Vega Bot EA V1.4 MT5 is an upgraded automated trading solution designed for traders who want precision, discipline, and consistency in the financial markets without relying on emotional decision-making. Built specifically for the MetaTrader 5 platform, this Expert Advisor focuses on structured trade execution, adaptive risk control, and rule-based market analysis.

Unlike many retail trading robots that rely on aggressive recovery techniques, Vega Bot EA V1.4 emphasizes stability and controlled exposure. The latest version introduces refined internal logic, better adaptability to changing market conditions, and improved trade management suitable for both personal trading accounts and structured trading environments.

This guide offers a complete, unbiased overview of Vega Bot EA V1.4 MT5, explaining how it works, who it is designed for, recommended usage, and what traders should realistically expect.

Introduction to Vega Bot EA V1.4 MT5

Automated trading has become an essential tool for modern traders, especially those who cannot monitor charts continuously. Vega Bot EA V1.4 MT5 aims to fill this gap by providing a structured, algorithm-based trading approach that executes trades based on predefined market conditions rather than speculation.

The EA is developed exclusively for MetaTrader 5 and is built around a modular logic system that evaluates market strength, volatility, and directional bias before entering trades. Its core philosophy is not to trade frequently, but to trade selectively when market conditions align with its internal criteria.

Core Trading Philosophy

Vega Bot EA V1.4 MT5 is built around three key principles:

- Trade only when conditions meet predefined rules

- Protect capital through controlled risk parameters

- Adapt execution behavior based on market volatility

Instead of chasing every market movement, the EA waits for structured confirmations derived from price action behavior, volatility expansion, and directional momentum. This makes it more suitable for traders who prioritize risk control over aggressive growth.

How Vega Bot EA V1.4 MT5 Works

The EA operates through a rule-based analytical engine that continuously scans the market. It does not rely on random entries or manual indicators alone. Instead, it evaluates multiple internal conditions before placing trades.

Key operational steps include:

- Market condition evaluation using volatility and momentum filters

- Directional bias confirmation before trade placement

- Entry execution using either market or pending orders

- Automatic stop loss and take profit placement

- Dynamic trade management once the position is active

The EA is designed to function autonomously once installed and configured, reducing the need for constant user intervention.

Supported Instruments and Timeframes

Vega Bot EA V1.4 MT5 is optimized primarily for:

- Gold (XAUUSD)

- Major forex pairs

- Selected indices and instruments depending on broker conditions

The most recommended timeframe is M15, as it provides a balance between signal quality and execution frequency. However, traders may experiment with other timeframes during testing phases to evaluate performance behavior.

Risk Management Approach

One of the strongest aspects of Vega Bot EA V1.4 MT5 is its focus on risk discipline. The EA is designed to always operate with predefined risk boundaries, ensuring that no trade is left unmanaged.

Key risk control characteristics include:

- Mandatory stop loss usage on trades

- Configurable risk per trade based on account balance

- Protection against excessive exposure

- No grid-based position stacking

- No martingale lot multiplication

This makes the EA more suitable for traders who prefer long-term sustainability rather than short-term equity spikes.

Trade Management and Exit Logic

Once a trade is placed, Vega Bot EA V1.4 MT5 actively manages the position. The EA does not rely solely on fixed take profit targets but can adapt exits based on market behavior.

Trade management features include:

- Dynamic trailing stop adjustments

- Volatility-aware exit logic

- Optional break-even management

- Controlled partial exit logic depending on configuration

This active management approach helps protect open profits while allowing room for trades to develop naturally.

Customization and Settings Flexibility

Vega Bot EA V1.4 MT5 offers extensive input parameters, allowing traders to customize behavior based on their trading style and risk tolerance.

Common adjustable settings include:

- Risk percentage per trade

- Stop loss and take profit multipliers

- Trade session filters

- Volatility thresholds

- Execution timing controls

While default settings are designed to work effectively, traders are encouraged to understand each parameter before making adjustments.

