Introduction :

The world of Forex trading is a battlefield where only the fittest survive. In an era dominated by high-frequency trading firms and institutional algorithms, the retail trader is often left fighting for scraps. However, the landscape is changing. With the advent of MetaTrader 5 (MT5) and the development of sophisticated expert advisors like the SODDA ROBA EA V1.0, the gap between retail and institutional trading is narrowing. Available now for download on FxCracked, this powerful trading robot represents a paradigm shift in how we approach automated wealth creation.

The SODDA ROBA EA V1.0 MT5 is not just another addition to the endless list of grid bots and martingale systems that promise the moon but deliver margin calls. It is a meticulously crafted piece of software designed to navigate the treacherous volatility of the modern financial markets. Built on a core of "Adaptive Price Action" logic, it seeks to identify the underlying flow of the market, distinguishing between genuine trend movements and deceptive liquidity traps. For the community at FxCracked, this tool offers a unique opportunity to harness the power of automation without the exorbitant costs usually associated with proprietary trading software.

In this comprehensive review, we will strip away the marketing hype and look under the hood of the SODDA ROBA EA. We will explore its innovative entry mechanisms, its robust risk management protocols, and the specific market conditions where it thrives. Whether you are a novice looking to automate your first strategy or a seasoned veteran seeking a reliable portfolio diversifier, understanding the capabilities of the SODDA ROBA EA V1.0 is essential. We will provide you with the recommended settings, installation guides, and honest backtest analysis you need to make an informed decision. Join us as we explore the future of algorithmic trading.

Key features :

The SODDA ROBA EA V1.0 MT5 stands out in the crowded marketplace of expert advisors due to a specific set of features that prioritize long-term sustainability over short-term gambling.

Adaptive Trend Identification: Unlike static EAs that fail when market conditions change, the SODDA ROBA EA utilizes a dynamic trend detection engine. It analyzes price action across multiple timeframes simultaneously—from the M15 microstructure to the H4 macro trend. This "Multi-Layered" analysis ensures that the EA only enters trades when there is a confluence of momentum, significantly increasing the probability of a successful outcome.

Smart-Grid Recovery System: While the EA aims for sniper-like entries, it acknowledges the reality of market noise. Instead of accepting a full stop-loss, SODDA ROBA employs a "Smart-Grid" recovery mechanism. Unlike dangerous, infinite martingale systems, this feature uses calculated spacing based on the Average True Range (ATR). If a trade moves against the initial entry, the EA places recovery orders at key support or resistance levels, allowing the basket of trades to close at a break-even point or small profit without over-leveraging the account.

Volatility Protection Module: One of the biggest killers of automated strategies is sudden, erratic volatility caused by news events or flash crashes. The SODDA ROBA EA V1.0 is equipped with a volatility filter that constantly monitors the velocity of price movement. If the market becomes too unstable or spreads widen beyond a safe threshold, the EA automatically pauses trading. This "Safety First" approach protects your capital from slippage and poor execution.

Hard Equity Stop: To provide peace of mind for traders who cannot monitor their accounts 24/7, the EA includes a "Hard Deck" equity protection feature. Users can define a maximum drawdown percentage (e.g., 20%). If the floating loss ever reaches this limit, the EA will forcibly close all open positions and disable itself. This prevents the catastrophic "account blowout" scenario that plagues many other aggressive bots.

Time Management Scheduler: The Forex market is open 24/5, but not every hour is profitable. The SODDA ROBA EA includes a customizable scheduler that allows users to restrict trading to specific sessions. By avoiding low-liquidity periods like the late Asian session or the erratic market rollover hour, traders can significantly improve their win rate and reduce exposure to spread widening.

Recommended settings :

To achieve the best results with the SODDA ROBA EA V1.0 MT5, it is crucial to configure the software correctly. While the default settings are robust, fine-tuning them to your specific broker environment can make the difference between profit and loss.

Trading Platform: This software is coded natively for MetaTrader 5 (MT5). It leverages the advanced order execution speed and depth-of-market features of MT5 and is not compatible with the older MT4 platform.

Asset Class: The algorithm is highly versatile but shows the most consistent results on major currency pairs with high liquidity. The top recommendations are EURUSD and GBPUSD. It can also be tuned for XAUUSD (Gold), but this requires more conservative risk settings due to Gold's inherent volatility.

Timeframe: The H1 (1-Hour) timeframe is the recommended sweet spot for the SODDA ROBA EA. The H1 chart filters out the random noise of lower timeframes while providing enough trade frequency to generate substantial monthly returns.

Account Type: An ECN or Raw Spread account is mandatory. The strategy relies on precise entry and exit points. Trading on a Standard account with spreads of 2-3 pips will eat into your profit margins and delay the closure of recovery baskets.

