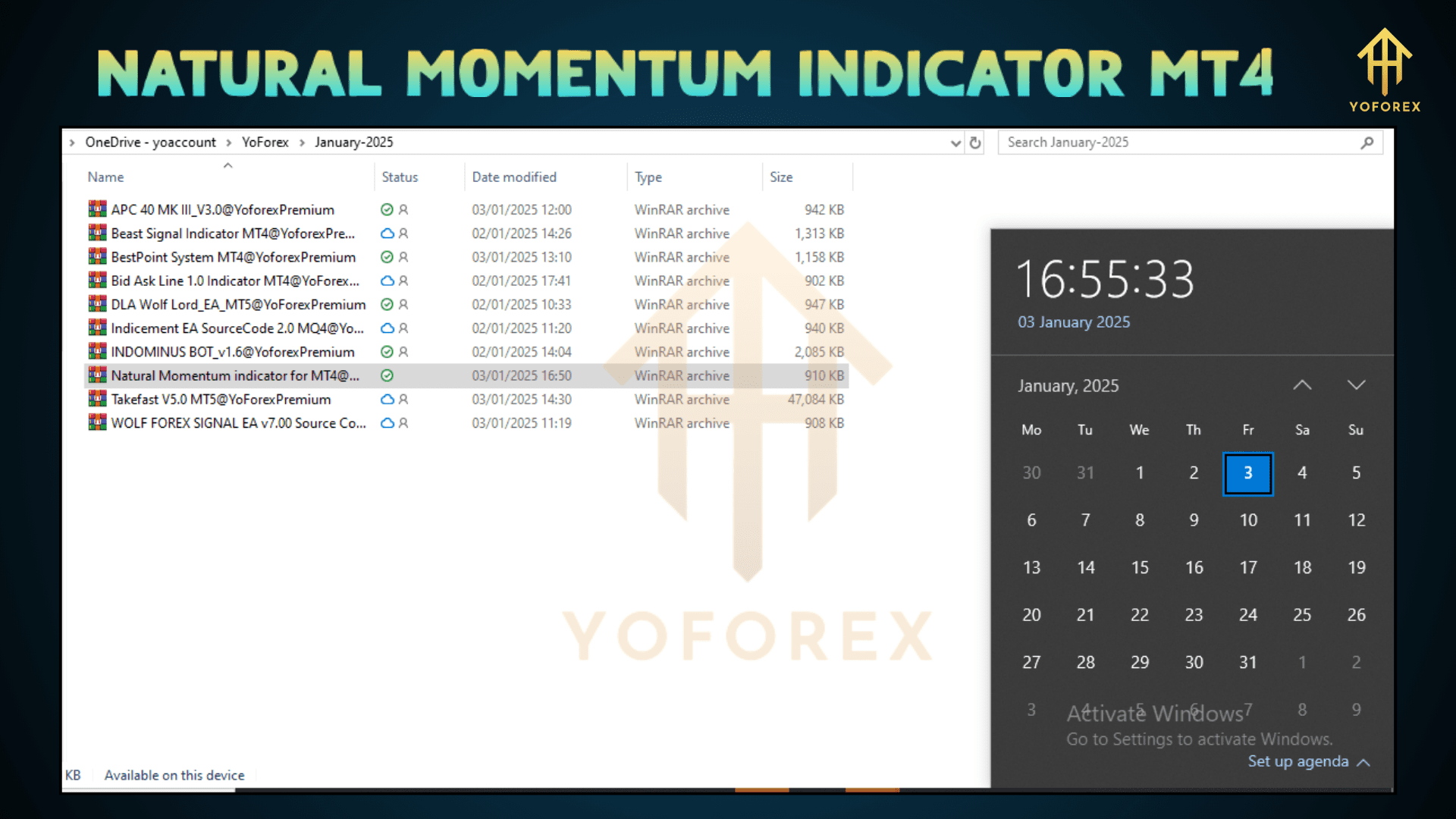

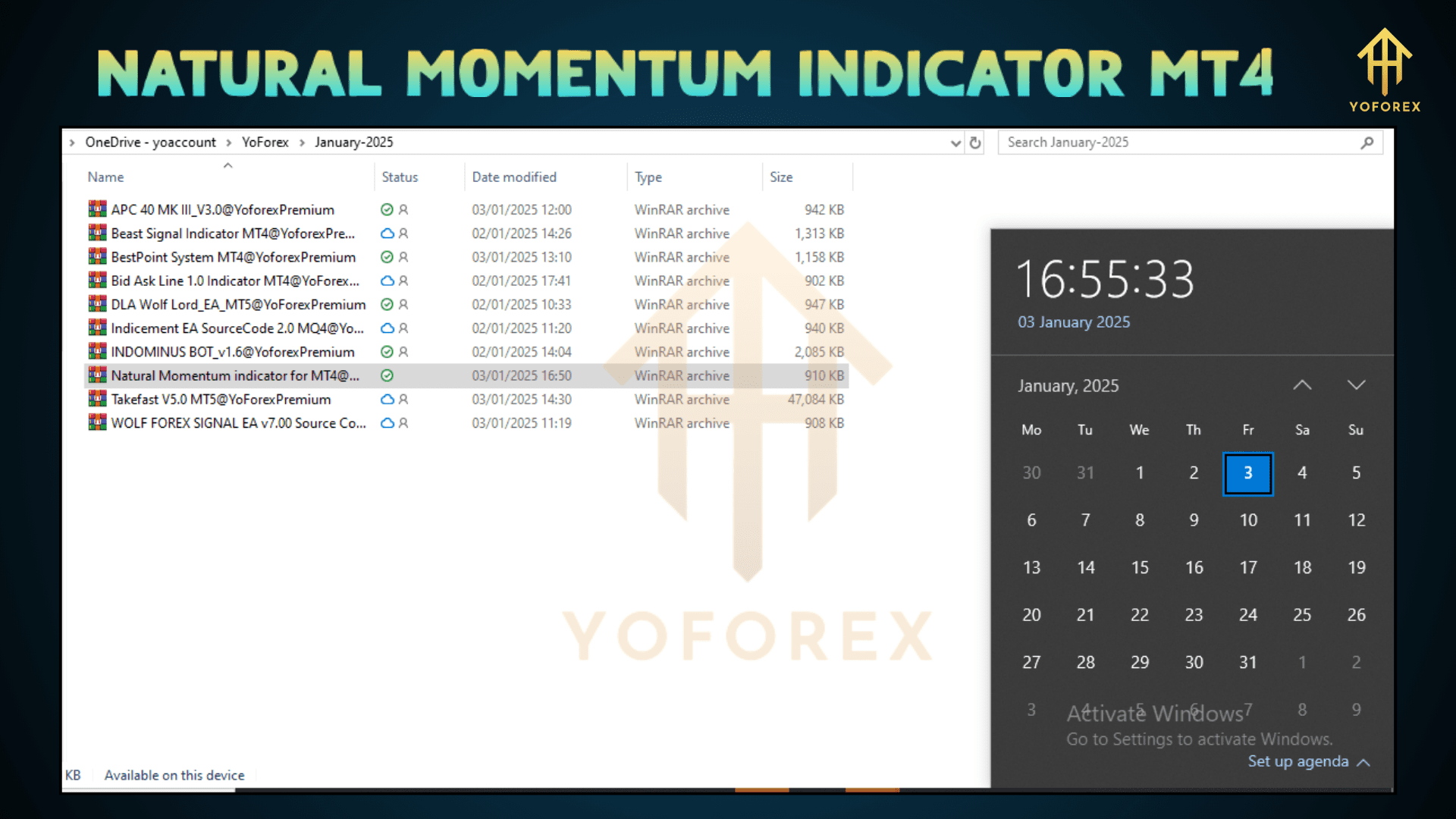

Natural Momentum Indicator MT4: A Winning Strategy for Automated Trading

When considering an automated trading strategy like the Natural Momentum Indicator MT4 (often used with an Expert Advisor or EA), it’s crucial to understand the minimum deposit, time frame, and currency pairs best suited for optimal performance. Below is a breakdown of the key components and how the EA takes trades, ensuring that you can use this strategy effectively.

