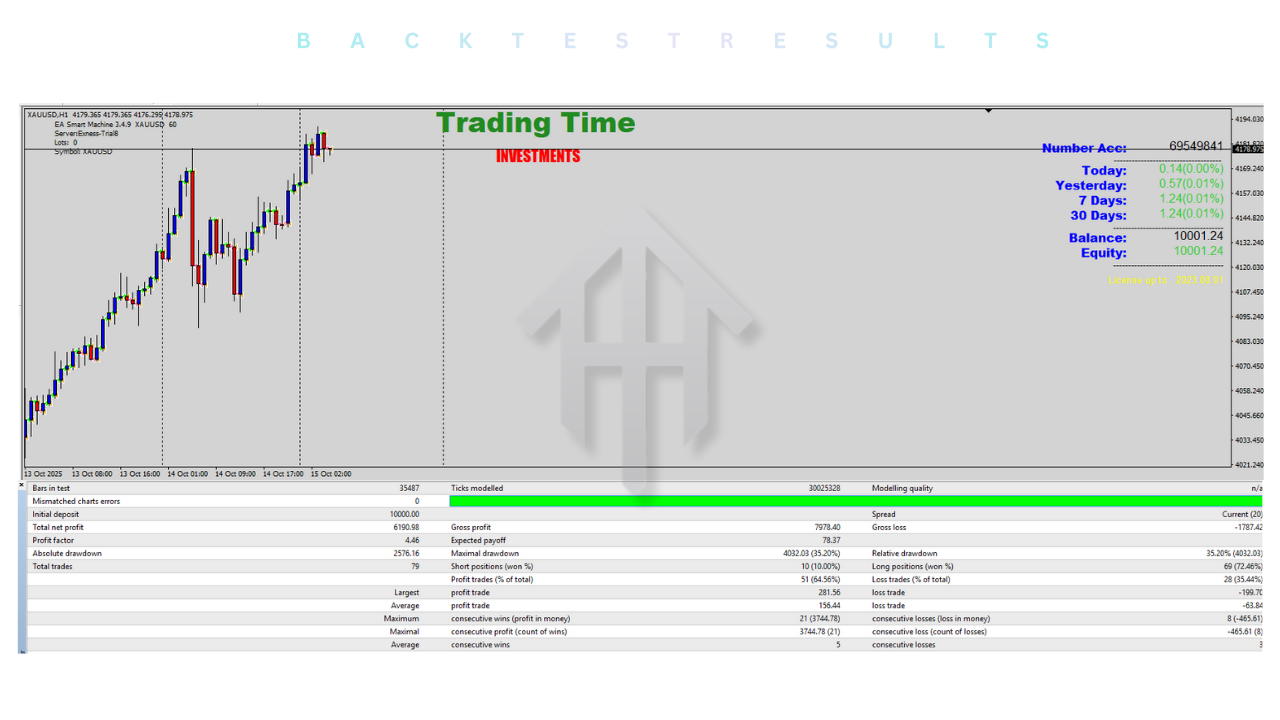

The evolution of algorithmic trading has reached a pivotal point in 2025 where retail traders now have access to institutional grade tools. Among these, the Smart Machine EA V3.4.9 for MetaTrader 4 has stood out as a robust solution for those seeking to automate their market participation. This expert advisor represents a significant leap from its predecessors, offering a refined approach to grid trading that incorporates modern volatility filters and smart entry logic.

To understand why the Smart Machine EA V3.4.9 is gaining traction, one must look under the hood at its architectural design. Unlike basic grid bots that simply layer orders at fixed intervals, this version utilizes a proprietary wave detection algorithm. It analyzes price exhaustion and momentum before placing the first trade of a cycle. This ensures that the robot is not simply catching a falling knife but is entering during a potential pivot point.

The Logic Behind the Smart Machine Algorithm

The primary philosophy of the Smart Machine EA V3.4.9 is based on the mathematical certainty that the market moves in waves. For every strong trend, there is eventually a retracement or a consolidation phase. The EA is designed to capitalize on these inevitable pullbacks. By using a multi-indicator approach involving the Relative Strength Index and volume analysis, the software identifies when a currency pair has moved too far from its mean value.