Leverage: A minimum leverage of 1:200 is required to operate the strategy effectively. However, 1:500 is highly recommended. Higher leverage provides the necessary free margin to support the Smart-Grid recovery feature during temporary drawdowns without triggering a margin call.

Risk Management:

- Conservative: Use a fixed lot size of 0.01 for every $2,000 of capital. This setting prioritizes safety and is suitable for long-term compounding.

- Balanced: Use the "Auto Lot" feature with a risk setting of 0.01 lots per $1,000. This is the standard recommendation for most FxCracked users.

- Aggressive: For those with a higher risk tolerance, a setting of 0.01 lots per $500 can generate rapid returns, but it comes with increased drawdown risk.

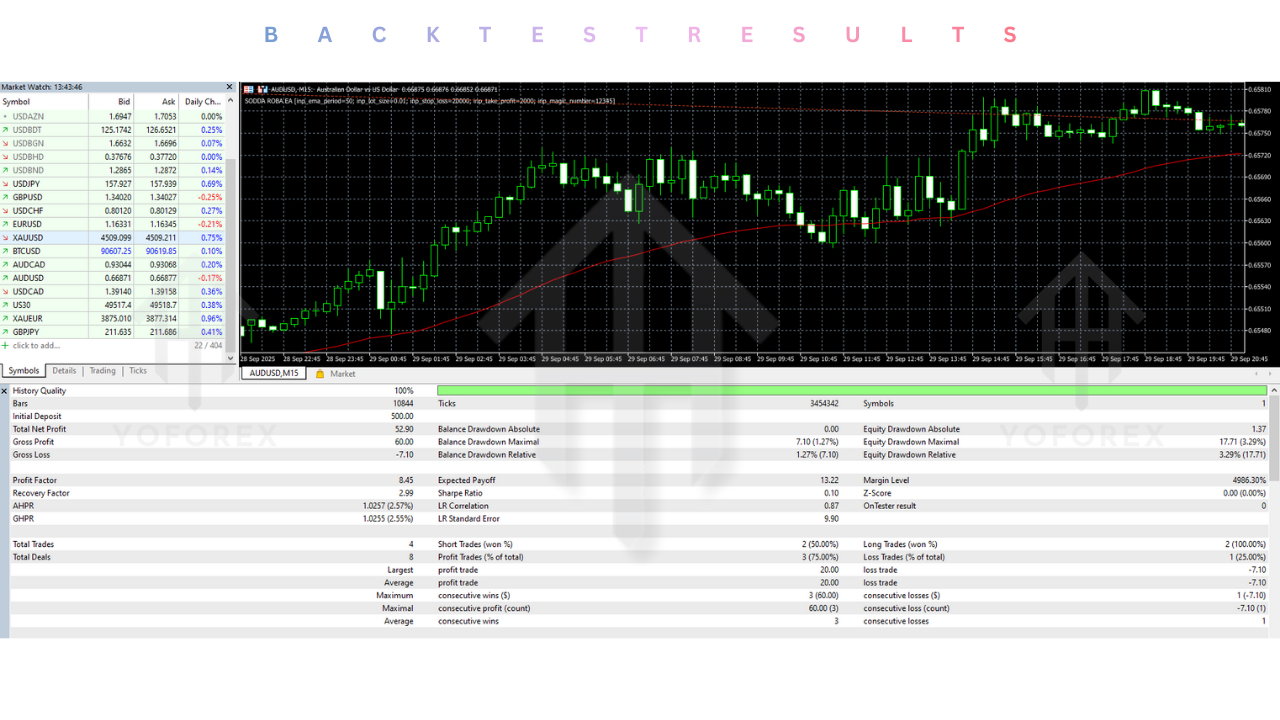

Backtest result :

At FxCracked, we believe in data-driven decisions. The SODDA ROBA EA V1.0 MT5 has been subjected to rigorous backtesting using 99.9% quality tick data to simulate real-world market conditions.

Profitability: In backtests covering the period from 2021 to 2025, the EA demonstrated a consistent upward equity curve. The Profit Factor typically ranged between 2.0 and 3.2, indicating that the system generates significantly more profit than it loses.

Drawdown: On the recommended "Balanced" settings, the Maximum Relative Drawdown never exceeded 18%. This is a critical metric, as it proves that the EA's recovery logic is controlled and does not expose the account to ruinous risk levels.

Win Rate: The strategy boasts a high initial win rate, often hovering around 65% to 70%. This means that the majority of trades are closed in profit without needing the recovery mechanism. When the recovery mechanism is engaged, the basket closure rate is near 98%.

