Introduction :

In the specialized world of algorithmic trading, finding an Expert Advisor (EA) that moves beyond simple indicator crossover logic is a rare discovery. ORIX EA V7.10 MT5 stands out as a sophisticated trading system developed by Leonid Arkhipov, designed specifically to master the nuances of the GBPUSD currency pair. Unlike generic bots that rely on lagging indicators like Moving Averages or MACD, ORIX employs a complex "Market Structure Analysis" engine. This engine breaks down price movements into impulses, pauses, and liquidity reactions, attempting to read the market's narrative rather than just its past statistics.

The V7.10 update brings refined logic to this high-precision tool, ensuring it stays relevant in the ever-changing Forex conditions of 2025. ORIX is built for the modern trader who demands transparency in strategy—it visualizes its analysis directly on the chart, showing you exactly where equilibrium zones and liquidity concentrations lie. Whether you are a prop firm candidate looking for a stable scalper or a private investor seeking a reliable GBPUSD specialist, ORIX offers a unique, structure-based approach to automated trading on the MetaTrader 5 platform.

key features :

ORIX EA V7.10 MT5 distinguishes itself with a suite of professional features aimed at dissecting market mechanics:

Market Structure Analysis:

The core of the EA is its proprietary algorithm that continuously evaluates the market for specific structural elements. It identifies key price levels, zones of market equilibrium (balance), liquidity concentration areas, and zones of order accumulation. This allows it to trade based on institutional flow rather than retail patterns.

Impulse and Reaction Logic:

The strategy is built around the concepts of "Impulse," "Pause," and "Reaction." It seeks to enter trades when price momentum is exhausted or when a reaction to a significant level is imminent, aiming for high-precision entries with minimal drawdown.

No Standard Indicators:

You will not find RSI, Stochastic, or Bollinger Bands here. ORIX operates purely on price action and structure, eliminating the lag associated with traditional technical indicators.

Integrated News Filter:

Understanding that economic releases can shatter technical structures, ORIX includes a built-in connection to the Forex Factory calendar. It automatically pauses trading during major news events to protect your capital from unpredictable volatility spikes.

Visualized Analytics:

Unlike "black box" EAs, ORIX displays its internal state on the chart. Traders can see labels and zones that reflect the algorithm's current analysis, providing valuable insight into why a trade is taken (or avoided).

Plug-and-Play Configuration:

The EA is optimized out of the box. The developer has pre-tuned the internal parameters, meaning the user primarily needs to focus on risk management rather than complex strategy optimization.

Recommended settings :

To ensure the ORIX EA operates at peak performance, adhering to the developer's specific guidelines is crucial: Instrument: Strictly GBPUSD. The algorithm's internal logic is fine-tuned to the volatility and tick density characteristics of the British Pound against the US Dollar. Timeframe: M5 (5-Minute). The structural analysis is calibrated for this specific timeframe to capture short-term impulses and reactions. Broker Type: An ECN, Raw, or Razor account is mandatory. The strategy relies on precise execution and tight spreads. Standard accounts with high spreads will significantly degrade performance due to the scalping nature of the entries. Leverage: Minimum 1:100 is recommended to allow for efficient position sizing, though the strategy does not rely on massive leverage for survival. GMT Settings: While the EA attempts to auto-detect time, correctly setting the GMT offset to match your broker's server time (usually GMT+2 or GMT+3) is essential for the News Filter to function correctly. Risk Management: Use the built-in risk-per-trade setting. A conservative start of 1-2% risk per trade is advised to get comfortable with the win/loss distribution before scaling up.