When the EA identifies an entry, it opens a position. If the market continues to move against the initial trade, the Smart Machine EA initiates its grid management protocol. However, the V3.4.9 update introduced a critical safety mechanism: time-based filtering. The robot evaluates how long the price has been trending without a correction before adding a second or third layer to the grid. This prevents the account from becoming over-leveraged during the early stages of a strong news-driven trend.

Technical Architecture and Core Indicators

The technical setup typically involves several key indicators that work in synchronization to provide a holistic view of the market. The RSI is used to identify overbought and oversold conditions across multiple timeframes, ensuring that the EA does not buy at the very top of a peak or sell at the bottom of a trough. Additionally, the Average True Range is utilized to calculate the dynamic distance for the grid levels based on current market breath. This ensures that in a volatile market, the grid expands to give the trade more room to breathe, while in a quiet market, the grid tightens to hit take-profit targets faster.

The Moving Average Convergence Divergence also serves as a secondary trend filter. This ensures that the grid is not being built against a massive structural shift in the market. By combining these three distinct types of indicators—oscillators, volatility measures, and trend followers—the Smart Machine EA V3.4.9 achieves a balanced perspective that many simpler robots lack.

Optimization for 2025 Market Conditions

The financial markets in 2025 have shown increased intraday volatility compared to previous years. The Smart Machine EA V3.4.9 has been patched specifically to handle these flash movements. One of the most critical features for traders using this version is the News Filter integration. By connecting to a live economic calendar, the EA can automatically pause trading before high-impact events such as central bank interest rate decisions or employment data releases.

For those looking to maximize performance, the choice of currency pairs is paramount. While many traders gravitate toward the EURUSD due to low spreads, the Smart Machine EA often performs exceptionally well on mean-reverting cross pairs. AUDCAD, NZDCAD, and EURGBP are frequently cited as the most stable pairs for this specific algorithm. These pairs tend to oscillate within ranges more frequently than the major USD pairs, which is the ideal environment for a grid-based system.

Risk Management and Capital Preservation

No discussion of an automated trading robot is complete without a deep dive into risk. The Smart Machine EA V3.4.9 is a high-yield tool, which inherently carries risk. To mitigate this, the software includes an Equity Protection feature. Traders can set a hard percentage limit on drawdown. If the account equity drops below this threshold, the EA will instantly close all open positions, preventing a total account wipeout.

Furthermore, the lot sizing module allows for two distinct approaches. Fixed Lot Sizing is best for those who want absolute control over their risk per trade, ensuring that no matter the account size, the volume remains constant. On the other hand, Percentage Based Sizing is best for compounding growth, where the EA automatically increases lot sizes as the account balance grows. For a version 3.4.9 user, starting with a 0.01 lot per 1000 units of currency is generally considered the safest baseline.

The Importance of VPS and Low Latency

Implementing the Smart Machine EA V3.4.9 on your MT4 terminal requires a few specific steps to ensure stability. Using a Virtual Private Server is highly recommended. A VPS ensures that the robot stays online even if your local computer loses power or internet connectivity. Since a grid bot must manage open baskets of trades twenty-four hours a day, even a few minutes of downtime during a market surge can be detrimental to the calculation of the next grid level.

Low latency is another factor that can significantly impact the profitability of this EA. Because the robot often aims for small profit targets across a large basket of trades, slippage can eat into the margins. Choosing a broker with ECN execution and keeping the EA on a server located close to the broker's data center will ensure that orders are executed at the exact price required by the algorithm.

Final Verdict on the Smart Machine Series

The Smart Machine EA V3.4.9 for MT4 is a sophisticated piece of trading technology that, when used with the right settings and risk parameters, can be a powerful asset. It bridges the gap between simple automation and complex algorithmic execution. However, success with this EA requires a disciplined approach. Traders must be willing to monitor the news, withdraw profits regularly to reduce exposure, and resist the urge to use excessively high multipliers in the grid settings.

By treating the EA as a professional tool rather than a get-rich-quick scheme, users can leverage the mathematical advantages of grid trading while keeping the risks of the forex market at a manageable level. The V3.4.9 update remains one of the most stable versions for the MT4 platform today.

Comments

Leave a Comment