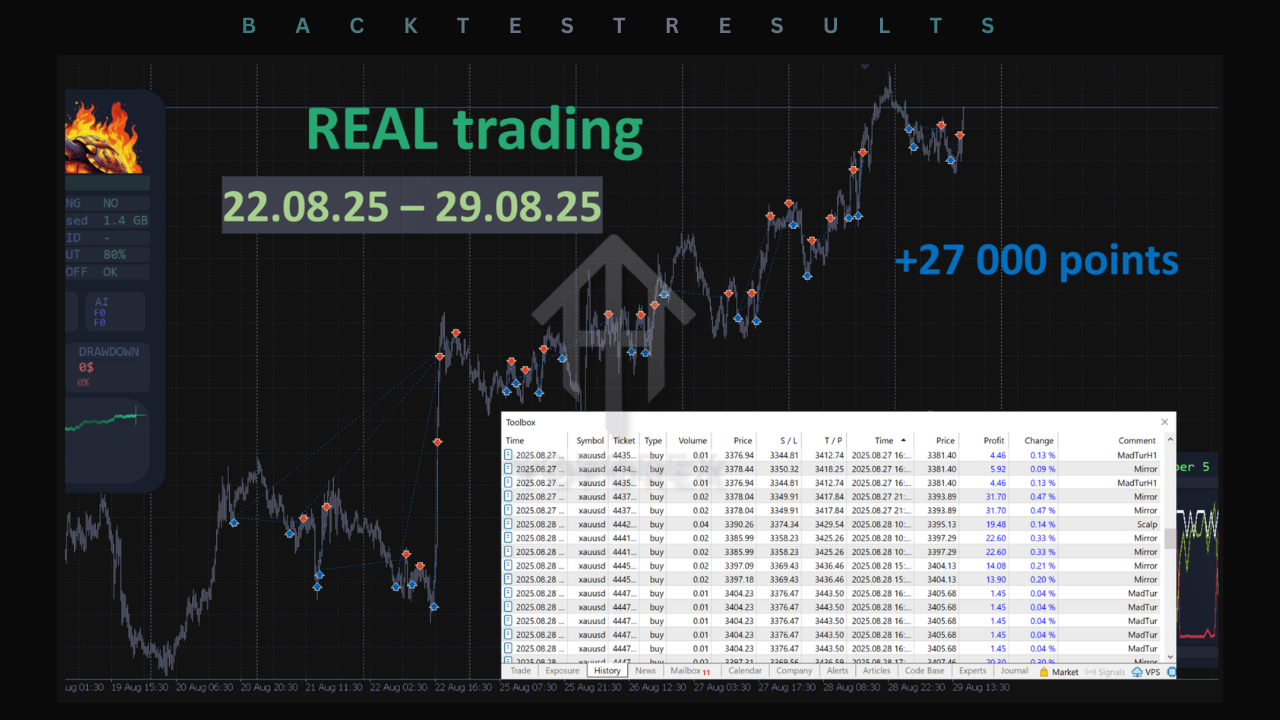

The EA operates primarily on the H4 (4-Hour) timeframe. This is a deliberate design choice to filter out market noise. Lower timeframes like M1 or M5 are often dominated by random price fluctuations and high-frequency algorithm spoofing. By focusing on H4, the Mad Turtle EA aims to capture significant structural moves in the market, particularly on Gold (XAUUSD).

Traders must understand that this is not a high-frequency scalper. You may experience periods of inactivity where the AI determines that market conditions are too ambiguous to trade. This patience is a feature, not a bug. It prevents the account from being churned during low-volatility sessions where spread costs would eat up potential profits.

Risk Management: The Absence of Martingale

The most significant technical advantage of Mad Turtle V6.5 is its refusal to use Martingale or Grid systems. In a Martingale system, the bot doubles the position size after a loss to recover the drawdown. While this produces a smooth equity curve initially, it inevitably leads to a margin call when the market trends strongly against the initial position.

Mad Turtle V6.5 uses a strict Stop Loss for every single trade. If a trade goes against the prediction, the EA takes the loss and waits for the next setup. This approach ensures that a single bad trade cannot wipe out the trading account. The V6.5 update further refines this by introducing lower risk profiles and a new "MID" risk mode, which bridges the gap between the conservative Low setting and the aggressive High setting. This makes the EA suitable for capital preservation strategies, which is rare for tools found in the retail market.

