Content The world of automated Forex trading is constantly evolving, with new Expert Advisors appearing on the market daily. Among the recent trends in the Southeast Asian trading community is the emergence of high-frequency bots with aggressive names, such as the Scatter Petir EA V1.0 for MetaTrader 4. This software has generated significant interest in private trading groups and forums due to its promise of rapid account growth and high-volatility trading performance.

In this comprehensive guide for FxCracked.org, we will examine what the Scatter Petir EA V1.0 is, how its trading logic typically functions, the risks associated with this specific style of algorithmic trading, and how to install and test it properly on your MetaTrader 4 terminal. Whether you are a seasoned algorithmic trader or a beginner looking for new tools, understanding the mechanics behind this bot is essential before you attach it to a live chart.

Understanding the Scatter Petir Strategy

The name Scatter Petir is unique and gives us insight into the strategy behind the software. In many trading communities, the term Petir translates to Lightning, suggesting a strategy that relies on speed, quick execution, and potentially high-impact market entries. While the exact source code of every variation differs, Expert Advisors with this naming convention generally fall into the category of High-Frequency Scalpers or Grid systems.

These strategies are designed to take advantage of small price movements. Instead of holding a position for days or weeks, the Scatter Petir EA likely aims to enter and exit the market within minutes or even seconds. The goal is to accumulate small profits repeatedly throughout the trading session. When the market is volatile, the bot scatters orders across the chart, creating a net of positions that aim to capture profit regardless of short-term direction, provided the price eventually retraces.

The Mechanics of Volatility Trading

The core philosophy of an EA like Scatter Petir is volatility. Most standard trading robots struggle when the market moves too fast, often suffering from slippage or requotes. However, lightning-style bots are often coded to thrive in these conditions. They typically utilize a dynamic distance setting for their trade entries.

For example, if the market spikes due to a sudden influx of volume, the EA might trigger a series of pending orders. If the strategy relies on a Grid system, it will place buy or sell orders at fixed intervals. If the price moves against the initial trade, the bot adds more positions, often with a slightly increased lot size (a method known as Martingale) to lower the average entry price. This allows the entire basket of trades to close in profit with only a minor reversal in price.

This approach is highly attractive to traders with smaller accounts because it can generate a smooth equity curve during ranging markets. However, it requires a deep understanding of risk management, as trending markets without retracements can pose a threat to the account balance.

Best Pairs and Timeframes

Based on the architecture of similar tools in the market, the Scatter Petir EA V1.0 is likely optimized for assets with high liquidity and sufficient volatility. The most common pair for this type of strategy is XAUUSD (Gold). Gold is a favorite among high-frequency bot developers because it respects technical levels and moves significantly enough each day to hit multiple profit targets.

Currency pairs like GBPUSD and EURUSD are also common candidates. These pairs have low spreads during the London and New York sessions, which is critical for scalping strategies. If the spread is too high, the cost of trading eats into the small profits generated by the bot.

Regarding timeframes, this EA is generally designed for the M1 (1-minute) or M5 (5-minute) charts. The lower timeframes allow the algorithm to react instantly to price tick data. Running this EA on an H1 or H4 chart would likely render its logic ineffective, as the signals are based on immediate market noise rather than long-term trend analysis.

Risk Management and Account Safety

Using a tool like Scatter Petir EA requires a strict approach to risk management. Because these bots can be aggressive, they are not fire-and-forget solutions. Traders must monitor them or use specific settings to protect their capital.

The first line of defense is the Lot Size. It is highly recommended to start with the minimum lot size allowed by your broker, usually 0.01. If you are using a standard account with a deposit under one thousand dollars, this might still be too risky. In such cases, a Cent Account is the ideal solution. A Cent Account displays your balance in cents (e.g., $100 becomes 10,000 cents), allowing the EA to execute its strategy with a much larger safety margin relative to the balance.

The second safety measure is an Equity Protector. Many advanced versions of these EAs come with a built-in function that closes all trades if the floating loss reaches a certain percentage of the account. If the version you download does not have this, you can find separate utility EAs that perform this function. Setting a hard stop at 20 percent or 30 percent drawdown ensures that a bad market day does not result in a total loss of funds.

Installation Guide for MetaTrader 4

Installing the Scatter Petir EA V1.0 is a straightforward process for anyone familiar with the MT4 platform. Follow these steps to ensure the bot is correctly loaded:

First, locate the downloaded file. It should have an .ex4 or .mq4 extension. Copy this file.