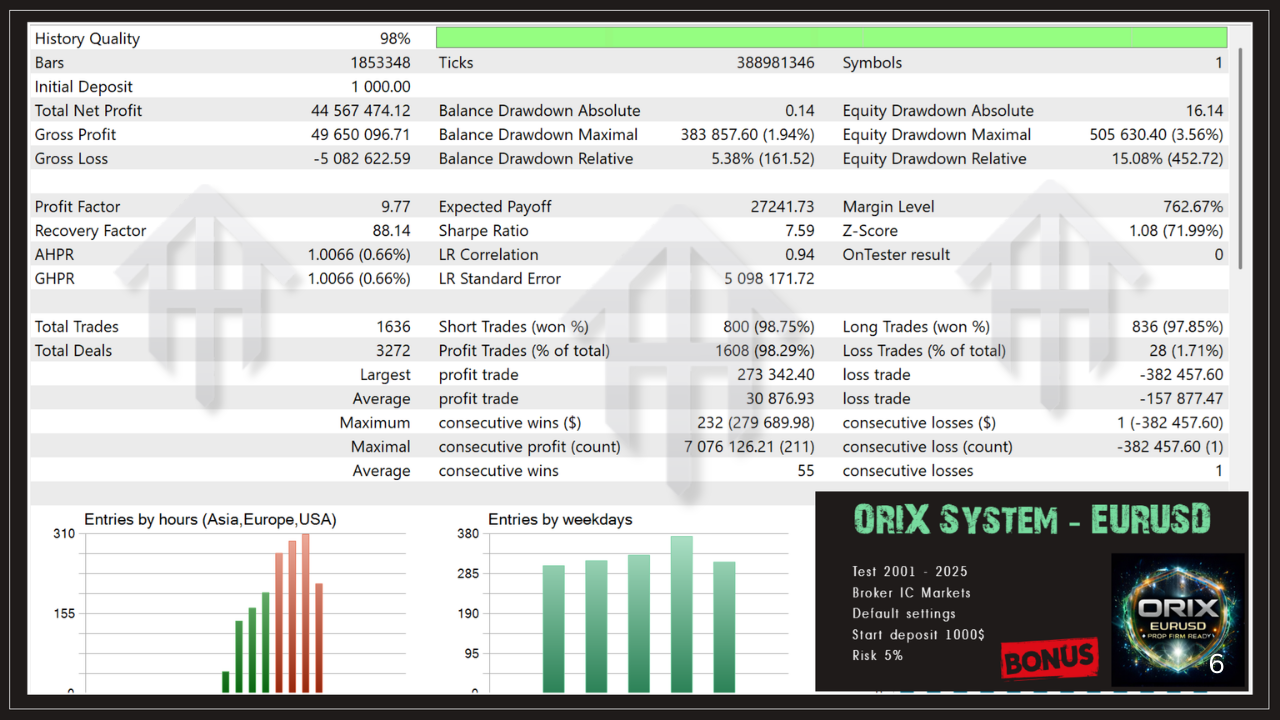

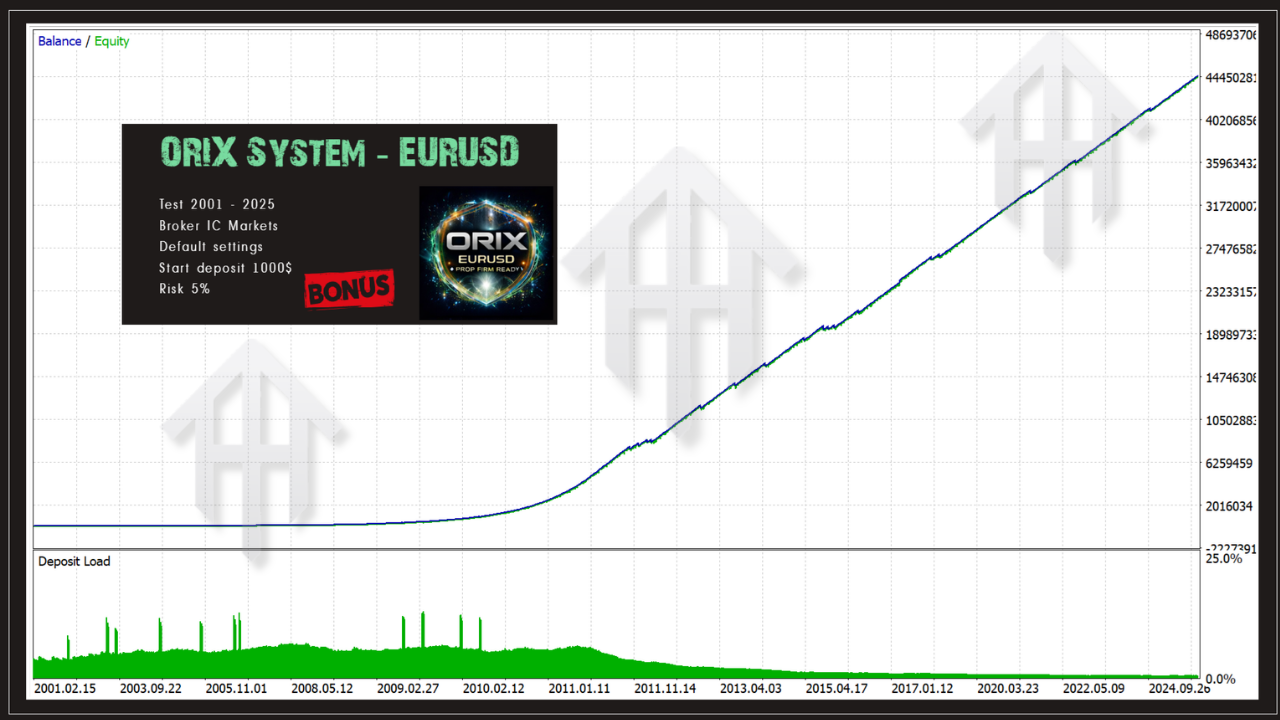

Backtest result :