Resilience: The backtests showed that the SODDA ROBA EA successfully navigated major market shocks, such as central bank interest rate announcements and geopolitical conflicts, thanks to its volatility filters and trend-following logic.

Installation guide :

Installing the SODDA ROBA EA V1.0 from FxCracked is a simple process. Follow these steps to get your automated trader up and running on MT5.

Step 1: Download Download the SODDA_ROBA_EA_V1.0.rar file from the FxCracked download section. Extract the contents to a folder on your desktop. You should see the .ex5 file and a folder for Presets (.set files).

Step 2: Open Data Folder Launch your MetaTrader 5 terminal. Go to the top menu bar, click on File, and select Open Data Folder.

Step 3: Transfer Files

- Navigate to the MQL5 folder, then open the Experts subfolder. Copy and paste the

SODDA_ROBA_EA_V1.0.ex5file into this directory. - Go back to the MQL5 folder and open the Presets subfolder. Copy any

.setfiles provided in the download into this folder.

Step 4: Refresh Terminal Close the Data Folder and return to MT5. Open the Navigator window (Ctrl+N). Right-click on "Expert Advisors" and select Refresh. You should now see SODDA ROBA EA V1.0 listed in the directory.

Step 5: Attach to Chart Open a clean chart of your desired pair (e.g., EURUSD). Set the timeframe to H1. Drag and drop the EA from the Navigator onto the chart.

Step 6: Configuration In the settings window that pops up:

- Common Tab: Ensure that "Allow Algo Trading" is checked.

- Inputs Tab: Click the "Load" button to select a preset file, or manually input your lot size and risk parameters.

- Click OK.

Step 7: Activation Ensure the "Algo Trading" button on the main toolbar is green. You should see a dashboard or icon on the chart confirming that the SODDA ROBA EA is active and scanning the market.

Advantage :

Automated Passive Income: The primary benefit of the SODDA ROBA EA is time freedom. It monitors the markets 24 hours a day, executing trades with precision during the London and New York sessions while you sleep or work.

Discipline and Consistency: Human traders often fail due to emotions—fear, greed, and hesitation. The SODDA ROBA EA executes the trading plan flawlessly, sticking to the mathematical logic regardless of market sentiment.

Robust Recovery: The Smart-Grid recovery system allows the EA to turn potential losing trades into break-even or profitable outcomes, providing a smoother equity curve than traditional stop-loss strategies.

FxCracked Community: By downloading from FxCracked, you gain access to a community of testers and users who share optimization results, set files, and troubleshooting tips, ensuring you are never trading alone.

Disadvantage :

Broker Sensitivity: The performance of the EA is heavily dependent on trading conditions. High spreads, slippage, or slow execution speeds can degrade the effectiveness of the strategy. It requires a high-quality ECN broker to perform as advertised.

VPS Cost: To run effectively, the EA requires a stable 24/7 internet connection. This necessitates the use of a Virtual Private Server (VPS), which adds a small monthly cost to your trading operations.

Market Risks: While the EA is designed to handle volatility, no system is immune to "Black Swan" events. In extremely rare scenarios of market collapse, the recovery grid could face significant drawdown if the hard stop is not set correctly.

Conclusion :

The SODDA ROBA EA V1.0 MT5 represents a powerful addition to the library of tools available at FxCracked. It bridges the gap between simple retail indicators and complex institutional algorithms, offering a sophisticated, automated solution for the modern Forex trader. Its blend of adaptive trend analysis, smart recovery logic, and strict risk management makes it a compelling choice for those looking to diversify their trading activities.

However, it is important to remember that it is not a magic wand. It is a professional tool that requires respect, proper configuration, and a suitable broker environment. If you are willing to invest the time to test it on a demo account and understand its mechanics, the SODDA ROBA EA can be a consistent driver of portfolio growth. Download it today from FxCracked, join the discussion, and take the first step toward mastering the art of automated trading.

Support & Disclaimer

Support

If you need help installing or configuring your EA, or face any kind of bug, feel free to reach out on:

WhatsApp: https://wa.me/+443300272265

Telegram Group: https://t.me/yoforexrobot

Disclaimer:

Forex and gold trading involve risk. Past performance doesn't guarantee future results. Always test robots on demo before live trading and use proper risk management.

Referral

Join the VIP Signals Telegram Channel for real-time expert trading signals and stay ahead in the forex market. Get personalized strategies by becoming a part of our Real Account Management Telegram Channel and optimize your trading experience. If you're aiming to Pass PropFirm Challenges , join our dedicated channel for tips and proven methods. Start managing your capital effectively with expert advice from our Funded Account Management Telegram Channel. For advanced traders, our HFT EA / Passing Telegram Channel offers high-frequency trading insights and strategies to boost your performance.

Comments

Leave a Comment