1. Minimum Deposit

The minimum deposit required to start using the Natural Momentum Indicator MT4 depends on your risk tolerance, trading goals, and the broker you’re using. However, here is a general guideline:

| Account Type |

Minimum Deposit |

| Standard |

$100 – $500 |

| Pro |

$500 – $1,000 |

| VIP |

$1,000+ |

- Risk Management: Start with the lowest deposit for testing and gradually scale up based on performance and risk appetite.

- Broker Influence: Some brokers may require higher deposits for certain types of accounts, especially those offering low spreads or high leverage.

2. Time Frame to Run

The time frame for executing trades with the Natural Momentum Indicator MT4 plays a significant role in achieving consistent profits. The EA is designed to capitalize on momentum shifts in the market. Here’s how it works across different time frames:

| Time Frame |

Best for |

Trade Duration |

| M15 (15 minutes) |

Short-term, high-frequency trades |

A few minutes to an hour |

| H1 (1 hour) |

Medium-term, more stable signals |

1 hour to several hours |

| H4 (4 hours) |

Longer-term, fewer trades |

A few hours to a day |

- Quick Scalping: The M15 time frame works well for scalping and quick momentum trades.

- Swing Trading: The H1 and H4 charts provide better opportunities for swing trades, capturing larger momentum swings.

3. Currency Pairs to Run

The Natural Momentum Indicator MT4 works best with trending pairs that exhibit clear momentum, ideal for this strategy. Here are the most suitable currency pairs:

| Currency Pair |

Reason for Selection |

| EUR/USD |

High liquidity, clear trends |

| GBP/USD |

Volatile, often high momentum |

| AUD/USD |

Stable and responsive to news |

| USD/JPY |

Strong trends in high volatility |

| USD/CHF |

Consistent with natural momentum |

- Popular Pairs: EUR/USD and GBP/USD are great for fast-moving trends, while USD/JPY is ideal for slower, more predictable momentum trades.

- Low Spread: Choose pairs with lower spreads to minimize trading costs.

