Introduction :

In the history of financial markets, few stories are as compelling as the "Turtle Trader" experiment. In 1983, legendary commodities trader Richard Dennis made a wager with his partner William Eckhardt that trading was a teachable skill, not an innate talent. They recruited a group of novices—bartenders, actors, and security guards—gave them a strict set of rules, and turned them loose on the markets. The result? The group generated over $175 million in profits. The strategy they used was a pure trend-following system based on Donchian channel breakouts and volatility-based risk management.

The PZ Turtle Indicator V2.0 MT5 brings this exact methodology to the modern MetaTrader 5 platform. Developed by PZ Trading, this tool is not just a simple signal generator; it is a complete trading system overlay. It visualizes every aspect of the classic Turtle rules: the 20-day and 55-day breakouts, the N-based stop losses (ATR), and the aggressive pyramiding logic that allows traders to compound winning positions. For the community at FXCracked.org, this indicator offers a professional-grade implementation of a strategy that has stood the test of time, removing the need for manual calculations and allowing you to trade with the mechanical discipline of the original Turtles.

Key features :

1. The Dual-System Engine The original Turtle strategy employed two parallel systems to ensure no major trend was missed. PZ Turtle Indicator V2.0 faithfully replicates this structure:

- System 1 (S1): Based on a shorter-term 20-day breakout. It includes the crucial "Whipsaw Filter," which ignores a new signal if the previous breakout resulted in a win. This prevents over-trading in choppy markets.

- System 2 (S2): Based on a longer-term 55-day breakout. This is the "fail-safe" system designed to catch major multi-month trends that System 1 might have filtered out.

2. ATR Volatility-Based Stops (The "N" Factor) Risk management was the secret sauce of the Turtles. They didn't use fixed pip stops; they used "N," which represents the underlying volatility of the market (Average True Range). This indicator automatically calculates "N" and plots dynamic Stop Loss lines on the chart. If the market is volatile, the stop widens to avoid noise. If the market is quiet, the stop tightens. This "breathing" stop loss is essential for staying in big trends.

3. Pyramiding and Add-Ons The Turtles didn't just enter a trade and wait; they aggressively added to winning positions. This technique, known as Pyramiding, is fully supported by the indicator. As price moves 1N (one unit of volatility) in your favor, the indicator alerts you to add another "unit" to your position. This allows you to maximize profit on strong moves, turning a standard winner into a massive windfall.

4. Strict Exit Visualization Knowing when to fold is as important as knowing when to bet. The PZ Turtle Indicator plots precise exit lines distinct from the stop loss. For System 1, it marks the 10-day opposing extreme (e.g., 10-day low for a long trade). For System 2, it marks the 20-day opposing extreme. Following these visual exits ensures you only close the trade when the trend has structurally reversed, preventing the common mistake of taking profits too early.

5. Multi-Asset Functionality While Richard Dennis traded soybeans and cotton, the logic of breakout trading applies universally. The V2.0 MT5 version is optimized to work across modern asset classes, including Forex pairs, Indices (US30, DAX), and Commodities (Gold, Oil). It adapts the Donchian logic to the tick data of any instrument loaded on your chart.

Recommended settings :

To trade like a true Turtle, you must resist the urge to optimize the settings for short-term gratification. The classic settings are robust for a reason.

Timeframe: Daily (D1): This is non-negotiable for the purist. The strategy relies on "Days" (20-day Highs). Using it on H1 or M15 introduces too much noise and destroys the statistical edge. H4 (4-Hour): Can be used by aggressive traders, but false signals will increase significantly.

Indicator Inputs:

- Donchian Fast Period: 20 (The S1 Trigger).

- Donchian Slow Period: 55 (The S2 Trigger).

- ATR Period: 20 (Used for calculating 'N').

- Stop Loss Multiplier: 2.0 (The classic 2N stop).

- Pyramid Units: 4 (Maximum number of additional trades allowed per trend).

Alert Configuration: Enable "Breakout Alerts" and "Pyramid Alerts." Since this is a Daily strategy, setting up email or mobile push notifications allows you to monitor the markets passively. You only need to check the charts when the specific breakout criteria are met.

