The gold market, known in the trading world as XAUUSD, represents one of the most liquid and volatile assets available to retail traders. Because of its unique price action characterized by sharp breakouts and rapid reversals, manual trading can often lead to emotional decision-making and significant losses. This is why automated trading systems, specifically Expert Advisors (EAs), have become the go-to solution for professional gold traders. Among the most discussed tools in recent months is the Pocong Gold EA V1.07 for MetaTrader 4.

This technical guide explores the inner workings of the Pocong Gold EA V1.07, providing an in-depth analysis of its algorithmic structure, risk management protocols, and the optimal environment required to run this software successfully on YoForex.

Understanding the Logic of Pocong Gold EA V1.07

Pocong Gold EA V1.07 is an automated trading robot designed exclusively for the gold market. Unlike many other EAs that attempt to trade multiple currency pairs with a generic set of rules, Pocong Gold is hard-coded to handle the specific volatility and average true range of XAUUSD.

The strategy behind V1.07 is rooted in high-frequency scalping combined with a sophisticated trend-momentum filter. The EA scans the lower timeframes, specifically the 1-minute (M1) and 5-minute (M5) charts, looking for price exhaustion points and micro-trend shifts. Once a high-probability entry signal is identified, the bot executes trades with lightning speed to capture small price movements, often referred to as scalping.

Technical Enhancements in Version 1.07

The transition from previous versions to V1.07 brought several critical updates aimed at account preservation and efficiency:

Improved Signal Accuracy: The entry algorithm has been refined to reduce false signals during sideways or choppy market conditions. By integrating multiple technical indicators like RSI and Moving Averages into its core logic, the EA ensures that it only enters trades when there is sufficient momentum.

Dynamic Lot Sizing: One of the standout features of V1.07 is its ability to adjust lot sizes based on the available equity. This ensures that as your account grows, the EA scales the position sizes accordingly, maintaining a consistent risk-to-reward ratio.

Enhanced Execution Speed: Gold moves fast, especially during the London and New York session overlaps. The V1.07 code has been optimized for low-latency execution, ensuring that trades are opened and closed with minimal slippage, provided you are using a high-quality ECN broker.