Portfolio Mode and Internal Models

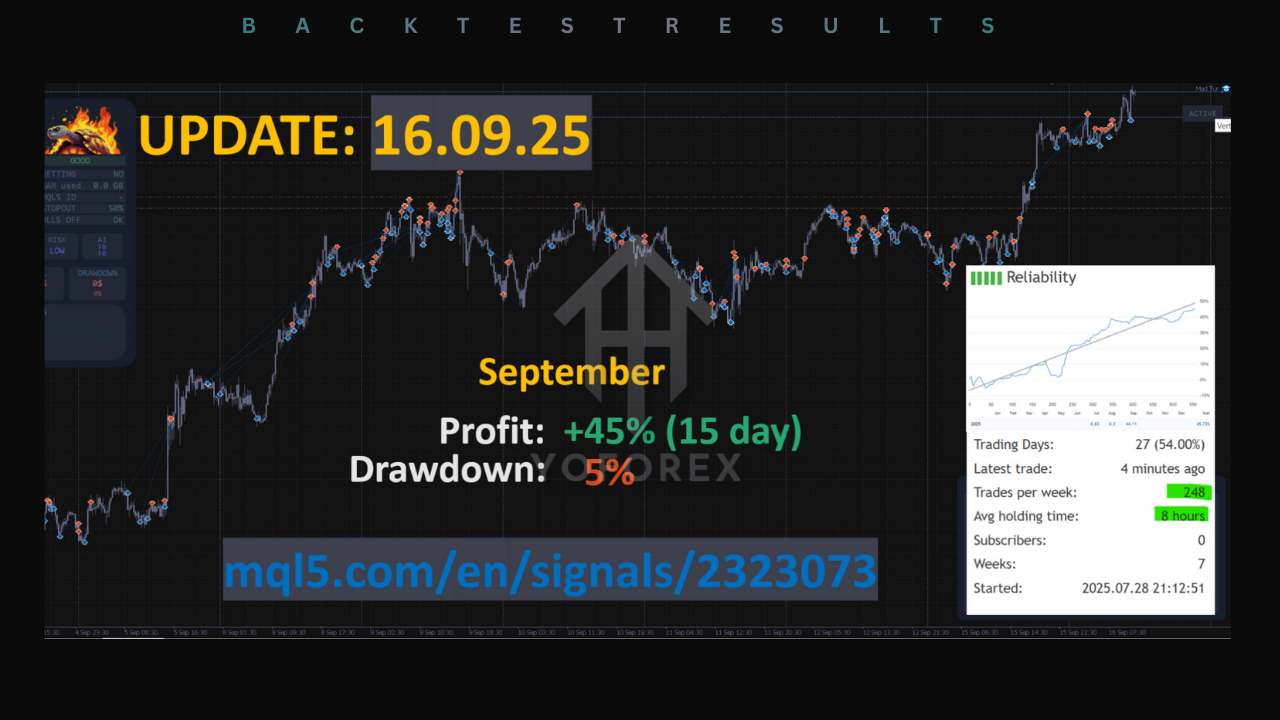

Version 6.5 introduces a feature called Portfolio Mode. Previously, traders were limited to running a single model logic on a chart. Now, the EA allows for the simultaneous execution of multiple internal models.

The primary model is the "Turtle," designed for catching breakouts and long trends. The secondary model, "Scalper PRO," operates on a different logic, looking for shorter-term mean reversion opportunities. By running these together in Portfolio Mode, traders can potentially smooth out the volatility of their equity curve. When the trend-following model is in a drawdown during a ranging market, the scalping model may generate profits to offset the losses, and vice versa.

The "Omega" model, which was present in previous versions, has been removed from the automatic rotation in V6.5. This decision suggests a commitment to quality control, removing strategies that showed instability during forward testing.

Installation and Configuration Guide

To run Mad Turtle EA V6.5 successfully, follow these specific configuration steps. First, ensure you are using a low-latency VPS. Since the neural network calculations are more CPU-intensive than standard EAs, a sluggish computer can lead to missed entry signals.

Second, select the "Full Auto" mode if you are new to the system. In this mode, the EA automatically scans your account balance and currency to determine the appropriate lot size. It takes the guesswork out of money management. For experienced users, the manual "Portfolio" mode allows for granular control, but it requires a deep understanding of correlation risk.

Finally, verify that your broker time is set to GMT+2 or GMT+3. The neural networks were likely trained on standard forex server time. Using a broker with a different time zone offset can result in H4 candles forming at different times, which feeds incorrect data patterns to the AI.

Conclusion

Mad Turtle EA V6.5 is a sophisticated tool for traders who are tired of gambling with Martingale grids. It offers a professional, data-driven approach to trading Gold and major forex pairs. While it requires patience and a proper technical setup, the use of ONNX technology places it ahead of most standard MQL5 scripts. For traders looking for sustainability over quick, risky gains, this EA is a formidable option.

Reference:

Join the VIP Signals Telegram Channel for real-time expert trading signals and stay ahead in the forex market. Get personalized strategies by becoming a part of our Real Account Management Telegram Channel and optimize your trading experience. If you're aiming to Pass PropFirm Challenges, join our dedicated channel for tips and proven methods. Start managing your capital effectively with expert advice from our Funded Account Management Telegram Channel. For advanced traders, our HFT EA / Passing Telegram Channel offers high-frequency trading insights and strategies to boost your performance.

Comments

Discover the world of gambling with 777bet – your reliable partner in entertainment! For online betting sites, customer support is essential, and 777bet stands out in this regard.

Leave a Comment