Open your MetaTrader 4 platform. Go to the File menu in the top left corner and select Open Data Folder.

In the window that opens, navigate to the MQL4 folder and then open the Experts folder. Paste the copied file here.

If the EA comes with any preset files (ending in .set) or custom indicators, place them in the Presets or Indicators folders respectively within the MQL4 directory.

Close and restart your MT4 platform. Alternatively, you can right-click on the Navigator panel and select Refresh. The Scatter Petir EA should now appear in your list of Expert Advisors.

Drag the EA onto the chart of your chosen currency pair. A settings window will pop up. Ensure that under the Common tab, the box labeled Allow Live Trading is checked. Also, make sure the AutoTrading button on the top toolbar of MT4 is green.

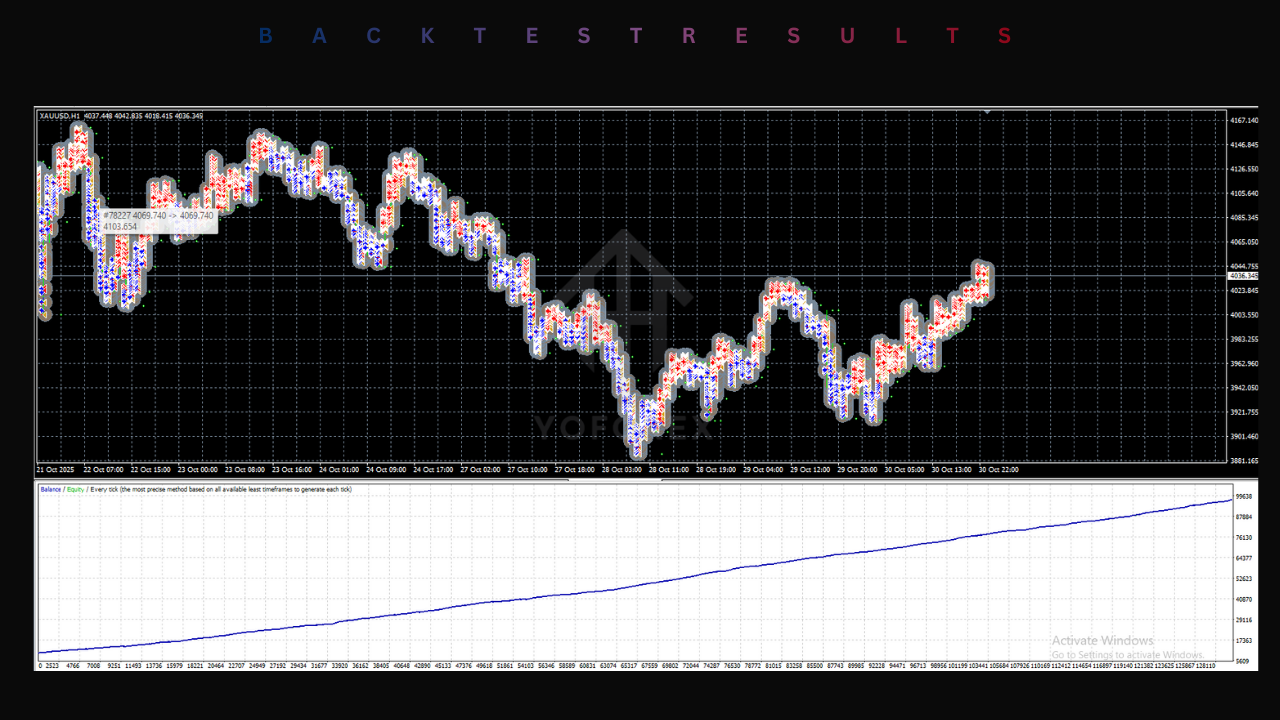

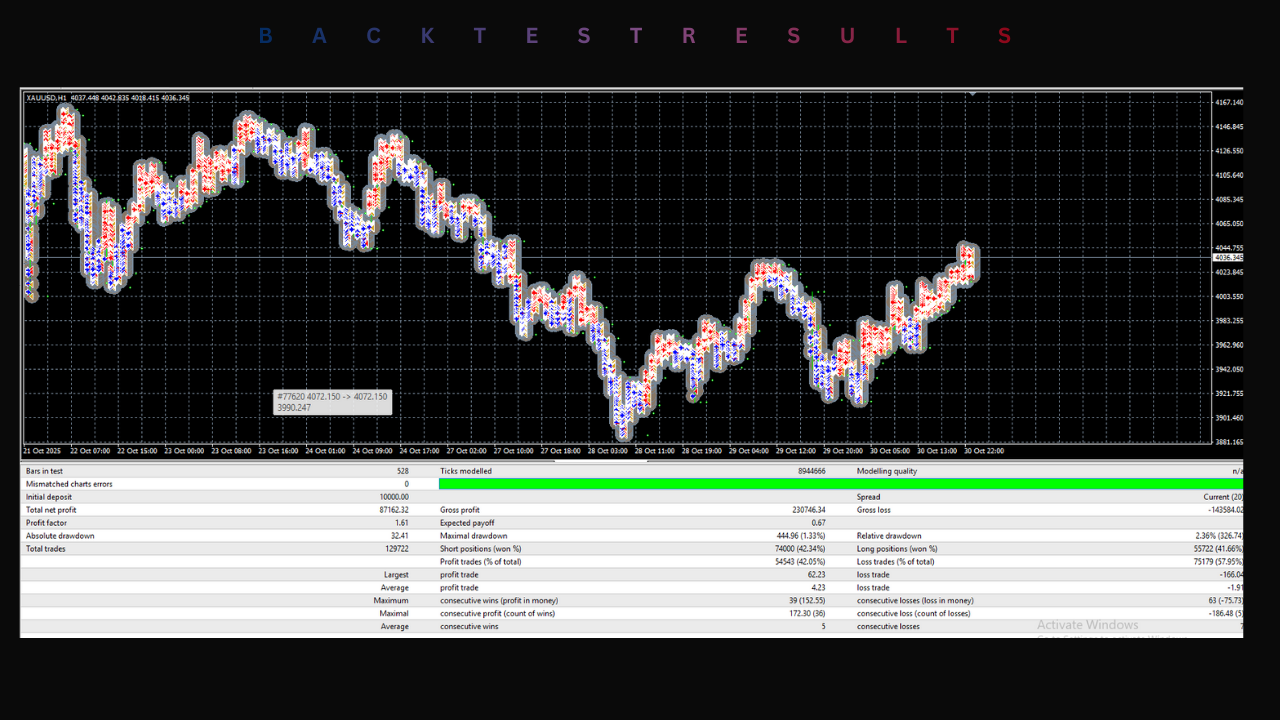

Backtesting and Optimization

Before running this EA on a live account, backtesting is mandatory. Use the Strategy Tester in MT4 (Ctrl+R) to simulate the bot's performance over historical data.

When backtesting, pay close attention to the Drawdown metric. A high total profit is meaningless if the relative drawdown exceeds 50 percent, as this indicates a high probability of blowing the account in live conditions.

It is also important to test the EA during different market conditions. Test it during periods of high news impact (like Non-Farm Payrolls) and during quiet summer months. This will give you a realistic expectation of how the Scatter Petir EA handles different volatility environments. If the backtest fails during news events, you know that you must disable the bot during major economic releases.