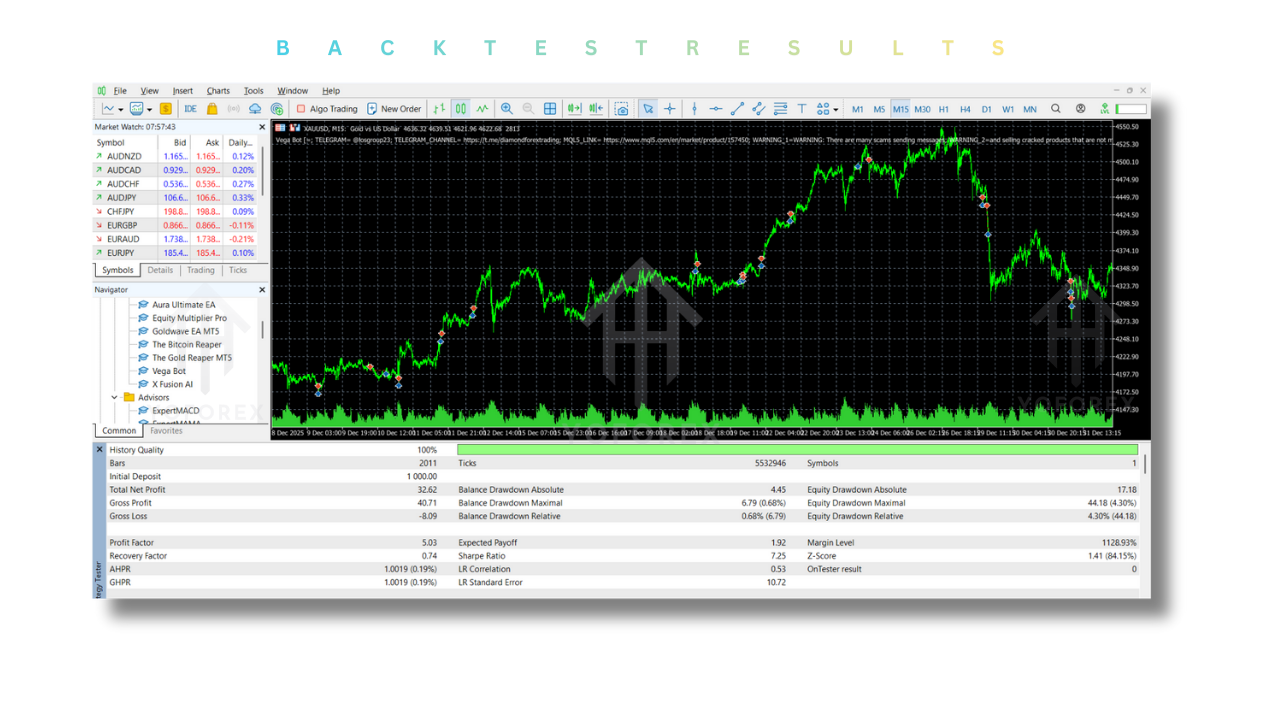

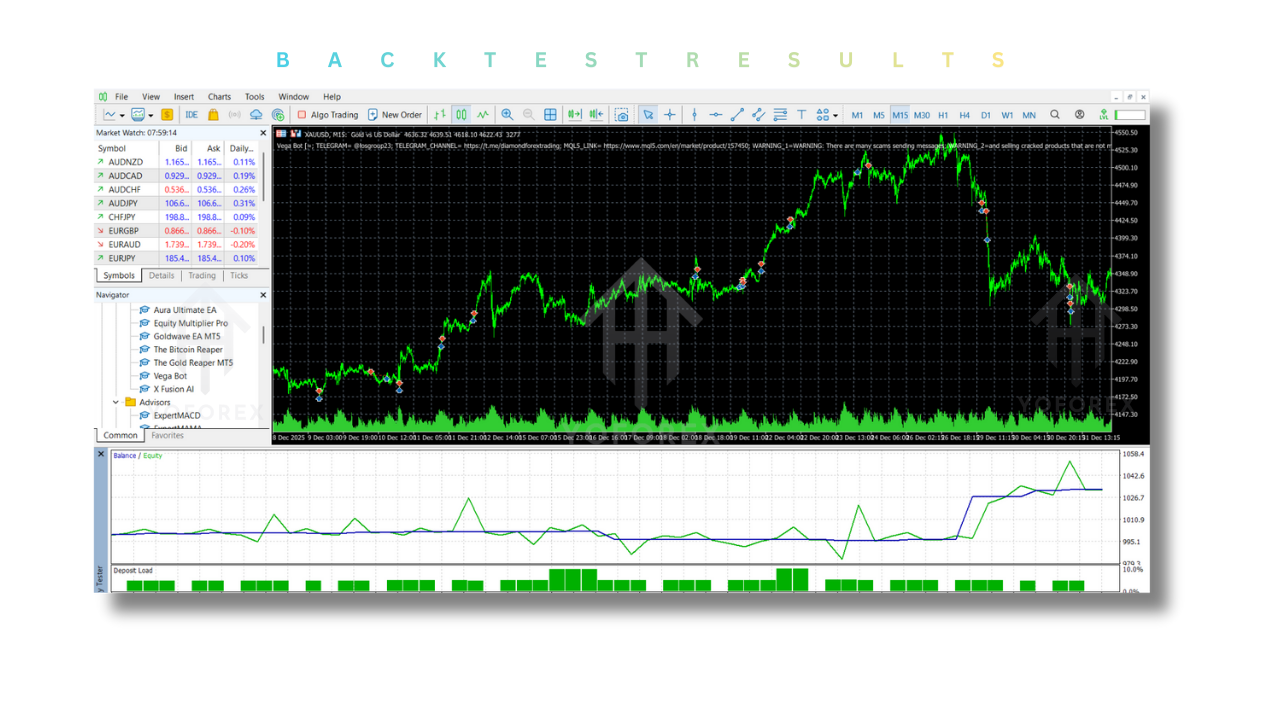

Performance Expectations and Realistic Outlook

It is important to approach any automated trading system with realistic expectations. Vega Bot EA V1.4 MT5 is not designed to generate unrealistic daily returns or eliminate drawdowns entirely.

Instead, it aims to:

- Reduce emotional trading errors

- Provide consistent execution discipline

- Maintain controlled drawdown levels

- Deliver steady performance over time

Performance will always depend on factors such as broker conditions, spread behavior, account leverage, and risk settings.

Suitable Account Types

Vega Bot EA V1.4 MT5 works best with:

- Low-spread trading accounts

- Stable execution environments

- Brokers with reliable MT5 infrastructure

While the EA can operate on small accounts, a balanced starting capital allows for better risk distribution and smoother performance.

Installation and Setup Process

Setting up Vega Bot EA V1.4 MT5 is straightforward:

- Install the EA into the MetaTrader 5 Experts directory

- Restart the trading platform

- Attach the EA to the recommended chart and timeframe

- Load the provided configuration file

- Enable auto-trading and allow algorithmic permissions

Once configured, the EA can operate independently.

Who Should Use Vega Bot EA V1.4 MT5

This Expert Advisor is ideal for:

- Beginner traders seeking structured automation

- Traders with limited screen time

- Users who value risk-controlled strategies

- Traders looking to reduce emotional trading behavior

It may not be suitable for traders expecting extremely aggressive growth or high-frequency scalping behavior.

Advantages of Vega Bot EA V1.4 MT5

Key strengths of the system include:

- Disciplined trade logic

- Built-in risk protection

- Flexible configuration options

- Adaptive trade management