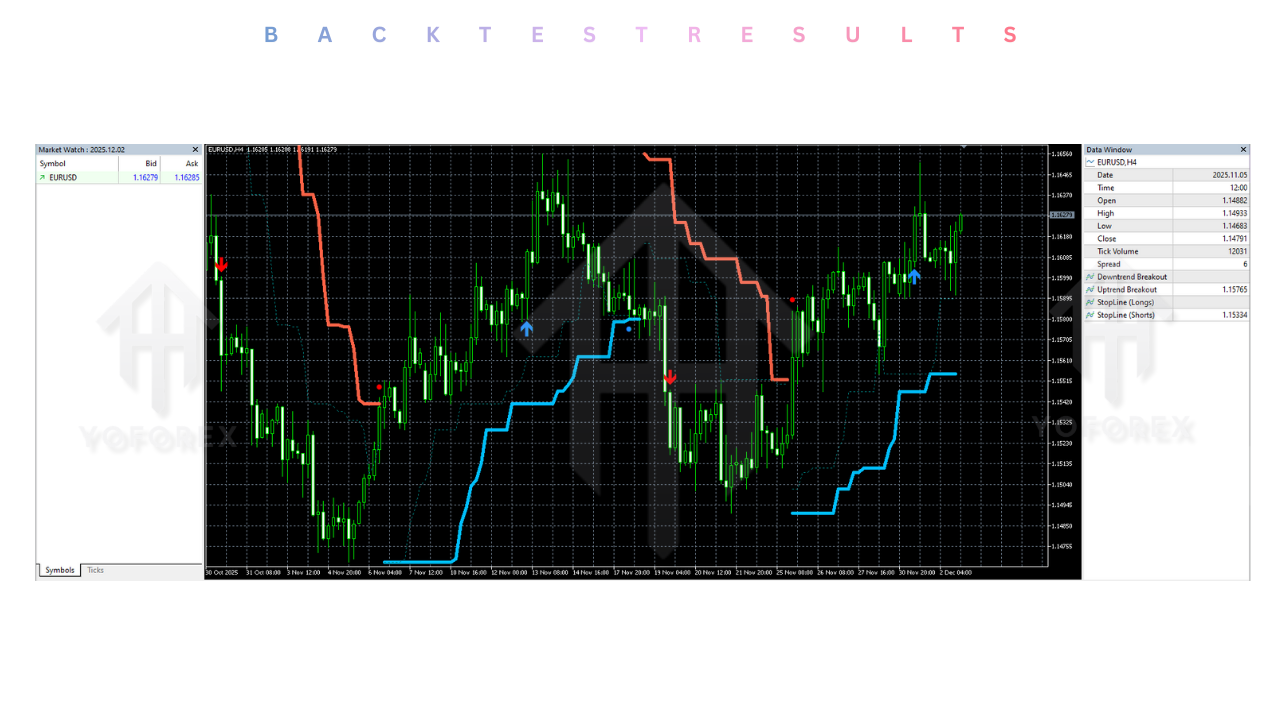

Backtest result :

When analyzing the performance of the PZ Turtle Indicator V2.0 strategy, one must adjust their expectations regarding "Win Rate." This is a classic trend-following system, which has a very specific performance profile.

Win Rate: Expect a win rate between 35% and 45%. Most trades will be small losses or breakeven scratches. This is normal. The strategy relies on the "Fat Tail" distribution, where the few winning trades (the big trends) generate massive profits that cover all the small losses and more.

Market Conditions:

- Trending Markets (Bull/Bear): The strategy performs exceptionally well. During the 2014 Oil crash or the 2022 Inflation trends, the 55-day breakout rule captured nearly the entire move.

- Ranging Markets: Performance suffers here. In a sideways market, price will break the 20-day high and immediately reverse, triggering a loss. This "death by a thousand cuts" is the cost of doing business for a trend follower.