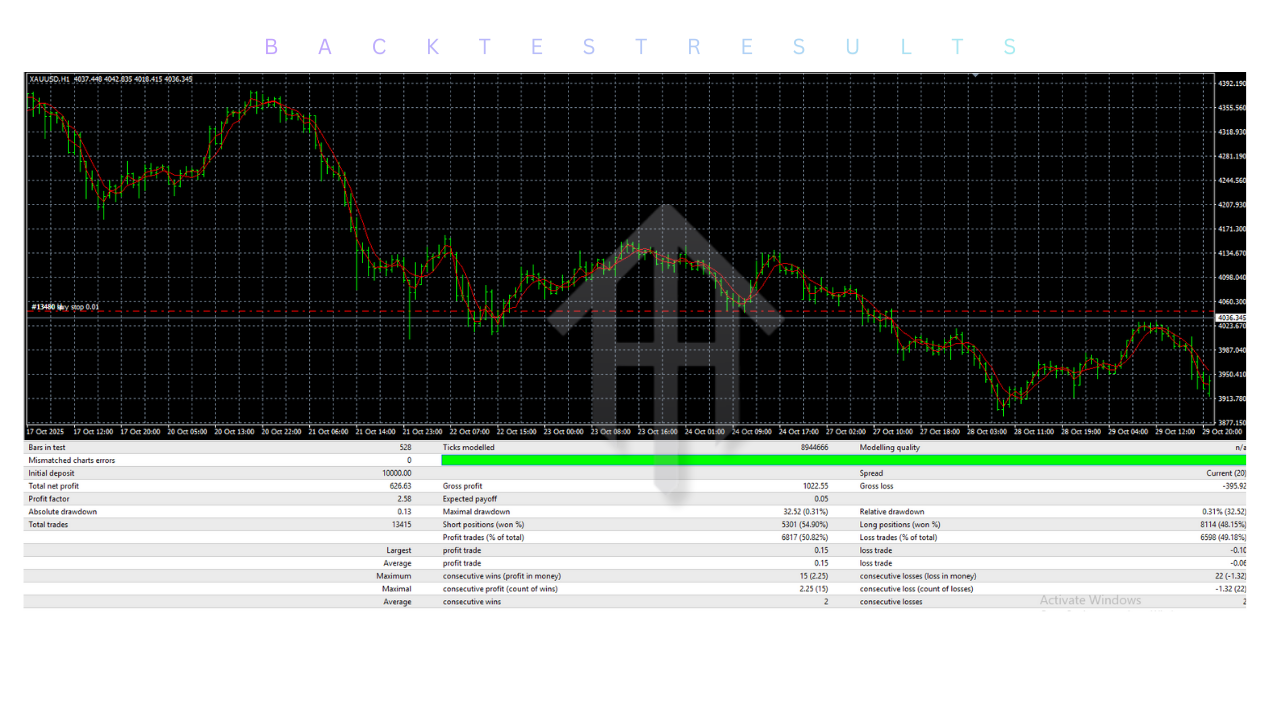

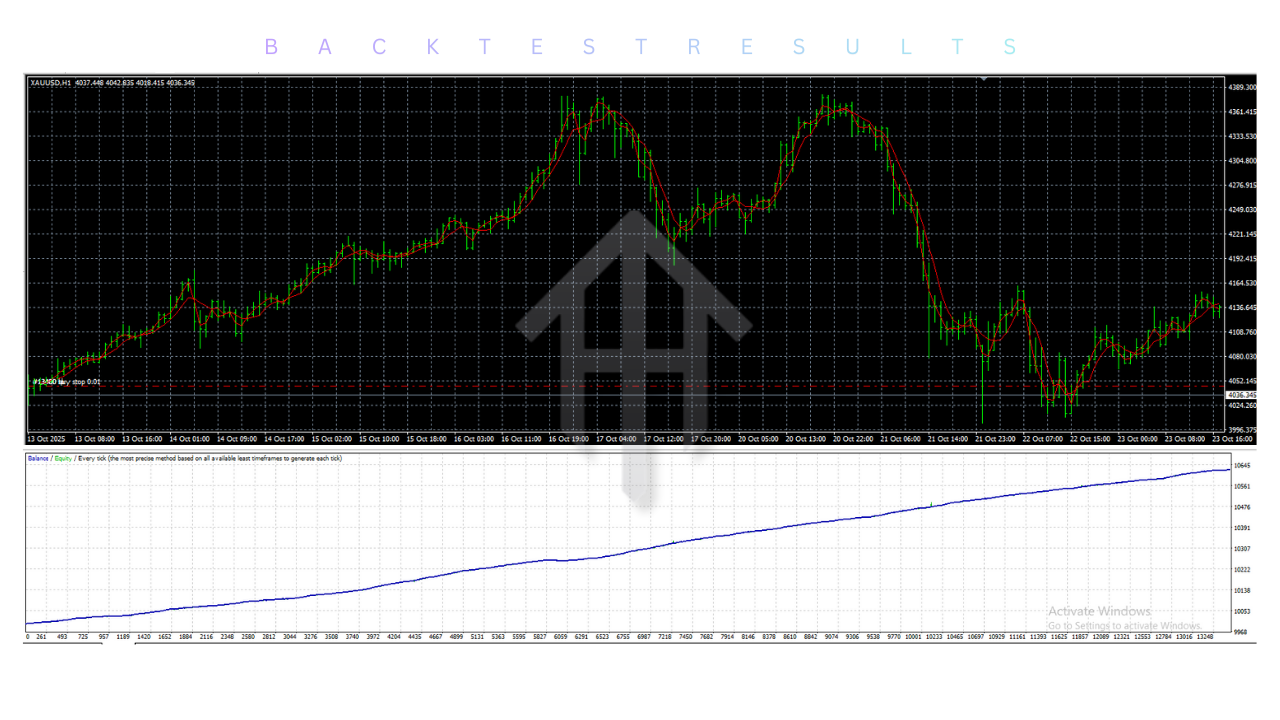

Risk Management and the Drawdown Factor

Trading gold with an automated system requires a deep understanding of risk. The Pocong Gold EA V1.07 utilizes an averaging technique. When a trade does not immediately go into profit, the EA may open additional positions at calculated intervals to shift the break-even point. While this is a highly effective way to close out trades in profit during retracements, it does involve significant drawdown if the market moves in a straight line without any pullbacks.

To mitigate this, V1.07 includes a hard-stop loss feature and a maximum drawdown limit. Traders are encouraged to set a maximum loss percentage that aligns with their personal risk tolerance. For instance, setting a 20 percent max drawdown will prompt the EA to liquidate all positions if the floating loss reaches that threshold, effectively saving the remaining 80 percent of the capital from a total account wipeout.

Operational Requirements for Success

To achieve the results seen in backtests and live monitoring, certain technical conditions must be met:

Low Spread Infrastructure: Gold spreads can vary significantly between brokers. Because Pocong Gold is a scalper, every pip counts. It is essential to use a broker that offers raw spreads or ECN accounts where the gold spread stays below 20 pips.

Virtual Private Server (VPS): Since the EA needs to monitor the market every second and execute trades instantly, running it on a local computer is not advisable. A dedicated Forex VPS ensures that the EA stays online 24/5 with zero interruptions, even if your local internet or power fails.

Capitalization: While the EA can run on smaller accounts, gold’s volatility requires a buffer. A minimum of 500 USD on a standard account is recommended. For those starting with smaller capital, such as 50 USD or 100 USD, a Cent account is the safer option as it provides the EA with more "room to breathe" during market fluctuations.

Installation and Configuration Guide

Installing the Pocong Gold EA V1.07 on your MT4 terminal is a straightforward process. First, you must navigate to the MQL4 folder within your MetaTrader 4 platform and place the EA file in the Experts directory. Once the platform is restarted, the EA will appear in the Navigator window.

When attaching the EA to the XAUUSD chart, ensure that the Auto Trading button at the top of the terminal is highlighted in green. In the EA settings, you will find various parameters such as Start Lot, Multiplier, and Distance. For beginners, it is highly recommended to use the default "Set Files" provided with the EA, as these have been optimized for standard market conditions.

The Importance of Backtesting and Demo Trading

No trader should ever deploy an EA on a live account without prior testing. Before risking real capital with Pocong Gold EA V1.07, use the MT4 Strategy Tester to run simulations over at least the last six months of historical data. This will give you an idea of how the bot handles major news events and volatile swings.

Furthermore, running the EA on a Demo account for at least two weeks is crucial. This allows you to see how your specific broker’s execution and spreads affect the EA’s performance in real-time.

Final Thoughts on Pocong Gold EA V1.07

The Pocong Gold EA V1.07 is a high-performance tool tailored for the modern gold trader. Its ability to capitalize on the fast-paced movements of XAUUSD makes it a compelling choice for those looking to automate their trading income. However, it is not a magic solution. Its success depends heavily on the trader’s ability to manage risk, use proper infrastructure, and remain disciplined during periods of drawdown.

Comments

Leave a Comment