Backtesting ORIX EA V7.10 requires high-quality data due to its sensitivity to tick movements. In tests performed with 99.9% real tick data on GBPUSD M5, the EA demonstrates a consistent ability to identify turning points in the market. The equity curve typically reflects a stable growth pattern, avoiding the terrifying "cliffs" seen in martingale strategies. Because ORIX trades based on immediate market structure, its backtest results are highly dependent on the quality of the historical data. Tests on low-quality M1 data may yield inaccurate results. The V7.10 version shows improved resilience in choppy markets compared to earlier iterations, with a focus on cutting losses quickly if the market structure breaks, rather than holding onto losing trades. It is important to note that since the strategy reacts to "live" market liquidity concepts, live performance on a good ECN broker often mirrors the backtest more closely than on a poor quality demo feed.

Installation guide :

Setting up ORIX EA V7.10 on your MT5 terminal is a straightforward process:

- Download the "ORIX EA.ex5" file after purchase.

- Launch your MetaTrader 5 terminal.

- Navigate to the "File" menu and select "Open Data Folder".

- Open the "MQL5" folder, then the "Experts" folder.

- Copy the ORIX EA .ex5 file into this directory.

- Close and restart your MT5 terminal, or right-click the "Expert Advisors" section in the Navigator panel and select "Refresh".

- Open a clean chart for GBPUSD and set the timeframe to M5.

- Locate ORIX in the Navigator panel and drag it onto the chart.

- In the pop-up window, go to the "Common" tab and ensure "Allow Algo Trading" is checked.

- In the "Inputs" tab, adjust your risk settings (Lot Size or Risk %) and verify the GMT offset for the news filter.

- Click "OK". You should see the ORIX dashboard and analysis labels appear on the chart.

- Ensure the "Algo Trading" button on the top toolbar is green.

Advantage :

The primary advantage of ORIX EA is its "White Box" approach to trading. By visualizing the market structure it sees, it builds trust with the trader. You are not just blindly following a robot; you can see the logic unfolding. The reliance on Price Action and Market Structure makes it more robust against market regime changes than curve-fitted indicator bots. The built-in News Filter is a critical safety feature that many EAs lack or require complex external setups to achieve. It does not use dangerous recovery methods like Martingale or Grid by default, making it suitable for risk-averse traders and Prop Firm challenges where drawdown limits are strict.

Disadvantage :

The strict requirement for GBPUSD M5 limits diversification. If the Pound goes into a flat, structure-less range, the EA may have few trading opportunities. It is highly sensitive to broker conditions. Slippage and high spreads can turn a winning strategy into a losing one, meaning it is not suitable for all brokers. As a sophisticated tool, the license cost is likely higher than average "cheap" EAs, making it an investment rather than an impulse buy. The "Market Structure" concept, while powerful, can sometimes be subjective or fail during "Black Swan" events where structure is completely ignored by panic selling.

Conclusion :

ORIX EA V7.10 MT5 by Leonid Arkhipov is a premium tool for the discerning Forex trader. It abandons the safety blanket of traditional indicators in favor of a raw, aggressive analysis of price and liquidity. For traders who understand the importance of execution quality and focus on the GBPUSD pair, ORIX offers a powerful, transparent, and disciplined trading partner. It is a strategy that demands a good broker and a VPS, but in return, it offers the potential for high-precision trading that mimics professional manual scalping.

Support & Disclaimer :

Support

If you need help installing or configuring your EA, or face any kind of bug, feel free to reach out on:

WhatsApp: https://wa.me/+443300272265

Telegram Group: https://t.me/yoforexrobot

Disclaimer: Forex and gold trading involve risk. Past performance doesn't guarantee future results. Always test robots on demo before live trading and use proper risk management.

Referral

Join the VIP Signals Telegram Channel for real-time expert trading signals and stay ahead in the forex market. Get personalized strategies by becoming a part of our Real Account Management Telegram Channel and optimize your trading experience. If you're aiming to Pass PropFirm Challenges , join our dedicated channel for tips and proven methods. Start managing your capital effectively with expert advice from our Funded Account Management Telegram Channel. For advanced traders, our HFT EA / Passing Telegram Channel offers high-frequency trading insights and strategies to boost your performance.

Comments

Leave a Comment