Risk-to-Reward Ratio: The average Reward-to-Risk ratio is typically 4:1 or higher. A single successful campaign on a pair like GBPJPY can yield 1000+ pips, wiping out months of small whipsaw losses.

Installation guide :

Installing the PZ Turtle Indicator V2.0 on MetaTrader 5 is a simple process. Follow these steps to get the system running on your terminal.

- Download: Download the

PZ_Turtle_Indicator_V2.0.ex5file from the FXCracked.org library. - Open Data Folder: Launch your MT5 platform. Go to the top menu, click File, then Open Data Folder.

- Navigate: Double-click the

MQL5folder, then open theIndicatorsfolder. - Install: Copy and paste the

.ex5file into this directory. - Refresh: Close the folder. Return to MT5, right-click the Navigator panel (usually on the left side), and select Refresh.

- Load: Locate "PZ Turtle Indicator" in the list. Drag it onto a Daily chart (e.g., EURUSD D1).

- Configure: In the "Inputs" tab, verify the settings (20/55 periods). In the "Colors" tab, adjust the lines to ensure they are visible against your background.

- Activate: Click OK. The Donchian channels, entry arrows, and stop-loss lines should appear immediately.

Advantage :

1. Mechanical Discipline: The biggest advantage is the removal of emotion. The indicator tells you exactly where to enter, where to put your stop, and where to exit. There is no guessing. This prevents the "fear of missing out" (FOMO) and the fear of pulling the trigger.

2. Catching Every Major Trend: If you follow the signals, it is mathematically impossible to miss a major market move. If Gold goes to $3000, the 55-day breakout will ensure you are in the trade long before the peak.

3. Dynamic Risk Management: The ATR-based stop loss is superior to fixed pips. It adjusts to the market's personality. If volatility spikes, your stop widens to keep you safe. If the market calms down, your stop tightens to protect profit.

4. Visual Clarity: Unlike complex "black box" indicators, the PZ Turtle Indicator displays its logic clearly on the chart. You can see the channels and understand why a signal is being generated.

Disadvantage :

1. The "Whipsaw" Grind: In a non-trending, choppy market, the system will generate false breakouts. You might buy a 20-day high only to see the price collapse the next day. Enduring weeks or months of small losses requires immense psychological strength.

2. Drawdown Duration: Trend followers can experience long periods of stagnation (flat equity) while waiting for a trend to develop. It is not a system for those who need "daily income."

3. Late Entries/Exits: By design, breakout strategies enter late (after the move starts) and exit late (after the trend bends). You will never catch the exact bottom or top.

Conclusion :

The PZ Turtle Indicator V2.0 MT5 is a time-tested, professional tool for the serious trader. It is not a magic wand that prints money every day, but rather a robust framework for wealth accumulation over the long term. It forces the trader to adopt the mindset of a fund manager: cut losses short, let profits run, and manage risk based on volatility.

For the community at FXCracked.org, this indicator is an invaluable resource for learning structured trading. Whether you use it as a standalone system or as a trend filter for your own strategies, it provides a disciplined, objective view of market structure. If you have the patience to trade the Daily charts and the stomach to endure the chop, the PZ Turtle Indicator can help you catch the "monster trends" that define a successful trading career.

Support & Disclaimer :

Support

If you need help installing or configuring your EA, or face any kind of bug, feel free to reach out on:

WhatsApp: https://wa.me/+443300272265

Telegram Group: https://t.me/yoforexrobot

Disclaimer: Forex and gold trading involve risk. Past performance doesn’t guarantee future results. Always test robots on demo before live trading and use proper risk management.

Referral

Join the VIP Signals Telegram Channel for real-time expert trading signals and stay ahead in the forex market. Get personalized strategies by becoming a part of our Real Account Management Telegram Channel and optimize your trading experience. If you're aiming to Pass PropFirm Challenges , join our dedicated channel for tips and proven methods. Start managing your capital effectively with expert advice from our Funded Account Management Telegram Channel. For advanced traders, our HFT EA / Passing Telegram Channel offers high-frequency trading insights and strategies to boost your performance.

Comments

Leave a Comment