4. How the EA Takes Trades

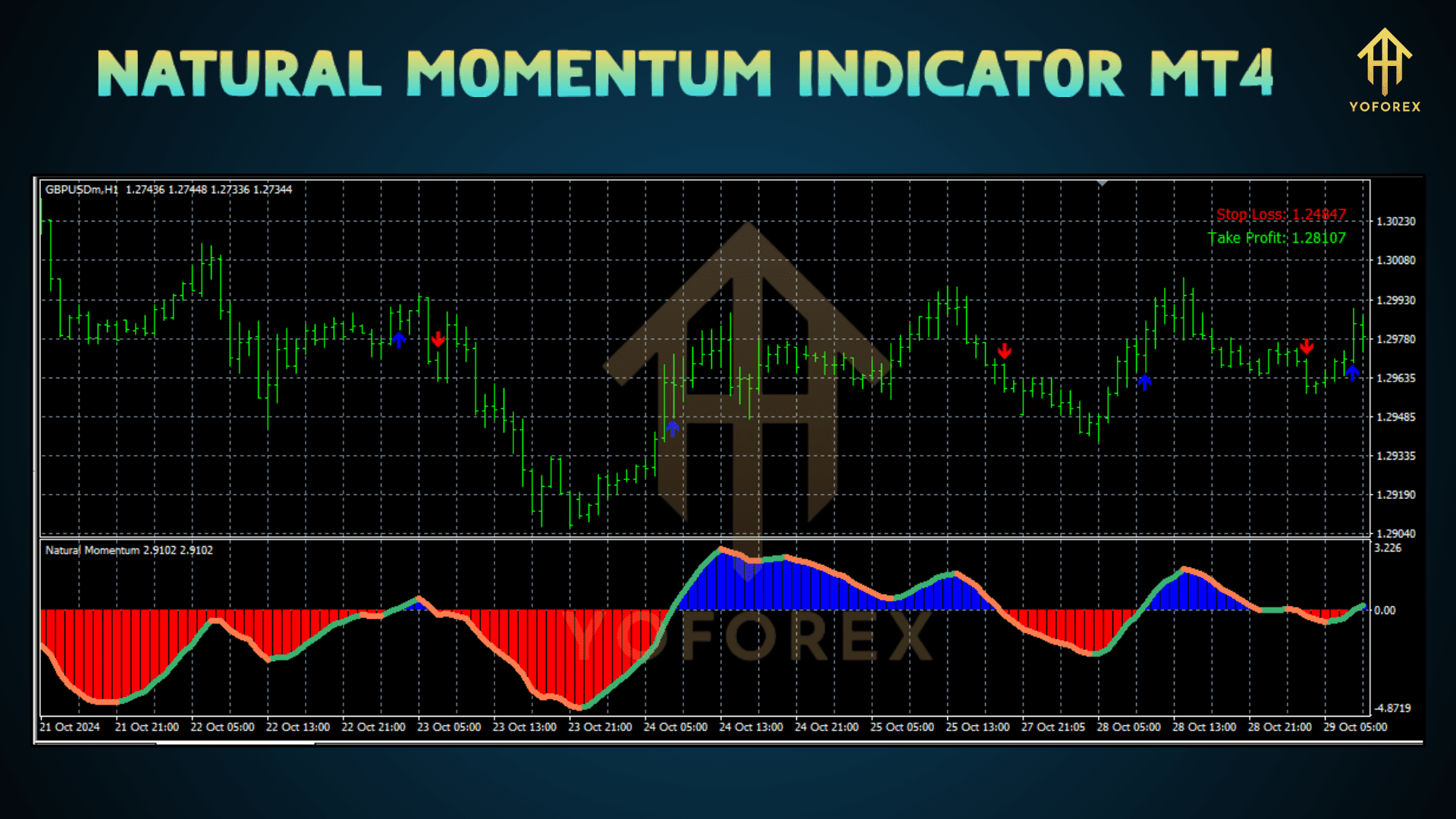

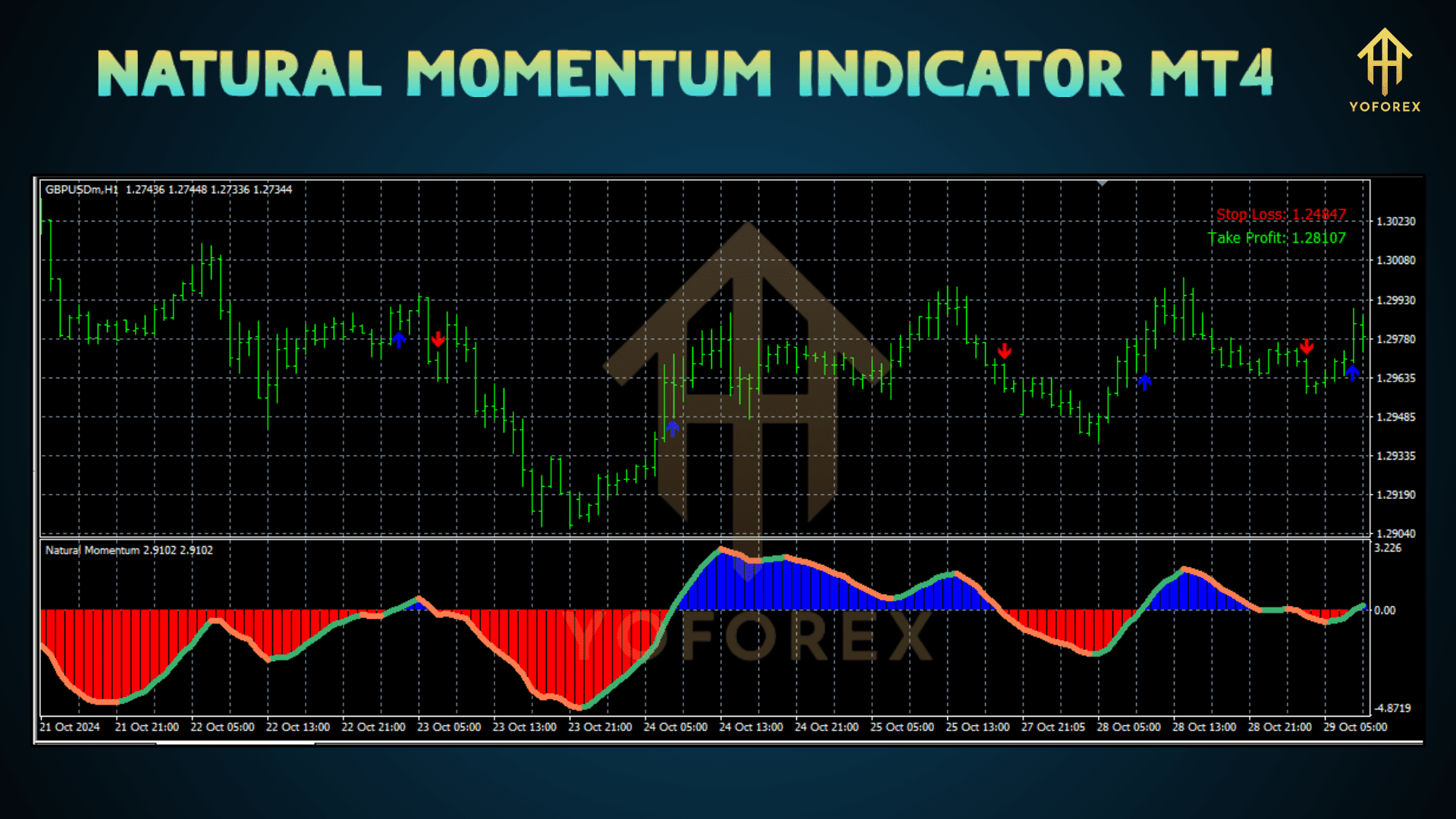

The Natural Momentum Indicator MT4 utilizes a proprietary algorithm that analyzes price action and momentum. Here’s a detailed breakdown of how the EA takes a trade:

- Signal Detection: The EA identifies momentum shifts by analyzing the price action using the Natural Momentum Indicator, which is based on the strength and direction of market movement.

- Entry Points: Once momentum exceeds a threshold, the EA places buy or sell orders based on pre-defined rules such as:

- Bullish Momentum: Buy when the price is rising and momentum confirms the strength.

- Bearish Momentum: Sell when the price is falling and momentum confirms weakness.

- Exit Strategy: The EA monitors price action to ensure that the momentum is maintained. Trades are exited either:

- Based on stop-loss or take-profit targets.

- Or when momentum starts to reverse, triggering an exit signal to lock in profits or limit losses.

5. Tips for Optimizing the Natural Momentum Indicator MT4 EA

- Backtesting: Always backtest the strategy on historical data before using it with real funds to fine-tune the EA’s performance.

- Risk Management: Use a low risk-to-reward ratio (e.g., 1:2) to ensure sustainable profits and protect against large drawdowns.

- Market Conditions: Best results occur during trending markets; avoid using the EA during choppy or sideways market conditions.

Conclusion:

The Natural Momentum Indicator MT4 is a powerful tool for traders looking to automate their trading strategies with a focus on momentum. By setting the right deposit, choosing the appropriate time frame, and selecting trending currency pairs, you can maximize the effectiveness of this EA. Always remember to test thoroughly and adjust according to market conditions to achieve long-term profitability.

Happy Trading

Happy Trading

There are no reviews yet.