- Clean integration with MT5

These qualities make it a practical tool rather than a speculative system.

Limitations to Consider

No trading system is perfect. Traders should be aware that:

- Performance varies across brokers

- Market conditions change over time

- Improper settings can increase risk

- Automated systems still require monitoring

Responsible usage and regular evaluation are essential.

Final Thoughts

Vega Bot EA V1.4 MT5 stands out as a well-structured automated trading solution focused on stability, logic, and risk discipline. Instead of relying on aggressive recovery methods, it emphasizes controlled execution and adaptive trade management.

For traders seeking a reliable MT5 Expert Advisor that prioritizes sustainability over hype, Vega Bot EA V1.4 MT5 is a system worth evaluating through proper testing and responsible deployment.

Support & Disclaimer

Support

If you need help installing or configuring your EA, or face any kind of bug, feel free to reach out on:

WhatsApp: Click here

Telegram Group: Join our community

Disclaimer: Forex and gold trading involve risk. Past performance doesn't guarantee future results. Always test robots on demo before live trading and use proper risk management.

Refferal

Join the VIP Signals Telegram Channel for real-time expert trading signals and stay ahead in the forex market. Get personalized strategies by becoming a part of our Real Account Management Telegram Channel and optimize your trading experience. If you're aiming to Pass PropFirm Challenges, join our dedicated channel for tips and proven methods. Start managing your capital effectively with expert advice from our Funded Account Management Telegram Channel. For advanced traders, our HFT EA / Passing Telegram Channel offers high-frequency trading insights and strategies to boost your performance.

Happy Trading

Comments

Leave a Comment