The Importance of a VPS

For high-frequency EAs like Scatter Petir, your internet connection is a vital component of the system. If your home internet disconnects while the bot has open trades, it cannot manage them or close them at the profit target. This can lead to unexpected losses.

Using a Virtual Private Server (VPS) is the industry standard for algorithmic trading. A VPS is a remote computer that runs 24/7 with a stable connection to the broker's server. By installing your MT4 and the EA on a VPS, you ensure that the robot can trade without interruption, regardless of your local computer's status or power outages.

Conclusion

The Scatter Petir EA V1.0 MT4 represents a specific class of trading tools designed for traders who seek action and volatility. Its aggressive nature can be a powerful asset when managed correctly, but it carries inherent risks that must be respected. By understanding the mechanics of grid and scalping strategies, using proper risk management like Cent Accounts, and ensuring a stable trading environment with a VPS, you can maximize the potential of this software.

Always remember that past performance in backtests is not indicative of future results. Forex trading involves significant risk, and tools found on the internet should always be verified on a demo account before real capital is committed. We hope this guide helps you navigate the features and installation of the Scatter Petir EA.

For more information, support, or to join our community of traders discussing this and other tools, feel free to reach out to us via our official channels below.

WhatsApp: https://wa.me/+443300272265

Telegram Group: https://t.me/yoforexrobot

Comments

Leave a Comment